Market Statistics

| Study Period | 2019 - 2030 |

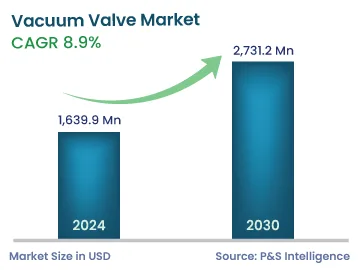

| 2024 Market Size | 1,639.9 Million |

| 2030 Forecast | 2,731.2 Million |

| Growth Rate(CAGR) | 8.9% |

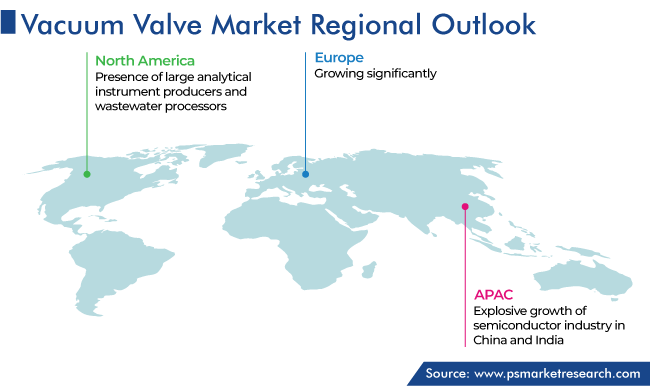

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12774

Get a Comprehensive Overview of the Vacuum Valve Market Report Prepared by P&S Intelligence, Segmented by Type (Pressure Control, Isolation, Transfer, Air Admittance, Check), Pressure Range (>10.3 torr, 10.3 to 10.8 torr, <10.8 torr), Application (Analytical Instruments, Semiconductors, Flat-Panel Display Manufacturing, Thin-Film Coating, Paper & Pulp, Chemicals, Food & Beverages, Pharmaceuticals), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 1,639.9 Million |

| 2030 Forecast | 2,731.2 Million |

| Growth Rate(CAGR) | 8.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The vacuum valve market revenue has been estimated at USD 1,639.9 million in 2024, which is expected to witness a CAGR of 8.9% during the forecast period (2024–2030), reaching USD 2,731.2 million by 2030. This can be ascribed to the rise in the demand for semiconductors, flat-Panel displays, pharmaceuticals, and thin-film coatings.

The major market trends include the expanding use of IoT-integrated valves with the shift in the focus toward automation and improved maintenance, and usage of smart valves to replace out-of-date valves. Additionally, the rapid construction of new power plants, as well as the renovation of the existing ones, propels the demand for vacuum valves.

Vacuum systems need valves for isolation, pressure control, and gas flow direction. There are various types of vacuum valves, the choice of which depends on where and why they are needed. Their design differs as per the size, material, temperature limit, operational speed, actuation method, lifespan, pressure range, and outgassing. For instance, a solenoid is an electrically operated valve that creates a magnetic field through an electric current and uses this principle to open and close.

High-quality valves have various applications in the medical device and pharmaceutical areas, such as sterilization and vacuum-packaging. Similarly, in the oil & gas industry, various fluid flow management techniques are vital. As a result, depending on the desired outcome, different valves can be employed at various stages of extraction, refining, and distribution. Additionally, in chemical and allied sectors, including petrochemical and , toxic raw materials, by-products, and final products are common. As a result, chemical factories require high-quality vacuum valves that can withstand the chemicals used.

The growing usage of indium–tin oxide (ITO) thin-film coatings in the manufacturing of flexible displays and high-resolution displays is propelling the market. In the thin-film coating procedure, a variety of techniques are employed, such as CVD, PVD, MOCVD, and PECVD. All of them must occur in carefully controlled environments, such as argon atmospheres and vacuums. The effectiveness of the coating process depends on precise control of the vacuum and gas distribution, for which vacuum valves are indispensable.

The booming food & beverage industry is another key driver for the market, as vacuum valves allow the related processes to be carried out in specific or controlled conditions. This is why such a setup is widely used for heat- and oxygen-sensitive ingredients.

The global consumption of milk in 2023 has been beyond 184,650 thousand metric tonnes. In the dairy industry, these components are used in the process, vacuum flash of cooling milk, and increasing the concentration of milk by vacuum evaporation. Other applications are de-aeration of water and liquid foodstuff, fractional distillation, vacuum filtration, freeze-drying of herbs, spices, and coffee; and bottling of beer and soft drinks.

The growing paper & pulp industry is also driving the market forward. It uses plug, V-port ball, knife-gate, high-performance butterfly, and rotary for basis weight management, cleaner and pump isolation, vacuum control, flow-level control, and condensate and steam flow control. For applications involving the handling of chemicals and steam, such as steam venting, steam impregnation, and pressure and flow control, the V-port ball and plug variants are employed in the pulping process. Valves with a toughened trim are ideally suited for chemical and steam handling applications.

Flat-panel displays for consumer electronics are being produced at a higher rate than anticipated. In comparison to one containing cathode ray tubes (CRT), a flat-panel display is smaller, lighter, and uses less power. Vacuum and emission reduction equipment that can handle sizable processing chambers and supply high gas flow rates with good reliability is necessary for manufacturing flat-panel displays. Vacuum valves are an ideal solution for this purpose as they also provide zero-humidity solutions.

The surge in the global demand for semiconductors for electronic items is the key driver for the market in this regard. The semiconductor manufacturing process has multiple steps, one of which is vapor deposition. Moreover, there are different types of this process, each of which needs different degrees of vacuums. Deposition applications need high-vacuum turbo pumps and primary dry pumps, preferably those that have the lowest cost of ownership and longest process lifespan.

The global current power consumption is beyond 160,000 TWh, and it will be beyond 25,000,000 TWh by 2030. India, being the third-largest producer and consumer of electricity in the world, has allocated USD 885 million for the solar power sector in budget 2023–24. This will enable a boost in the production of PV panels, which require the vacuum technology for high outputs, low breakage rates, and contamination-free handling during wafer separation and other processes.

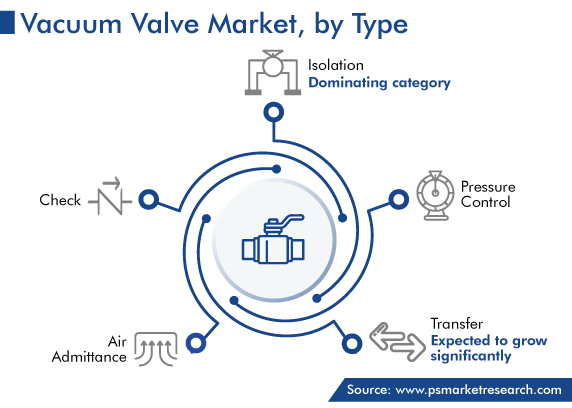

Based on valve type, the isolation category has the largest share in 2023. These variants are of a high quality and, thus, give better prevention from particle creation and outgassing. There are multiple subcategories of this type, as they are used for diverse applications. Their primary applications are in the manufacturing of analytical instruments, food & beverages, chemicals, and semiconductors.

Butterfly valves is high in demand under isolation category because of the high reliability and efficiency and low maintenance of these variants and the continuous improvement in the material and technology used in their production. These devices control the flow of liquids efficiently, which leads to their wide usage in the food & beverage, water treatment, and many other industries.

Based on industry, the semiconductors category is expected to grow fastest in the forecast period. Semiconductors are used in almost every electronic item, such as gaming consoles, mobile phones, laptops, microwaves and refrigerators, and IoT and AI devices, including connected cars and robots. Vacuum valves are required for precision, high accuracy, and controlled conditions during the fabrication of semiconductors. The need for these devices in the semiconductors industry is driven by the expanding demand for high-performance electronic devices, which can only be fulfilled with credible, high-end manufacturing processes.

During 2024–2030, the pharmaceuticals category's expansion will be the significant because several manufacturing processes in this industry need a vacuum, including distillation, drying, and filtration. A considerable change has occurred in the pharmaceuticals sector as a result of technological developments, emergence of low-cost manufacturing techniques, and greater investment in R&D. Further, product waste and downtime on the factory floor have decreased because of the usage of robotics and AI, which has, in turn, raised the productivity and efficiency of pharmaceutical companies.

Additionally, specialized laboratories in government, semi-government and private medical research organizations require standardized high-tech equipment, such as mass spectrometers and electron microscopes. The use of high- and ultra-high vacuums as the measuring environment is a feature shared by many of these devices. The high level of purity of the vacuum, in addition to its exact control, is of special significance in this situation.

Drive strategic growth with comprehensive market analysis

Geographically, APAC generates the highest revenue in the market for vacuum valves. This is due to the high demand for these systems in the manufacturing of semiconductors and flat-panel displays. Additionally, Asia-Pacific region will grow at a CAGR of 9.2% in the market during the forecast period. This will be driven by the explosive growth of the semiconductor industry in China and India as a result of the rising consumer electronics demand. Thus, the increasing number of semiconductor manufacturers in the region will fuel the vacuum valve market's expansion throughout the projection years.

Another driver will be the growth in the oil & gas and power sectors. The oil & gas sector has increased exploration and production activities to fulfill the growing demand for fuel and electricity. For instance, for the three-year period of FY 2022–25, Oil & Natural Gas Corporation (ONGC) will invest INR 31,000 crore to explore fuel reserves, which is 150% more than the investment over the last three-year period.

Further, with the increasing focus on reducing emissions, renewable resources, such as solar power, are high in focus. This industry is undertaking R&D to make electricity accessible for the entire population in the most-economical way. Another focus area is the achievement of the sustainable development goals (SDG) provided by the UN, to generate power in a way that leaves the least possible carbon footprint. Because vacuum valves are important during the production of PV panels, such initiatives will continue to bring opportunities for market players.

This fully customizable report gives a detailed analysis of the vacuum valve industry, based on all the relevant segments and geographies.

Based on Type

Based on Pressure Range

Based on Application

Geographical Analysis

The vacuum valve industry is investing heavily in research & development to offer a higher quality and improved performances, along with innovative designs. These strategies are ultimately aimed at achieving a larger customer base and enhanced business outcomes.

For instance, VAT Group, in September 2023, started work on a new innovation center at its corporate campus in Haag for all its innovation activities, with an investment of USD 43 million. Moreover, in October 2023, Henry Pratt Company unveiled the Pratt P77 perimeter-seated bi-directional knife gate valve, which has the capability to handle abrasive material and tough slurries.

Additionally, in March 2021, Hyperloop Transportation Technologies and GNB KL Group collaborated to create isolation valves for hyperloop system tubes. These 5-meter (16.5 feet) tall valves can withstand forces of 288,000 pounds (125 tonnes).

The market for vacuum valves values an estimated USD 1,639.9 million in 2024.

Between 2024 and 2030, the vacuum valve industry will witness a CAGR of 8.9%.

Isolation valves generate the highest revenue in the market for vacuum valves.

The integration of these devices with AI and IoT is trending in the vacuum valve industry.

The key end users in the market for vacuum valves are the food & beverage, research, pharmaceutical, chemical, solar PV, and oil & gas industries.

Product innovations are being undertaken by the major vacuum valve industry players.

Asia-Pacific is the largest market for vacuum valves, by region.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages