Vietnamese Diesel Generator Set Market Future Prospects

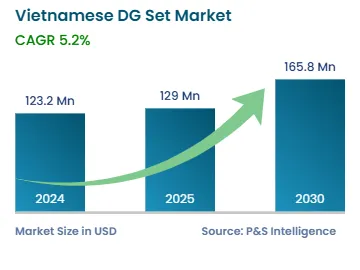

The Vietnamese diesel generator set market size stands at around 123.2 million in 2024, and it will grow at a CAGR of 5.2% during 2025–2030, to reach 165.8 million by 2030. In Southeast Asia, Vietnam is rapidly becoming one of the most-important genset markets, driven by the construction of special economic zones (SEZs), government infrastructure initiatives, such as metro trains, smart cities, and state and national roads; and increasing power consumption. Additionally, the country is witnessing rapid urbanization, mainly due to the expanding industrial and construction sectors.

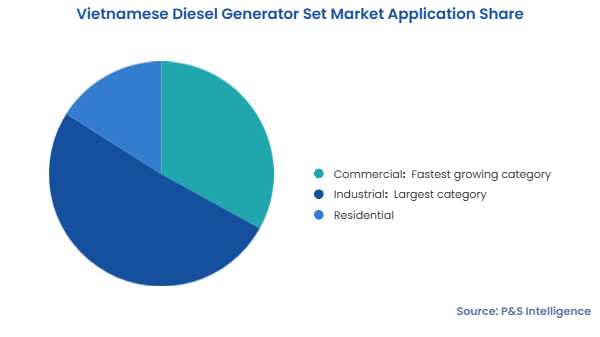

Furthermore, electricity is the key to the economic progress of a nation, but Vietnam lacks a proper grid infrastructure, due to which there is an inadequate power supply, which hampers the operations of residential and commercial spaces. Thus, the demand for generators is increasing, to provide a continuous power supply during a blackout and ensure a continuous electricity supply for several applications.

Moreover, according to a news article published in NhanDan in October 2021, the Vietnamese government aims to raise the total housing space to 27 square meters per person by 2025 and 30 square meters by 2030, under a strategy of the Ministry of Construction (MOC). Further, in the next 10 years, the government will focus on smart and green homes, redevelopment of old apartment buildings, and housing development associated with urban development. In addition, the policies cover the development of houses for low-income earners and workers in urban areas. Thus, the surging number of residential units, driven by government initiatives, will result in the rising sales of diesel gensets to meet the backup power demand.