Report Code: 11640 | Available Format: PDF | Pages: 175

Wet Age-Related Macular Degeneration (AMD) Market by Product (Lucentis, Eylea, Avastin), by Distribution Channel (Direct, Indirect), by Age Group (Above 80 Years, 60-80 Years, 40-59 Years), by Route of Administration (Intravitreal, Intravenous), by End User (Hospitals & Clinics, Research & Academic Institutes), by Geography (U.S., Canada, Germany, France, U.K., Italy, Spain, Russia, Sweden, Norway, Belgium, Switzerland, Austria, China, Japan, India, South Korea, Malaysia, Thailand, Australia, Singapore, Brazil, Mexico, Argentina, Colombia, Israel, South Africa, Saudi Arabia) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2014-2024

- Report Code: 11640

- Available Format: PDF

- Pages: 175

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Wet Age-Related Macular Degeneration Market Overview

The global wet age-related macular degeneration (AMD) market is expected to generate revenue worth $10.4 billion in 2024, registering a CAGR of 7.1% during 2019–2024. The increasing prevalence of AMD, lack of availability of specific treatment, and surge in geriatric population are the major factors influencing the market growth.

AMD, a disease characterized by blurred vision or blindness as a result of the damage to the macula of the retina, is of two types: wet and dry. In wet AMD, abnormal blood vessels grow under the macula and the retina. These abnormal blood vessels may bleed or leak fluid, causing the macula to bulge or lift up from its position, thus resulting in severe vision loss.

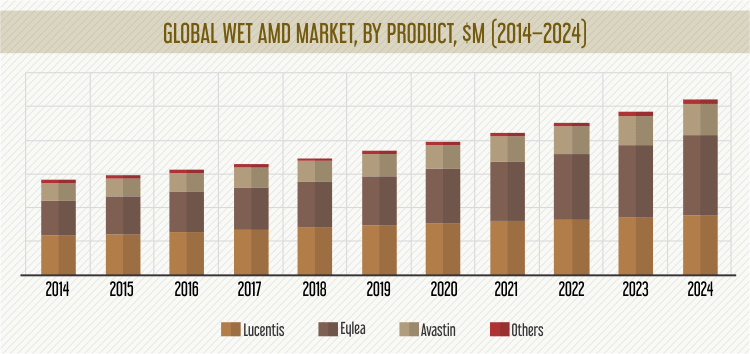

Based on product, the wet age-related macular degeneration market is classified into Lucentis, Eylea, Avastin, and others, where “others” mainly include Visudyne and Macugen. Among these, the fastest growth in the market during the forecast period is expected from Eylea, with 10.0% CAGR. This can be mainly ascribed to the increasing market demand for this medication owing to its low cost and high efficacy in the management of wet or exudative AMD.

The wet age-related macular degeneration market is also bifurcated into direct and indirect channels of distribution. Between the two, the direct channel category is estimated to account for over 60% share in the market in 2018. This can be ascribed to the fact that a direct channel of distribution involves less investment and no intermediates for the supply of products, thus making the process shorter and simpler.

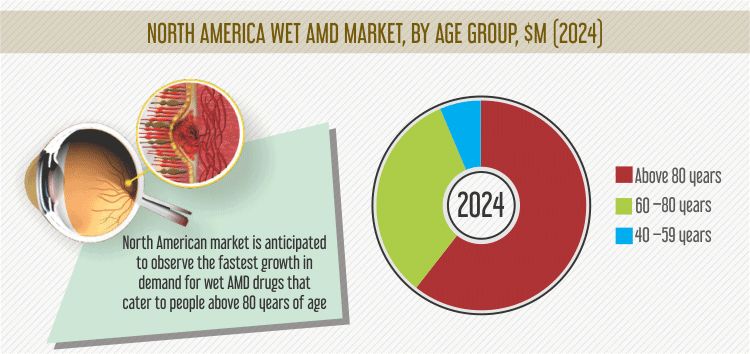

Based on age group, the wet age-related macular degeneration market is classified into drugs that cater to people aged 40–59 years, 60–80 years, and above 80 years. Among these, wet AMD drugs catering to people above 80 years of age are estimated to contribute approximately 60% revenue to the market in 2018, mainly on account of the increased prevalence of the disease in the geriatric population of this age group.

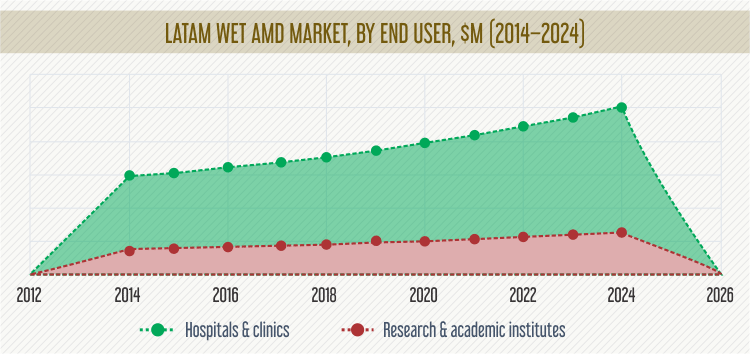

End users of wet AMD drugs include hospitals and clinics, and research and academic institutes. Hospitals and clinics, as an end-user category, hold the larger share in the wet age-related macular degeneration market, primarily due to the presence of a large pool of patients who seek medical treatment for exudative AMD in hospitals and clinics.

Wet Age-Related Macular Degeneration Market Dynamics

Growth Drivers

Some of the key factors driving the growth of the wet age-related macular degeneration market are the increasing prevalence of AMD and growing geriatric population.

With the population increasing worldwide and the demography reflecting predominance of older population, the global burden of AMD continues to rise at an unprecedented rate. AMD is the third leading cause of severe vision impairment that can possibly result in blindness. According to the National Eye Institute, AMD is a leading cause of vision loss among the elderly. Moreover, people aged 60 years and above are at a greater risk of developing the disease. The incidence of AMD is expected to further increase with the rise in geriatric population, with higher prevalence in Western countries.

Furthermore, studies show that smoking is the most common risk factor for AMD development and progression. According to the World Health Organization, there are approximately 1.1 billion tobacco smokers in the world at present, and the number is expected to double by 2050 if the trend continues. Thus, tobacco consumption is considered a major factor contributing to the increased prevalence of AMD across the world.

Besides, with the rise in population aged 60 years or above, the prevalence of AMD is witnessing a corresponding increase, globally. According to the report World Population Prospects by the United Nations, there were about 962 million people aged 60 years or above worldwide in 2017, and the number is expected to more than double by 2050. Since older people are more susceptible to degenerative disorders, the growth in geriatric population is expected to drive the wet age-related macular degeneration market in the near future.

Opportunities

Emerging market for wet AMD in Asia-Pacific (APAC) and prospective alternate therapies can be considered as notable opportunities in the wet age-related macular degeneration market.

The APAC region is providing plentiful opportunities for the growth of the players operating in the wet age-related macular degeneration market. Due to lack of accessibility and high cost of drugs, the sale of drugs for exudative AMD in APAC is not significant at present. However, the region has a high prevalence of AMD, which makes it a potential market for growth. Besides, the presence of the companies involved in the marketing and development of drugs for exudative AMD is comparatively low in APAC. Also, the region accounts for more than one-third of the macular generation cases reported globally and is therefore expected to contribute significantly to the demand for wet age-related macular degeneration drugs in the coming years.

Wet Age-Related Macular Degeneration Market Competitive Landscape

Key players in the global wet age-related macular degeneration market are investing heavily in acquisitions and collaborations to gain a larger market share. For instance, in February 2019, F. Hoffmann-La Roche Ltd. (Roche) acquired Spark Therapeutics Inc., a gene therapy company based in the U.S. The acquisition helped Roche gain access to Luxturna, the first gene therapy approved in the U.S. for the treatment of a rare disorder that often leads to blindness. The company already has a portfolio of eye disease drugs, including Lucentis for wet AMD. However, intensified competition from approved agents and potential gene therapies may constrain the economic viability of Lucentis. Luxturna, in this regard, is expected to help the company sustain its ophthalmology business.

Additionally, in February 2018, Ophthotech Corporation, in collaboration with the University of Massachusetts Medical School and its Horae Gene Therapy Center, initiated a study to focus on the application of novel gene therapy technology in the discovery and development of next-generation therapies for the treatment of ocular diseases. The company also announced the utilization of the university’s minigene therapy approach and other novel gene delivery technologies to target retinal diseases.

The wet age-related macular degeneration market is marked by the presence of several large players, such as Regeneron Pharmaceuticals Inc., Neurotech Pharmaceuticals Inc., Ophthotech Corporation, Kubota Pharmaceutical Holdings Co. Ltd., Gilead Sciences Inc., Novartis AG, Alimera Sciences Inc., and Bayer AG.

The wet age-related macular degeneration market is expected to generate $10.4 billion in 2024.

Wet age-related macular degeneration drugs include Eylea, Avastin, Lucentis, Macugen, and Visudyne.

The wet age-related macular degeneration market growth is driven by the growing prevalence of AMD and rising geriatric population.

The rising cases of wet AMD, presence of several key players, and growing number of drug approvals make North America the largest shareholder in the wet age-related macular degeneration industry.

The increase in the number of clinical trials is a key trend in the wet age-related macular degeneration industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws