Western and Central Europe Agricultural Machinery Market Future Prospects

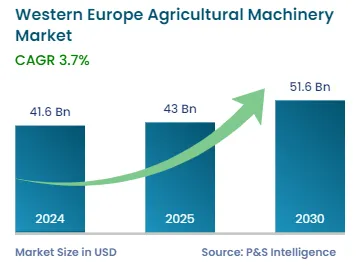

The Western European agricultural machinery market will generate an estimated USD 41.6 billion revenue in 2024, and the market size will advance at a CAGR of 3.7% during 2024–2030, to reach USD 51.6 billion by 2030.

Moreover, the Central European agricultural machinery market will generate an estimated USD 14.6 billion revenue in 2024, and the market size will advance at a CAGR of over 4.8% during 2024–2030, reaching USD 19.4 billion by 2030.

The key factors driving the market are the high rate of farm mechanization, rising preference for agricultural machinery, increasing cost of farm labor, and advancing technology.

Agriculture has long been a labor-intensive industry in Europe. However, as individuals migrate to metropolitan regions, the employment rates in this sector have dropped over time. Farmers are increasingly using agricultural technology to replace manual labor, since the former is a more cost-effective, readily available, and efficient way of farming.

As per the U.K. Department for Environment, Food and Rural Affairs, in 2021, the country produced only 58% of the food consumed domestically, with the rest imported. Moreover, that year, the country imported fruits and vegetables worth GBP 10.5 billion, while exporting less than GBP 1 billion worth. To address this, the government made commitments in May 2023 to keep domestic food supply to 60% of the total demand.

Further, according to the German Association of Agricultural Employers (GLFA), the number of short-term, contractual immigrant laborers in Germany during peak harvest seasons has decreased dramatically in recent years. Therefore, labor shortage and the improved productivity through mechanization have led to the growth in agriculture machinery demand.