Report Code: 12839 | Available Format: PDF | Pages: 250

Water Filters Market Size and Share Analysis by Type (Reverse Osmosis, Ceramic Filters, Activated Carbon Filter, UV Filtration), Media Type (Single and Dual Filter Media, Multimedia, Cartridge), Distribution Channel (Online, Offline), End Use (Municipal, Industrial, Commercial, Residential) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12839

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Water Filters Market Overview

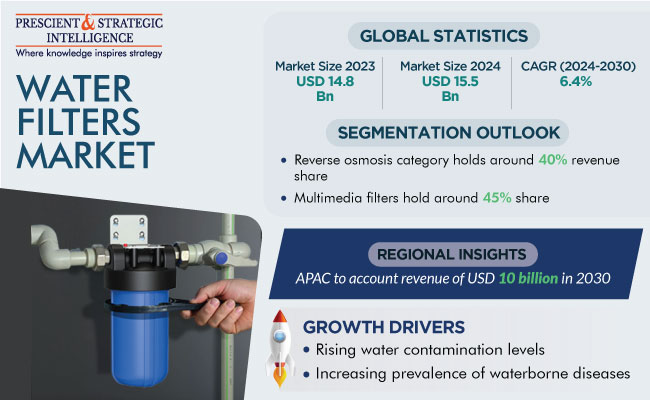

The water filters market size stood at USD 14.8 billion in 2023, and it is expected to grow at a compound annual growth rate of 6.4% during 2024–2030, to reach USD 22.5 billion by 2030.

Water filters are designed to eliminate undesirable substances from water, including sediments, taste, odor, hardness, and bacteria. These systems play a crucial role in removing microorganisms and suspended matter from water that has not undergone sedimentation treatment or eliminating particles that persist after sedimentation. The purpose is to enhance water quality, thus making it safe and suitable for drinking.

The market for water filters is growing due to a global increase in the need for purified water. The escalating levels of contamination in water sources have become a serious concern. The rising concentration of human and industrial waste in water streams renders it unsuitable for consumption, particularly for drinking purposes. The heightening awareness of water quality issues is a key driver for the demand for water filters among various end users on a global scale.

Rise in Water Contamination Levels owing to Increase in Effluent Release in Rivers

The fundamental reason behind the declining water quality is the increasing volume of effluents discharged into rivers, including untreated waste, pesticides, chemicals, and garbage from industries, farmlands, and municipal corporations. Additionally, the inorganic compounds used in agricultural fields flow into sewers during rains, and this sewage is then released into streams and rivers. Therefore, the depleting sources of clean drinking water are expected to drive the demand for water filters over the forecast period.

As per the World Health Organization (WHO), globally, more than one billion people drank water contaminated with feces in 2022. Feces, which harbor all kinds of microorganisms, pose a grave risk to drinking water, rendering it unfit for human consumption. Moreover, in 2021, more than 2 billion people lived in water-stressed countries, which is expected to aggravate water scarcity as a result of climate change and population growth.

Rising Prevalence of Water-Borne Diseases as a Result of Resource Contamination

Polluted water causes serious diseases, including cholera, diarrhea, dysentery, polio, and typhoid, due to the presence of various organisms in it. This factor causes approximately half a million diarrheal deaths each year, which is expected to drive need for purification systems. Filters effectively reduce the risk of waterborne diseases by removing debris, sediments, and heavy metals from water and enable consumers to get pure drinking water.

To combat this fundamental global issue, different technological advancements, such as reverse osmosis, ceramic filters, and activated carbon filters, have been introduced to ensure water purification in different industries, such as municipal, industrial, commercial, and residential. The scenario in developing economies is terrible owing to a lack of freshwater due to pollution and quick population growth. Hence, the surge in the prevalence of waterborne diseases will boost the water filters market revenue over this decade.

Rise in Health Awareness at Global Level Is Increasing Demand for Water Filtration Systems

The market is experiencing growth owing to the rise in health consciousness and an increase in disposable income, particularly in emerging economies. The surge in income levels enhances the purchasing power of consumers, thus leading to an elevated standard of living. Additionally, the demand for water purification systems in developing countries is driven by the increase in the availability of safe water from municipalities and a rise in water recycling activities.

Furthermore, the growing awareness of health and wellbeing on the global scale has resulted in the adoption of hygienic practices. The widespread availability of healthcare services, changes in economic and social systems, and advancements in diagnostics have collectively improved the health of consumers in various regions. Consequently, the increasing focus on health amidst the rise in the incidence of waterborne diseases is driving the demand for water purification systems. However, in poor countries, healthcare is not yet as advanced, so prevention becomes more important than cure. Hence, national and international agencies are working to raise awareness of water pollution and water treatment in under-developed countries.

Latest Technological Advancements in Water Filtration

To enhance customer satisfaction and health, new filtration technologies, such as advanced membrane systems and carbon nanotubes, are being incorporated by the market players into their products. Additionally, the acoustic nanotube technology, photocatalysis, aquaporin inside technology, and automated variable filtration (AVF) are some of the trending water purification technologies.

Further, advanced water quality sensors enable the instantaneous detection and analysis of a wide range of impurities. These sensors provide users with extensive data on various quality parameters, such as pH, presence of bacteria, concentration of dissolved solids, and chemical composition. Such crucial data enables informed decision-making to enhance the safety of drinking water.

Moreover, smart water purifiers are integrated with hi-tech components to confront contaminants. These methods may include nanotechnology, electro-absorption, and hybrid filtration systems. By effectively eliminating micropollutants, pharmaceutical residue, heavy metals, and microplastics, these technologies ensure a higher level of water purity than conventional approaches.

Further, AI incorporation into smart water purifiers enables constant learning and adaptation to water conditions and usage patterns. AI improves purification processes, adjust the filtration settings based on water quality, and predict the filter’s life expectancy. Thus, AI involvement not only enhances the efficiency but also lessens water wastage, thereby leading to an overall performance enhancement. Therefore, the consistent incorporation of novel technologies into water filtration systems is propelling the market growth.

| Report Attribute | Details |

Market Size in 2023 |

USD 14.8 Billion |

Market Size in 2024 |

USD 15.5 Billion |

Revenue Forecast in 2030 |

USD 22.5 Billion |

Growth Rate |

6.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Medium Type, By Distribution Channel; By End Use; By Region |

Explore more about this report - Request free sample

Reverse Osmosis (RO) Accounted for Largest Revenue Share

In 2023, the RO category captured the largest share of the revenue, within the type segment. This is primarily attributed to the effectiveness of RO systems, which utilize a semipermeable membrane to eliminate an extensive array of contaminants, such as dissolved salts, minerals, heavy metals, and microbes. The process involves forcing water through the membrane, leaving impurities behind, thus resulting in purified water.

Multimedia Filters Are Used Most Widely, especially in Industrial Facilities

Multimedia filters dominate the market with a revenue share of around 45%, in 2023. This is because they are used extensively in municipal and industrial applications across the globe. They help satisfy the growing need for drinkable water supply in the current scenario of the growing pollution levels and water scarcity. In industrial plants, they are used to remove impurities, pollutants, and other undesirable substances from the water used in manufacturing and other industrial processes.

Additionally, the cartridge category is expected to register a momentous CAGR, of 6.5%, during the forecast period, due to the increasing health awareness, rising urbanization rate and residential construction scale, and burgeoning need for purified water in households around the world. In addition, these types of water filters are available in various configurations for different needs. Further, they are generally compact and designed for specific applications, such as carbon filtration, sediment removal, or specialty filtration, which is why they are prevalent in households.

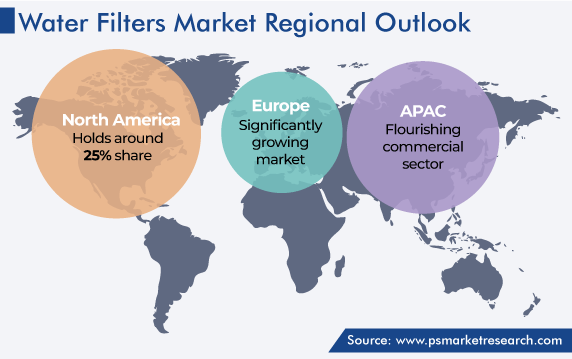

In 2023, APAC Dominated Global Market

In 2023, APAC was the dominant market, and it is expected to maintain its position, by reaching a value of around USD 10 billion by 2030.

The regional market is driven by the flourishing commercial sector, growing preference for purified water, and government initiatives to ensure the availability of clean drinking water to people. Moreover, the extensive use of water filtration systems here can be attributed to the fact that the region accounts for 60% of the world’s population.

China is the major market for water purifiers in the region as a consequence of the rapid urbanization, heightening health awareness, and strong water pollution concerns. These factors continue to propel the adoption of point-of-use water purifiers, and single- and dual-filter-media systems. Further, the country’s rapid industrial and agricultural progress has brought serious water contamination issues. Approximately 70% of the groundwater in China necessarily requires specialized treatment before use, while the tap water also comes with safety concerns due to the aged water infrastructure and severe reservoir pollution.

In addition, with the increase in water pollution awareness due to the existence of several government policies and programs, the Chinese population has begun to emphasize water quality. Further, the country is an emerging economy with substantial growth of businesses and trade. Further, domestic players that manufacture components and products at a competitive price are flourishing, which is further supporting the market growth.

Another country witnessing significant market growth in the region is India, which is already water-stressed. Hence, the government on various levels is taking measures to provide purified water to people and other end users. For instance, the Jal Jeevan Mission aims to provide clean tap water to every rural household by 2024. This factor supports the adoption of large filtration systems in water treatment units and, in turn, bolsters the market growth.

Similarly, almost all Middle Eastern countries face significant water stress, including Bahrain, Cyprus, Kuwait, Lebanon, Oman, and Qatar. The low water supply in these countries is worsened by a high demand from domestic, agricultural, and industrial users. Therefore, with the growing demand for purified water, the Sale of filters is increasing.

Significant Usage of Water Filters among Municipal Bodies

The municipal category accounted for a considerable revenue share, of more than 30%, in 2023 owing to the continual integration of single-, dual-, and multimedia filtration systems within municipal water supply networks. This integration is expected to bolster the demand for various types of filters for high-volume wastewater treatment and purification globally.

The water filter demand in the industrial category is also projected to flourish with a considerable rate during the forecast period. These systems are used in diverse industries to remove pollutants, such as sediments, metals, chemicals, minerals, and microorganisms, and ensure the availability of pure water for various manufacturing processes and for the workers.

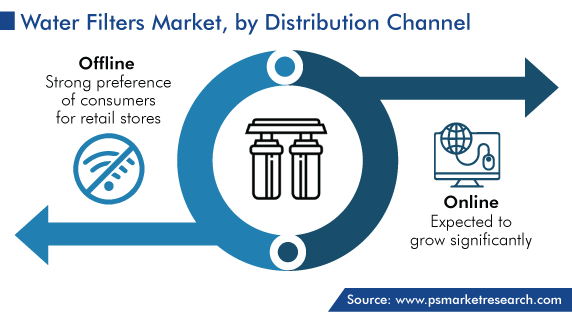

Offline Category Accounted for Highest Revenue Generator in 2023

In 2023, the offline category emerged as the dominant force in the market, leading the online distribution channel with a substantial margin. This is primarily credited to the strong preference of consumers for retail stores, owing to their perception as secure environments. Additionally, the opportunity for consumers to personally experience and test the product before committing to a purchase decision is a key factor contributing to this dominance.

Key Water Filter Manufacturers Are:

- A.O. Smith Corporation

- Eaton Corporation

- Veolia Water Technologies & Solutions

- Dow Inc.

- Evoqua Water Technologies LLC

- MANN+HUMMEL

- Suez S.A.

- PALL CORPORATION

- Pentair PLC

- Lydall Inc.

Market Size Breakdown by Segment

The study uncovers the biggest trends and opportunities in the water filters market, along with offering segmentation analysis at the granular level for the period 2017 to 2030.

Based on Type

- Reverse Osmosis

- Ceramic Filters

- Activated Carbon Filter

- UV Filtration

Based on Media Type

- Single and Dual Filter Media

- Multimedia

- Cartridge

Based on Distribution Channel

- Online

- Offline

Based on End Use

- Municipal

- Industrial

- Commercial

- Residential

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

The market for water filters will reach USD 22.5 billion in 2030.

The water filters industry 2023 size is USD 14.8 billion.

Multimedia variants hold the largest share in the market for water filters.

The incorporation of smart sensors and AI technology is trending in the water filters industry.

The market for water filters is driven by the rising water pollution levels, increasing incidence of waterborne diseases, and surging awareness of water safety.

The RO type is preferred in the water filters industry.

APAC is the largest market for water filters.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws