Market Statistics

| Study Period | 2019 - 2030 |

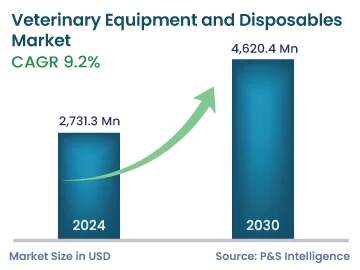

| 2024 Market Size | 2,731.3 Million |

| 2030 Forecast | 4,620.4 Million |

| Growth Rate(CAGR) | 9.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12784

Get a Comprehensive Overview of the Veterinary Equipment and Disposables Market Report Prepared by P&S Intelligence, Segmented by Type (Consumables, Equipment), Application (Surgery, Diagnosis, Monitoring, and Therapy), Animal (Companion Animals, Bovines and Large Animals), End User (Veterinary Clinics, Veterinary Hospitals, Veterinary Research Institutes), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,731.3 Million |

| 2030 Forecast | 4,620.4 Million |

| Growth Rate(CAGR) | 9.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The veterinary equipment and disposables market size stands at an estimated USD 2731.3 million in 2024, and it is expected to grow at a CAGR of 9.2% during 2024-2030, to reach USD 4,620.4 million by 2030.

This can be primarily attributed to the growing prevalence of zoonotic diseases, increasing adoption of companion animals, and rising demand for better veterinary critical care. Advanced technologies, such as wearables, can be helpful in tracking the health of pets from infancy, through youth and adulthood, to old age. Veterinarians use wearable technologies, including radiofrequency identification systems, GPS systems, and other sensors that track activity levels, food intake, and vitals, for pet monitoring.

Therefore, medical device companies are augmenting their focus on animal care, advancing the solutions they offer to pet owners as well as animal farmers. For instance, in January 2022, Covetrus announced the launch of a new veterinary operating system, Covetrus Pulse. It is based on cloud software that connects veterinarians to the technology required to manage their practice and frees up more time for them to spend with the pets in their care.

Additionally, the growing pet insurance demand, to help limit out-of-pocket expenditure on critical medical conditions, such as accidental injuries, is predicted to boost the usage of these pieces of equipment. Livestock insurance is available in countries such as Malaysia, India, and Vietnam, and it covers the cost of several veterinary procedures.

Consumables hold the largest share, of 60%, attributed to the rising animal care expenditure and the increasing number of sterilization procedures, which require consumables in high volumes. Moreover, they are used for various applications, including airway management and wound management. The key players are also focusing on launching new consumables for these and many other procedures. For instance, in March 2021, Axio Biosolutions announced its expansion into the veterinary wound management space with the launch of the SureKlot range of products.

The rescue & resuscitation category within the equipment sub-segment is expected to grow significantly in the coming years. This is ascribed to the rising incidence of cardiopulmonary arrest in cats and dogs, which needs quick patient assessment and an immediate administration of CPR.

The diagnosis, monitoring, and therapy category is expected to witness the faster growth, at a CAGR of 9.4%, owing to the need for the detection of health concerns before they become serious, so that effective treatment can be planned accordingly. Presently, artificial intelligence (AI) approaches are being used in veterinary health for predicting highly complex issues and studying host and pathogen interactions.

Surgical applications dominate the market, ascribed to the increasing number of surgical procedures. Moreover, the rising number of practitioners and advancing technologies are boosting the demand for surgical equipment.

Among surgical applications, dental surgery dominates the market owing to the rising awareness among pet owners regarding animals’ dental health. Moreover, the growing periodontal disease incidence and advancing technologies of dental devices and instruments drive the growth of this category.

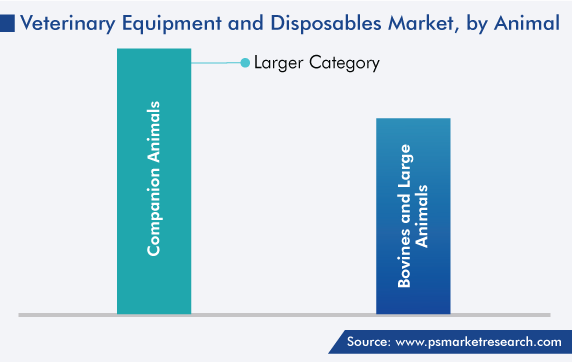

Companion animals dominate the market, attributed to the growth in their population and increase in the focus on their care. According to the American Veterinary Medical Association, the number of both dogs and cats in human households has increased significantly. Moreover, animal shelters are an important source for new pet acquisitions, accounting for 40% of cats and 38% of dogs adopted in 2021.

Besides, according to the North American Pet Health Insurance Association (NAPHIA), the demand for pet insurance over the years has resulted from the rise in the adoption of a large number of companion animals.

Additionally, the rising demand for effective therapies and diagnoses and the growing awareness of the care of companion animals are some key drivers for the category’s progress. The increasing number of initiatives for stray dog and cat rescue and the rising usage of rescue and resuscitation equipment are also boosting the revenue in this category.

The bovines and large animals category is also growing, because of the rising demand for meat and milk. In August 2021, the Animal Health Awareness Programme was organized by ICAR-Indian Veterinary Research Institute (IVRI), Eastern Regional Station (ERS), Kolkata, in the Balarampur Village. All the beneficiaries received an awareness kit comprising scientific literature regarding poultry/quail/duck farming, vaccination and deworming schedules, as well as a leaflet on poultry and duck diseases in the Bengali language.

Veterinary clinics are the largest end users, ascribed to the availability of a huge variety of treatment options here. Government animal welfare organizations have issued various guidelines to ensure the safety practices and standards to be implemented in such places, which, in turn, has augmented the footfall here. Moreover, across developed nations, the growth in this category can also be ascribed to the existence of a large number of vet clinics, which are performing an increasing number of surgeries.

Drive strategic growth with comprehensive market analysis

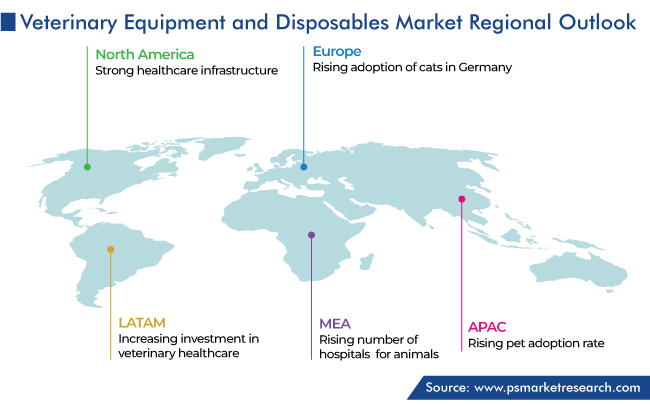

North America has the leading position in the market, and it will hold the same position till 2030, with a value of USD 1.2 billion. This is attributed to the strong healthcare infrastructure and technological advancements in the field of veterinary sciences. Moreover, the increasing expenditure on the health of pets, whose population is growing, contributes toward the growth.

In North America, the U.S. holds the leading position, and it will grow with a CAGR of 9.3%, attributed to the strong financial support by governments to enhance veterinary care. This is attributed to the growing pet adoption and increasing per capita animal healthcare expenditure. In addition, the significant increase in the prevalence of zoonotic diseases has been identified as the major driving factor for the development of advanced equipment and disposables.

Every year, approximately 4.1 million animals are adopted in the U.S., out of which 2 million are dogs and 2.1 million are cats. It is also estimated that around 90.5 million households in the country own a pet. Furthermore, the rising awareness of their health, advancing healthcare IT infrastructure, initiatives taken by the government to manage animals’ health, product innovations, and a high percentage of tech-savvy owners are boosting the progress of the U.S. veterinary equipment and disposables market.

Similarly, in the Asia-Pacific region, the market is expected to show significant progress in the coming few years due to the rising pet adoption rate, burgeoning livestock population, rapid urbanization, increasing awareness of animal health, and surging per capita animal health spending in the region. Among APAC countries, China and Japan are predicted to show notable growth, due to the increasing number of veterinary hospitals and clinics. In addition, the increasing R&D investments by the key players for the development of value-added products are expected to drive revenue generation in the region.

This report offers deep insights into the veterinary equipment and disposables market, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on Application

Based on Animal

Based on End User

Geographical Analysis

The market for veterinary equipment and disposables will value USD 4,620.4 million in 2030.

The 2024 estimated revenue of the veterinary equipment and disposables industry is USD 2731.3 million.

Consumables hold the larger share in the market for veterinary equipment and disposables.

The veterinary equipment and disposables industry revenue contribution of veterinary clinics is the highest.

The market for veterinary equipment and disposables is propelled by the rising adoption of pets and growing concerns over zoonotic diseases.

Currently, companion animals dominate the veterinary equipment and disposables industry.

North America is the largest market for veterinary equipment and disposables.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages