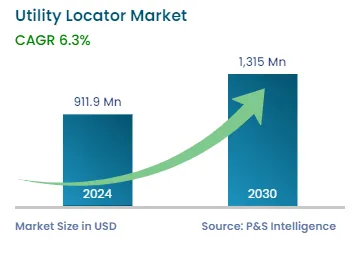

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 911.9 Million |

| 2030 Forecast | USD 1,315 Million |

| Growth Rate(CAGR) | 6.3% |

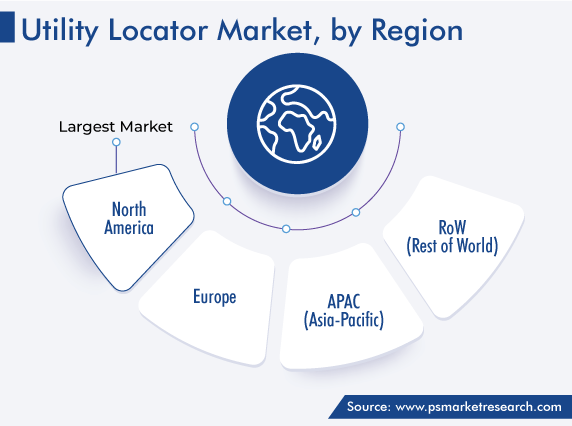

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12602

Get a Comprehensive Overview of the Utility Locator Market Report Prepared by P&S Intelligence, Segmented by Technique (Electromagnetic Field, GPR), Offering (Equipment, Services), Target (Metallic Utilities, Non-Metallic Utilities), Vertical (Oil & Gas, Electricity, Transportation, Water & Sewage, Telecommunications), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 911.9 Million |

| 2030 Forecast | USD 1,315 Million |

| Growth Rate(CAGR) | 6.3% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The utility locator market stood at USD 911.9 million in 2024, and it is expected to grow at a compound annual growth rate of 6.3% between 2024 and 2030, to reach USD 1,315 million by 2030.

The rising concern to ensure the safety of utilities that are present underground, technological developments that are paving the way for the accurate identification and location of utilities, as well as the rapid infrastructure development are expected to drive the market’s growth.

Outdated or missing data regarding the presence of utility structures underground in several sites is one of the major issues that comes into play during excavations and the execution of construction projects. Utility locators are necessary to accurately locate and identify the various metallic and non-metallic structures, cables, and pipes that are present beneath the ground.

Precision in identifying utility lines, such as telephone cables, gas pipes, and sewers, that exist beneath the ground makes it easier to prevent damage to them and injuries to workers. The lines are marked with paint or flags, so that during activities such as excavation or construction, the chances of them being harmed are mitigated.

During the projection period, the electromagnetic field technique is expected to hold the largest utility locator market share. Moreover, it is expected to grow at a CAGR of around 6%, attributed to the ability of this technique to provide information about a range of utilities, such as electricity wires, gas pipes, and water & sewage pipes, which are a part of the general civil infrastructure.

Utilizing a combination of a transmitter and receiver for generating and analyzing the signal, to identify the exact positions of the structures present below the ground, the electromagnetic field is mainly used for identifying metallic utility structures.

Additionally, the various purposes for which it can be used, such as for finding access points, monitoring excavation procedures, and tracing the target lines, would aid this category in maintaining its dominance on the market.

Apart from the electromagnetic field technique, the ground penetrating radar technique, wherein high-frequency radio waves are used, is expected to hold a significant share. The ground penetrating radar technique can detect both metallic and non-metallic pipes and conduits. Moreover, since it is non-invasive, it can be used for varied purposes, such as interior spaces.

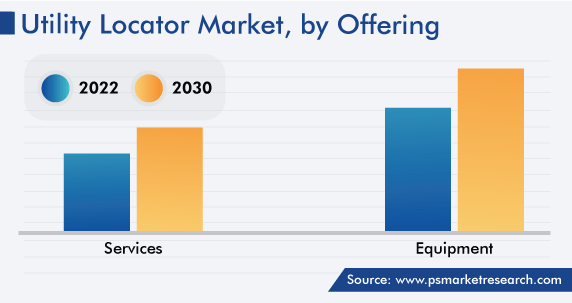

The services category is likely to grow at the higher CAGR, of around 6.1%, during the projection period. Training, inspection, repair & maintenance, and calibration services are regularly required for the equipment used in the utility locating process. Training is one of the most-essential services as it enables the operator to use the equipment with precision, while maintaining complete safety on the site. Moreover, with the regular usage of the equipment, maintenance and repairs are required.

The metallic utilities category includes metal pipes and conduits, whereas the non-metallic category includes concrete, plastic, and other materials. The metallic utilities category is expected to hold a significant market share in the coming years due to the wide usage of electromagnetic field solutions for the identification and tracking of such structures.

The telecommunications vertical, which includes lines for telephones and television, fiber-optic cables, and other related infrastructure, is expected to grow at a CAGR of more than 6.4% during the projection period and hold the largest share.

Telecommunications infrastructure is essential to meet the communication needs that exist worldwide. The deployment of sophisticated systems and technologies to provide coverage to rural areas, especially in developing countries, has become important. Moreover, the existing ones in cities and towns require maintenance without any disruption in communication.

In the same way, the swift pace at which urbanization is progressing in emerging economies would be advantageous in stimulating the market in the electricity as well as the water & sewage verticals.

Drive strategic growth with comprehensive market analysis

In the past, the North American region dominated the market, and it is expected to grow at a CAGR of more than 6% during the projection period. The growth can be attributed to the booming demand for the enhanced inspection of sites before digging or excavation, construction of new buildings, and maintenance of the existing infrastructure in the U.S. and Canada.

Construction is one of the major verticals contributing to the growth of the U.S. economy, and according to a government source, more than 1 million building permits were granted for residential construction in December 2022 alone. The government is also approving investments worth billions of dollars for new construction, since the safety concerns regarding the existing structures are rising and the country wants its infrastructure to be competent with that of developing nations, especially China. This implies that construction and infrastructure development would remain robust in the future, in turn, driving the demand for solutions that can help locate underground infrastructure.

Based on Technique

Based on Offering

Based on Target

Based on Vertical

Geographical Analysis

The 2024 value of the market for utility locator solutions was USD 911.9 million.

The utility locator industry is driven by the growing real estate construction activities and the need to protect the existing utilities.

Technological advancements are trending in the market for utility locator solutions.

The electromagnetic field technique dominates the utility locator industry.

APAC is the region with the brightest growth potential for the market for utility locator solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages