Report Code: 11740 | Available Format: PDF | Pages: 316

Alumina Market Research Report: By Type (Metallurgical, Tabular, Calcined, Reactive, Fused), Application (Metallurgy, Refractories, Ceramics, Abrasives), Geographical Outlook (U.S., Canada, Russia, Germany, France, Norway, China, Australia, India, Malaysia, Brazil, Argentina, U.A.E, Bahrain, Saudi Arabia, Qatar, South Africa) - Global Industry Analysis and Forecast to 2024

- Report Code: 11740

- Available Format: PDF

- Pages: 316

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

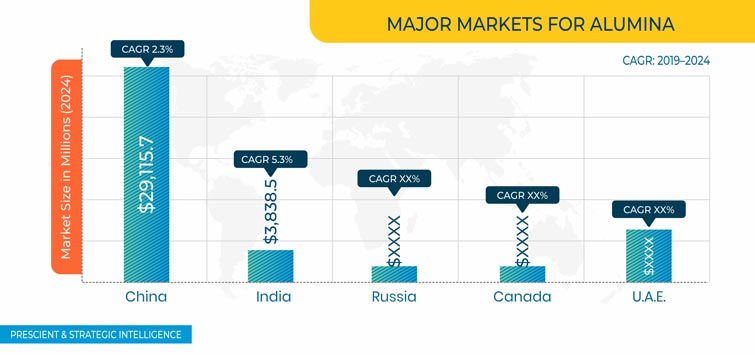

The alumina market revenue stood at $61,093.4 million in 2018, and it is expected to register a value CAGR of 2.2% and a volume CAGR of 3.0% between 2019 and 2024. The growth can be primarily attributed to the low cost of alumina. Moreover, the increasing usage of metallurgical-grade alumina for aluminum production in the Asia-Pacific (APAC) region will boost the demand for the oxide in the region.

In 2018, the APAC region dominated the market for alumina by registering a sale of 85,026.3 kilotons. The sales volume of the oxide in the region is expected to reach 102,683.1 kilotons in 2024, exhibiting a CAGR of 3.3% in the coming years. APAC is extensively integrated into the alumina supply chain with high-volume capabilities of aluminum production, bauxite mining, refining, and processing, especially in India, Indonesia, and China; and compounding of chemical-grade alumina into the final products.

According to the World Mineral Production 2013–2017 report published by the British Geological Survey, these three countries accounted for over 58.5% of the global alumina production in 2017. The data also mentions a high degree of forward integration, with APAC accounting for nearly 64% of the global aluminum production in 2017. Additionally, the APAC alumina market recorded the highest sales of metallurgical-grade alumina in 2017 due to the concentrated aluminum production capacity of India, Australia, China, Malaysia, and Indonesia.

The usage of metallurgical-grade alumina in the APAC region is followed by that of chemical-grade alumina. Large quantities of chemical-grade alumina are consumed in China due to the requirement for it in refractories, abrasives, and ceramics. The high demand for this grade can be chiefly credited to its better product characteristics, improving cost dynamics, and demand for high-performance substrates in the construction, automobile, and electrical and electronics sectors.

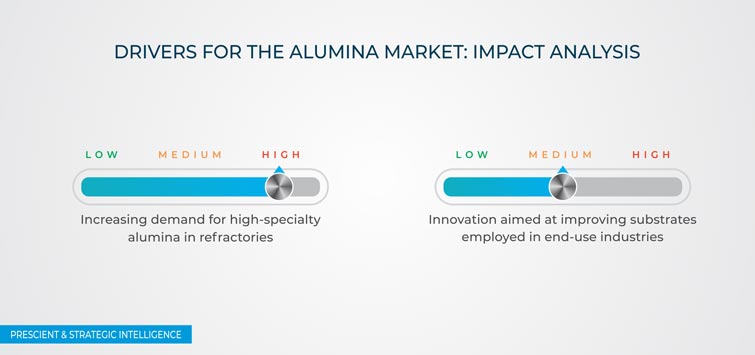

Market Dynamics

The surging production of this chemical in APAC has become a key trend in the alumina industry due to an increase in the bauxite mining activities in the region. In the coming years, the region will create a high demand for chemical- and metallurgical-grade alumina.

The spurring demand for high-quality glass, cement, and specialty steel and flourishing construction industry, owing to the macroeconomic growth in Eastern Europe and APAC and rapid industrialization, will fuel the requirement for alumina in the coming years. India, China, Russia, the U.K., and the U.S. generate a considerable product demand in the alumina market, as they account for a high-volume production and consumption of steel, thereby boosting the demand for the oxide for use as a refractory material.

The emergence of advanced technologies is projected to create a significant demand for chemical-grade alumina. The adoption of chemical-grade alumina will be driven by the spurring demand for environmentally acceptable, technologically feasible, and energy-efficient products and favorable government policies. For instance, the European Union (EU) and the U.S. have implemented various laws aimed at ramping up the domestic manufacturing of liquid crystal displays (LCDs), to meet the demand for flexible, high-resolution, large-panel LCD TVs.

Additionally, the soaring demand for high-performance substances for stationary energy storage devices, including lithium-ion batteries, and gas turbines will amplify the demand for alumina in the foreseeable future. The increasing requirement for high-performance materials can be owed to the rising focus of countries on lowering their dependence on fossil fuels and soaring attention on the diversification of their energy portfolios via the addition of renewable resources for electricity production.

Segmentation Analysis

The metallurgical category, within the type segment, accounted for the largest market share in 2018 due to the rising consumption of the compound in the transportation, packaging, consumer durables, and construction industries. In the coming years, the alumina market will witness a surge in the demand for the metallurgical-grade compound due to the growth of these end-use industries.

The ceramics category, under the application segment, will register the fastest growth in the coming years. Advanced ceramics are chiefly produced by using calcined alumina. The preference for this material can be owed to its ability to allow particle size control and distribution, high mechanical strength, exceptional corrosion resistance, low dielectric constant, good electrical insulation, and smooth mixability with other batch formulations. Moreover, alumina components are easily machinable and workable with an array of chemical and physical processes, which enhances its usage base.

Geographical Analysis

The APAC market for alumina generated the highest revenue during 2014–2018, and it is expected to retain its dominance in the coming years. This can be ascribed to the demand for high volumes of metallurgical-grade alumina and chemical-grade alumina, chiefly in China, owing to their high-volume consumption in ceramics, refractories, and abrasives. Other countries, such as India, Malaysia, Australia, and Indonesia, produce notable amounts of aluminum and also account for a substantial usage of metallurgical-grade alumina.

Competitive Landscape

The global alumina market is fragmented, with Chinese market players accounting for large market shares owing to their high production capacities. The Aluminum Corporation of China Limited accounted for the largest market share in the market in 2018. Several market players are engaged in joint ventures for production flexibilities, cost optimization, and catering to clients in several locations.

Recent Strategic Developments of Major Alumina Market Players

In January 2019, Vedanta Limited, a mining company based in India and a major alumina market player, planned to increase its capital expenditure to $250–$300 million in order to raise the production capacity of its Lanjigarh alumina refinery in Odisha. The refinery expansion is aimed at reducing Vedanta's dependence on imported alumina and also lead to decreased aluminum production costs.

In August 2019, CBA Brazilian Aluminum Company acquired Arconic Inc.’s operations, located in Itapissuma, Pernambuco, Brazil, for $50 million. The plant, which has an annual production capacity of 50,000 tons of aluminum sheets, will be involved in the production of CBA’s line of rolled products in order to improve the competitiveness of the domestic industry against imported products.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the alumina market?

- What is the historical size and present size of the different categories within the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to expand their market share?

- Which segment has the highest value potential in the market?

- Who are the global refractory manufacturers and what are their capacities?

- Who are the major consumers of alumina refractories?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws