Wound Closure Products Market Analysis

Explore In-Depth Wound Closure Products Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 10731

Explore In-Depth Wound Closure Products Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

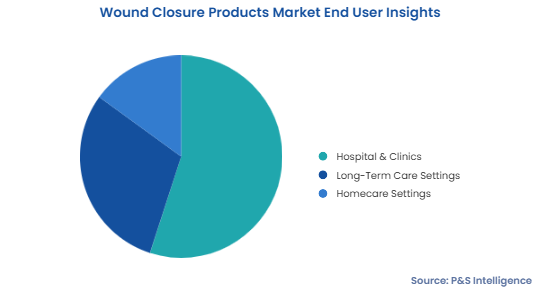

Hospitals and clinics accounted for the largest revenue share in 2024, and this category is further projected to maintain its dominance during the forecast period. This can be attributed to the improving hospital infrastructure, availability of technologically advanced products and greater footfall of patients in these settings, and increasing accessibility of hospitals to populations of all income levels.

Homecare settings will witness the fastest growth during the forecast, at a CAGR of around 5.5%. This can be ascribed to the rising geriatric population across the globe, increasing adoption of home healthcare services by this demographic, and surging usage of easy-to-use products. In addition, patients suffering from diabetic foot ulcers and accidental wounds usually require prolonged hospitalization, which can be difficult and costly for elderly patients. This creates a high demand for wound closure products that can be conveniently used in homecare settings.

We have considered the following end users:

Sutures accounted for the largest revenue share, of 40%, in 2024, and this category is further expected to maintain its dominance during the forecast period. This can be attributed to the wide usage of sutures to ligate the damaged tissue caused due to a surgery, cut, laceration, road accident, or injury; the increasing number of surgical procedures across the globe, and advancements in suturing materials. Moreover, sutures are used for the reduction of dead space, strengthening of wounds until healing, and reduction of the risk of bleeding and wound infection.

Surgical staples will register significant growth in revenue generation during the forecast period. This will be due to their usage to close large wounds, linear lacerations, and surgical wounds and accelerate the healing process. In addition, stapling is gaining popularity as it is easier, more rapid, and more consistent compared to suturing. Moreover, the availability of new, advanced staplers with options of single use and multiple use, makes them popular in hip arthroplasties, bariatric surgeries, Caesarean sections, bowel surgeries, and cholecystectomies.

Furthermore, wound closure strips held a significant revenue share owing to their flexibility, water resistance, less irritation, and ease of application. Moreover, the increasing pace of technological advancements in these products and their extensive usage in the management of long lacerations, skin tears, and post-operative surgical wounds will be responsible for the category’s growth in the coming years.

Adhesives and sealants are the fastest-growing category as they are biocompatible, easy to use, minimally invasive, and non-toxic formulations. They are also used along with various wound closure products to achieve better therapeutic efficacy.

These product types have been studied:

Surgical & traumatic wounds accounted for the largest revenue share in 2024, and this category is further expected to dominate the market during the forecast period. This can be ascribed to the rising prevalence of chronic diseases, surging number of surgical procedures, increasing focus on regenerative medicine, and booming prevalence of long-term post-operative wounds.

Moreover, diabetic foot ulcers have the highest CAGR in the market, of 6%, owing to the surging incidence of diabetes mellitus. Since elderly people are highly prone to diabetes and its complications, they need such closure products. According to the International Diabetes Federation (IDF), the number of people with this endocrinological condition will reach 783 million by 2045, increasing by a massive 45% from 2021.

Here are the wound types covered in the report:

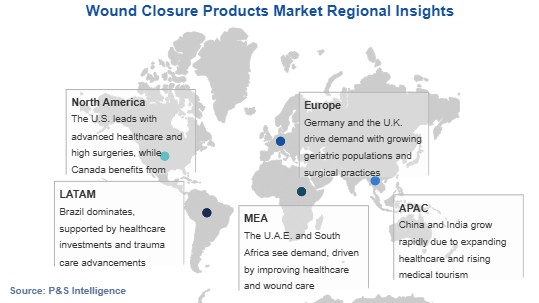

North America held the largest revenue share, of 40%, in 2024, and it is further expected to dominate the market during the forecast period. This is due to the growing prevalence of chronic diseases, such as diabetes, rising number of people suffering from road accidents and sports injuries, and presence of numerous companies offering such wound care solutions.

The U.S. accounts for the larger revenue share in the market, due to the presence of highly qualified and skilled surgeons, prominent players, and reimbursement policies for surgeries. As per the American Society of Plastic Surgeons, from 1,498,361 in 2022, the count of surgical cosmetic procedures in the U.S. rose by 5%, to 1,575,244 in 2023.

Europe holds a significant revenue share as well, which can be ascribed to the well-developed healthcare infrastructure, increasing number of product launches, growing number of trauma centers, rising adoption of technologically advanced wound care products, rising funding for wound care research, and growing awareness of wound management.

European countries, including Italy, Germany, France, Spain, and the U.K., are experiencing an increase in their geriatric population. Thus, the demand for such closure products is likely to increase, associated with the rising cases of chronic diseases and surgical injuries in Europe.

APAC will register the fastest growth during the forecast period, with a CAGR of 6.5%. This can be ascribed to the growing aging population, increasing volume of surgeries, rising count of road accidents, and burgeoning incidence of burns in the region. According to the WHO, 1 million people in India and 173,000 children in Bangladesh suffer from moderate burns each year. Further, 17% of the children with burns in Pakistan and Bangladesh are temporarily disfigured and 18% are permanently disfigured.

China contributes the majority of the revenue to the regional market, and it is expected to maintain its position during the forecast period. This is owed to the rising number of product launches, high competitiveness in the industry, and large manufacturing base for such products due to the advantage of cheap labor. Moreover, the increasing R&D activities and high investment by governments and industry giants drive the market growth.

Here is the regional breakdown of the market:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages