Report Code: 12892 | Available Format: PDF | Pages: 290

Vapor Deposition Market Size and Share Analysis by Process (Chemical Deposition, Physical Deposition), Application (Equipment & Film Coatings, Metalworks, Medical Devices, Cutting Tools, Microelectronics), End User (Electrical and Electronics, Automotive, Aerospace & Defence, Energy & Power, Metal Industry) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12892

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

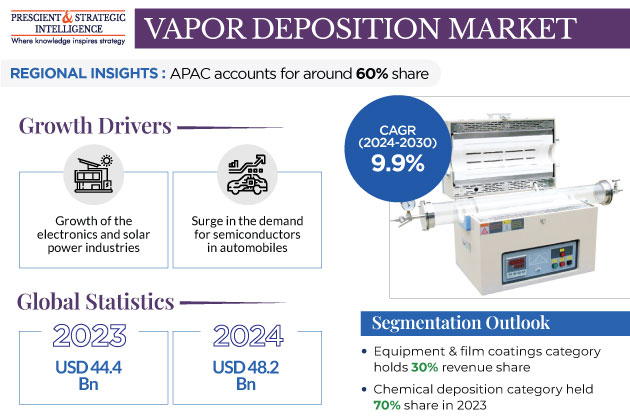

The global vapor deposition market generated revenue of USD 44.4 billion in 2023, and it is projected to witness a CAGR of 9.9% during 2023–2030, to reach USD 85.1 billion by 2030. This is majorly attributed to the growth of the electronics and solar power industries and surge in the demand for semiconductor in automobiles. Moreover, the growing demand for medical devices, booming LED device market, and various environmental regulations drive the market.

- With the advancing technology, efficient and precise deposition processes will be needed even more to manufacture the thin-film materials used in chip manufacturing.

- The utilization of this technique is vital while producing highly precise and biocompatible medical devices.

- As the advancement in healthcare technology continues, the Adoption of such processes will continue to grow.

Booming Semiconductor Industry

In today’s world of technology, the advancing semiconductor industry is the major vapor deposition market growth driver. Semiconductors are vital in almost all industries, such as medical equipment, automotive, and consumer electronics, helping realize the dreams of a smart city. Hence, as the semiconductor industry continuously expands and advances, the adoption of better wafer fabrication processes will also increase. The semiconductor industry’s future growth will be due to the quick adoption of a data-driven approach for everything, enabled by the improvement in the access to the AI, IoT, and 5G technologies.

- Moreover, leveraging their R&D capabilities, companies in various industries are using ICs to make their products more efficient and advanced.

- ICs enable the creation of lightweight, fast, and smart electronic devices.

- There has been a massive surge in the revenue generated in the semiconductor industry over the last few years.

- As per the Semiconductor Industry Association, semiconductors worth USD 555.9 billion were sold around the world in 2021, compared to USD 139.0 billion in 2001.

- The World Semiconductor Trade Statistics (WSTS) had forecast worldwide semiconductor industry sales to reach USD 601 billion in 2022 and USD 633 billion in 2023.

Vapor deposition techniques play a vital role in the manufacturing of semiconductors. These methods create thin layers of materials on semiconductor wafers, which enables the creation of intricate electronic components. As technology advances and the automotive industry grows, the demand for semiconductors continues to surge, which is why the usage of these processes will also experience a rapid rise in the forthcoming period.

- Advanced semiconductors require enhanced techniques of vapor deposition to ensure precise, high-quality, and uniform thin film deposition on semiconducting substrates.

- As electronics become smaller, more complex, and more powerful, cutting-edge vapor deposition processes will gain widespread preference.

Growing Pace of Innovation in Technology

There has been a significant rise in R&D efforts to advance vapor deposition technologies in recent years with the aim to improve the properties of substrates in various industries. For this, many research initiatives are taken by industry players, universities, and end users.

- The high-power impulse magnetron sputtering (HiPIMS) technology has enhanced capabilities for the deposition of thin films of metals, ceramics, and alloys.

- In this regard, Oerlikon Balzers launched BALIQ TISINOS PRO in July 2023.

- The higher-precision PVD coating allows industries to precision-machine challenging materials, especially 70-HRC steel, with improved efficiency.

- The coating reduces tool load, enhances wear resistance, extends tool longevity, and augments the overall product quality and output.

Additionally, AIXTRON introduced the G10-SiC, an advanced 200-mm CVD system for silicon carbide epitaxy, in September 2022. This high-temperature system is designed to enable large-scale production of SiC power devices on 150/200-mm wafers. Such advancements in vapor deposition technologies through research & development initiatives are creating an opportunity for the market players in several industries.

| Report Attribute | Details |

Market Size in 2023 |

USD 44.4 Billion |

Market Size in 2024 |

USD 48.2 Billion |

Revenue Forecast in 2030 |

USD 85.1 Billion |

Growth Rate |

9.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Process; By Application; By End User; By Region |

Explore more about this report - Request free sample

Chemical Vapor Deposition (CVD) Held Larger Share

By process, the chemical vapor deposition category held the larger market share, of 70%, in 2023, and it is expected to maintain its dominance during the forthcoming period.

- This is owing to the rapid development in the chemical vapor deposition technology, which drives its adoption in numerous applications.

- The key industry that uses this technology and, thus, drives the market, is semiconductor & electronics.

- Moreover, the adoption of this process on metal precursor delivery equipment, such as containers, vacuum pumps, and gas supply equipment, plays a vital role in the market advance.

- Thus, the expansion of end-use manufacturing facilities is likely to drive the growth of the market in this category.

Moreover, chemical vapor deposition process has many attributes, including atomic layer deposition, high-temperature, plasma, and low pressure. Moreover, there has been a surge in its usage in the aerospace and medical device industries as it enables the deposition of different metal precursors, dielectric compounds, and silicon precursors.

The physical vapor deposition (PVD) category is expected to show the faster growth, with a CAGR of 10%, during the forecast timeframe.

- This process is used to coat the surface of tools and the components to improve their functionality and shine.

- Moreover, the growing adoption of such processes in the semiconductor and consumer electronics industry has created an opportunity for companies offering the associated equipment and coating materials.

- It is used in numerous light-dependent applications, including spectacles and self-cleaning, tinted windows; electronic devices, such as displays, computer chips, and communication equipment; and PV modules.

- It is also used for functional and decorative finishes, such as hard, durable, and protective films and eye-catching gold, chrome, and platinum plating.

Equipment & Film Coating Category Dominates Industry

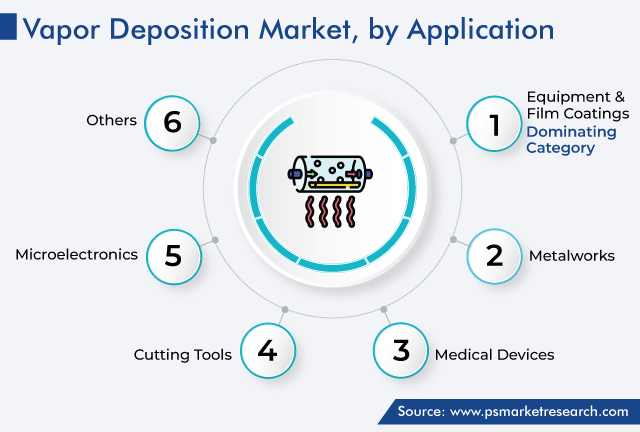

On the basis of application, the equipment & film coating category accounted for the largest revenue share, of 30%, in 2023, and it is further expected to maintain its dominance during the analysis period. This is owing to the growing demand for finishing on semiconductor substrates. Moreover, coatings created via vapor deposition protect the surface from damage due to various causes and enhance their appearance.

APAC Is Prime Revenue Contributor

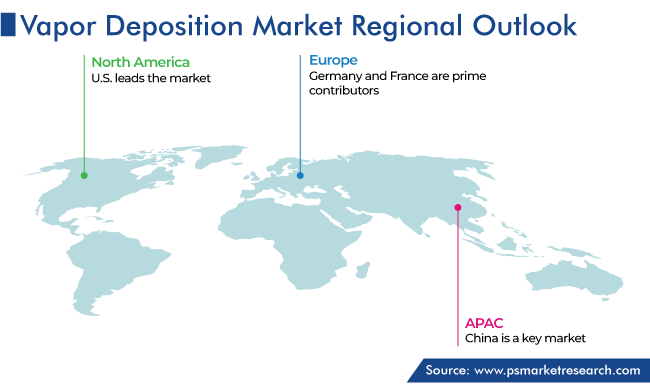

Geographically, the APAC region occupied the largest share in the vapor deposition market, of around 60%, in 2023, and the regional industry is expected to experience a strong CAGR during the projection period.

- This is because the region has an extensive manufacturing capacity for automotive and automotive components, semiconductors, and solar PV modules.

- Moreover, the growing pace of development in the electrical and electronics industry in the region, specifically microelectronics and displays of smartphones, TVs, and computers, propels the market.

- Further, the growing financial support from various countries’ governments to promote the domestic manufacturing of cutting-edge electronic components and reduce the dependence on the expensive imports, is a key market driver.

China is the highest revenue contributor in the APAC region, as it is the major producer of semiconductors and electronic components in the world. Hence, the usage of vapor deposition processes during the fabrication and manufacturing of electronic devices is incessantly rising in the country. Moreover, companies are expanding their manufacturing facilities and marketing & sales presence in the region, which is also one of the major reasons for the country’s market dominance. For instance, Impact Coatings AB, in April 2022, constructed a new physical vapor deposition subsidiary in Shanghai, China.

India is also showcasing a significant growth in the manufacturing of semiconductor and electronics devices.

- The country has emerged as the second-largest mobile phone manufacturer in the world, with more than 200 mobile phone manufacturing units.

- Moreover, the growing extent of government initiatives for Make in India projects encourages North American and European companies to set up new manufacturing facilities in the country.

- Moreover, the growing discretionary spending in the country will give opportunity for global players to enter India, by propelling the demand for cutting-edge consumer gadgets and automobiles.

Moreover, the Government of India has announced a USD 10-billion (INT 76,000 crore) program for the design, development, and manufacturing of semiconductors and displays. This move has the objective of attracting investments in the country’s semiconductor industry and positioning India as a major hub For them. Moreover, the government is providing fiscal support of 50% of the project cost through the pari-passu arrangement.

Top Providers of Vapor Deposition Equipment Are:

- IHI Group

- Applied Materials, Inc.

- ADEKA CORPORATION

- Plasma-Therm LLC

- Aixtron SE

- Tokyo Electron Limited

- Kurt J. Lesker Company GmbH

- Veeco Instruments Inc.

Market Size Breakdown by Segment

This report offers deep insights into the vapor deposition market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Process

- Chemical Deposition

- Physical Deposition

Based on Application

- Equipment & Film Coatings

- Metalworks

- Medical Devices

- Cutting Tools

- Microelectronics

Based on End User

- Electrical and Electronics

- Automotive

- Aerospace & Defence

- Energy & Power

- Metal Industry

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The global vapor deposition market will reach USD 85.1 billion by 2030.

The vapor deposition market will witness a CAGR of 9.9% in the coming years.

The expansion of the semiconductor industry, growth in electronics and solar power industries, increasing usage in automotive applications, and advancements in technology such as CVD and PVD processes are the primary drivers of growth.

Key trends include the rising adoption of CVD and PVD techniques, increasing usage in aerospace and medical devices industries, and the shift towards sophisticated electronic components in smart cities and consumer electronics.

The APAC region holds the largest market share.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws