Key Highlights

| Study Period | 2019 - 2032 |

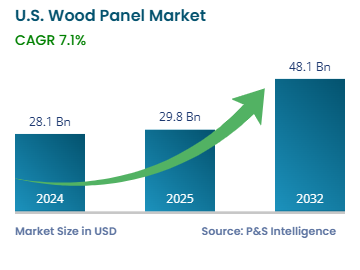

| Market Size in 2024 | USD 28.1 billion |

| Market Size in 2025 | USD 29.8 billion |

| Market Size by 2032 | USD 48.1 billion |

| Projected CAGR | 7.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13512

This Report Provides In-Depth Analysis of the U.S. Wood Panel Market Report Prepared by P&S Intelligence, Segmented by Product (Plywood, Medium-Density Fiberboard, High-Density Fiberboard, Particleboard, Oriented Strand Board, Hardboard, Softboard), Application (Furniture & Fixtures, Building & Construction, Consumer Goods & Appliances, Automotive), Distribution Channel (Oflline, Online), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 28.1 billion |

| Market Size in 2025 | USD 29.8 billion |

| Market Size by 2032 | USD 48.1 billion |

| Projected CAGR | 7.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. wood panel market size was USD 28.1 billion in 2024, and it will grow by 7.1% during 2025-2032, to reach USD 48.1 billion by 2032.

The market is driven by the increasing environmental awareness, supportive government policies, and rising construction activity. Residential and commercial structures depend on plywood, OSB, and MDF, as they are cost-effective and lightweight, yet strong. Sustainability is a major driver for this market as it drives the demand for low-carbon alternatives to non-renewable materials. This encourages green building projects and draws environmentally sensitive consumers.

The Energy Independence and Security Act promotes the use of renewable energy sources and supports the growth of the sustainable wood industry. This is because the Renewable Fuel Standards established as part of this act mandate a minimum percentage of biofuels to be blended in conventional gasoline and diesel. Biofuels are produced from biomass, such as wood pulp and agricultural and domestic waste.

The rapid shift toward wood products that provide safety and greater functionality drives the players to innovate items according to the consumer demands. Moreover, the Formaldehyde Standards for Composite Wood products Act limits the release of formaldehyde from wood products, thus inspiring producers to create safe products with lower emissions.

The plywood category held the largest market share, of 30%, in 2024 because of its adaptability and flexibility. Its fire and water resistance makes it suitable for structural applications, such as wall sheathing. According to a report, around 66.2% of the plywood is used in the residential sector, mainly for interior modifications.

The oriented strand board category will have the highest CAGR, of 8%, due to the rising demand for sustainable building materials for flooring, sheathing, and framing. The U.S. Forest Service has reported growth in OSB production and consumption in the construction industry.

The products analyzed in this report are:

The furniture & fixtures category held the largest market share, of 55% in 2024, because medium-density fiberboard and plywood are widely utilized for cabinets, chairs, closets, and tables. They are cost-effective and versatile, and thus perfect for the commercial and residential sectors. According to reports, consumers’ spending on home furnishings, interior design, and lifestyle preferences is set to increase to 1.7% of the total personal consumption expenditure by 2025.

The building & construction sector will have the highest CAGR, of 7.1%, because of increase in the use of engineered wood panels for roofing, walls, floors, and doors. The rapid urbanization and strong focus on sustainability drive the demand for wood panels. As per reports, over 90% of the single-family homes in the U.S. are made of wood because of its easy availability, cost-effectiveness, and aesthetic appeal.

The applications studied in this report are:

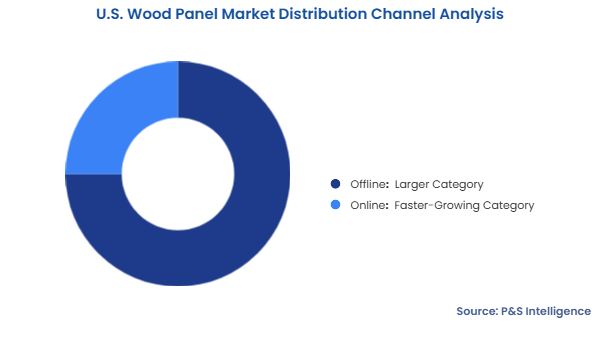

The offline category held the larger market share, of 75%, in 2024, as consumers depend upon traditional outlets, such as distributors, wholesalers, and retail stores. These channels provide a hands-on experiences and professional advice on the products. Customers, especially real estate developers and contractors, prefer to visit stores for large-scale purchases and immediate needs.

The online category will have the higher CAGR, of 8.1%, because consumers now prefer the convenience of shopping from home, They can compare products easily, pay electronically, and have the products delivered at their doorstep. E-commerce platforms, online retailers, and company websites serve small businesses. The growth of this channel is also driven by better internet access and changing consumer preferences. As per the International Trade Administration, B2B online sales in the U.S. are expected to increase at a CAGR of 11.22% between 2023 and 2027.

The distribution channels analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South region held the largest market share, of 55%, in 2024, because it has a high concentration of producers of wood panel products, such as Georgia-Pacific and Weyerhaeuser. The vast tracts of Southern yellow pine and a high demand from the residential housing sector in Texas and commercial construction in Georgia and North Carolina drive the market.

The West will have the highest CAGR, of 7.2%, due to the expansion of manufacturing facilities, increasing demand for engineered and environment-friendly wood products, and rising construction and remodeling activity in California and Oregon. According to reports, the U.S. housing market is expanding particularly due to the rise in home construction in the South and West.

The geographical breakdown of the market is as follows:

The market is fragmented, with many regional producers and established firms. This generates tough competition, with companies, including West Fraser, Roseburg, Kronospan, and Weyerhaeuser, enhancing the performance and sustainability of their products. Firms are employing new technology to produce superior and environment-friendly products. Other factors that contribute to the market fragmentation include the diverse product offerings, regional preferences, and consumer demand for customization.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages