Report Code: 10626 | Available Format: PDF

Waterproofing Chemicals Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024-2030

- Report Code: 10626

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

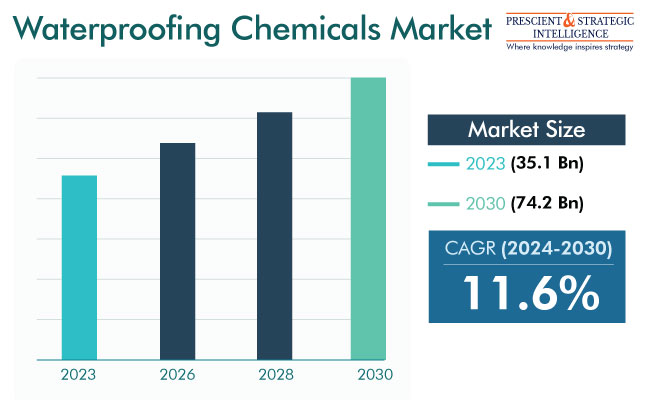

The waterproofing chemicals market is expected to propel from USD 35.1 billion (E) in 2023 to USD 74.2 billion in 2030, at 11.6 % CAGR between 2024 and 2030.

Waterproofing chemicals are commonly adopted for protecting buildings, pipes, and a host of other structures against seepage, as it can decrease their life and cause various issues. These chemicals enhance the life and reduce maintenance requirements of a structure, when applied to the exterior.

The growth of this industry can be attributed to the advantageous environmental guidelines, as well as the growing compliance with manufacturing standards. Furthermore, the increasing consciousness about the importance of waterproofing products in developing nations will increase the product requirement. Cement-based buildings experience massive deterioration because of the constant climatic changes. This reduces the life of commercial and residential structures, thus making waterproofing chemicals essential.

R&D for Producing Advanced Products Is Trending

With the rampant infrastructure expansion and rapid rate of urbanization, researchers and manufacturers are focusing on developing innovative solutions for improving the strength of buildings. A major innovation is advanced polymer-based waterproofing chemicals, which have exceptional flexibility, durability, and water resistance. Advancements in technology have, in turn, resulted in the introduction of enhanced application systems and methods, thus offering opportunities to the allied industries as well.

For instance, Kamdhenu Limited, a paint and emulsion manufacturer, launched Kamo Damp Proof, a new waterproofing product, in February 2023. It is manufactured with combined synthetic fibers and excellent elastomeric strong acrylic polymers. It forms a robust and thick membrane on the applied surface, thereby providing enhanced waterproofing.

Moreover, waterproofing chemical manufacturers are integrating innovative application methods, such as pre-applied membranes, self-adhesive membranes, and spray-applied membranes. These approaches offer quicker installation, as well as long-lasting and reliable waterproofing.

Additionally, the continuing developments might provide greater sustainability, customized solutions, and better performance for the advancing construction industry all over the world. The sustainability will majorly come from chemicals made from biobased polymers, which are sourced from nature, do not pollute the earth, and decompose naturally after their job is done.

Increasing Investments in Construction Industry Are Key Driver

The considerable investments in the construction industry across developing nations are a key factor boosting the requirement for waterproofing chemicals. With the fast urbanization, populace expansion, and strong economic growth, the construction industry is observing an increase in the number of projects and value of investments.

For instance, the 2023 Union budget of India has sanctioned INR 10 lakh crore for infrastructure development in the transportation, airport, railways, as well as urban infrastructure sectors, in the Tier II and Tier III cities of the country.

With the increasing investment pouring into the construction industry from private and government investors, the would be an increase in the focus on using superior waterproofing solutions. This is because they can enhance the performance and durability of the infrastructure. This has resulted in a surge in the requirement for chemicals that can efficiently address the precise waterproofing requirements of various building projects.

Rising Compliance with International Quality Standards To Boost Market

In emerging economies, such as Brazil, Indonesia, and India, users are concentrating on abiding by international quality practices, especially the environmental guidelines. For example, the onsite concrete mixing ban in many countries is intended to reduce the level of air pollution, which is now leading to the growing requirement for ready-to-use concrete admixtures. Moreover, tall buildings are being constructed in places where space is limited, thus resulting in the increasing need for high-performance waterproofing and other construction chemicals.

| Report Attribute | Details |

Market Size in 2023 |

USD 35.1 Billion (E) |

Revenue Forecast in 2030 |

USD 74.2 Billion |

Growth Rate |

11.6% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Polymer Category Is Large Contributor

The polymer category, based on type, is a key contributor to the waterproofing chemicals industry. This is mainly because of the increasing need for thermoplastic polyolefins because of their high energy competence. Additionally, the surging acrylic polymer requirement for waterproof coatings is likely to produce new opportunities for the market growth throughout this decade. The rising requirement is because of the fast urbanization in evolving markets, such as India, Indonesia, and China.

Roofing Category Is Leading Application Segment

The roofing category, based on application, is leading the industry, and this trend will continue till the end of this decade. This is mainly credited to the increasing expenses of governments and private entities for the development of infrastructure. Moreover, the fast urbanization and increasing disposable income of the middle-class people will boost the industry.

Moreover, the stringent regulations with regard to strong foundations and the growing trend of the redevelopment of older buildings in Europe and North America drive the market in the walls category. The growth in building & construction spending is because of the governments’ shifting inclination toward the enhancement of infrastructure, along with the rise in the disposable income of consumers.

Top Waterproofing Chemicals Producers Are:

- Pidilite Industries Ltd.

- JMH TRADING S.A.C.

- Mitsubishi Chemical Group Corporation

- Dow Inc.

- Arkema S.A.

- Evonik Industries AG

- Sika AG

- Zeon Corporation

- BASF SE

- RDA Holdings Private Limited

- Polygel Industries Pvt. Ltd.

- DuPont de Nemours Inc.

- ExxonMobil Corporation

- Trinseo PLC

- Choksey Chemicals Private Limited

- Thermax Ltd.

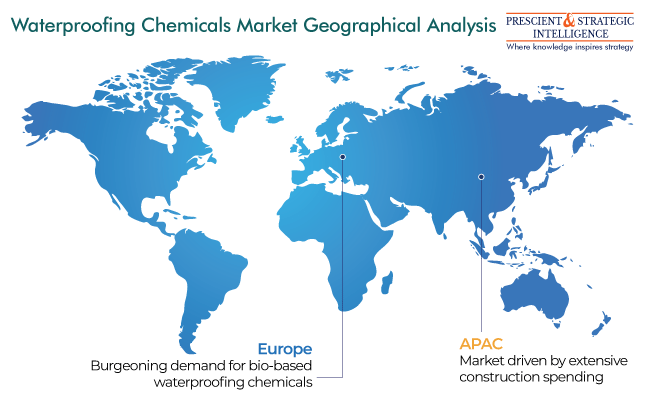

APAC Is Dominating Market

APAC is leading the industry, mainly because of the development in the construction industry owing to the rapid economic growth and industrialization in the continent. Moreover, the regional industry will advance because of the surging expenditure on infrastructure, as well as the increasing disposable income of people.

APAC, led by China and India, is the most-populous region in the world, which drastically increases the demand for houses and all kinds of commercial and industrial infrastructure. The construction boom in the region is also led by the rampant industrialization and urbanization as regional countries work to improve the quality of life and build smart cities. For instance, in 2023, infrastructure projects with a total spending of over USD 1.8 trillion have been announced in China.

Europe is expected to advance at a significant rate during the projection period. This would be primarily because of the shifting inclination toward sustainable construction activities, thus resulting in the development of bio-based waterproofing chemicals. The European Commission has established guidelines governing the manufacturing of natural-polymer-based products, such as biopolymers. Moreover, as per a report, by 2030, the construction output in Western Europe will cross USD 2.5 trillion.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws