Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 10.8 billion |

| Market Size in 2025 | USD 11.3 billion |

| Market Size by 2032 | USD 16.8 billion |

| Projected CAGR | 5.8% |

| Largest Region | West |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13509

This Report Provides In-Depth Analysis of the U.S. Wiring Devices Market Report Prepared by P&S Intelligence, Segmented by Product Type (Current Carrying Devices, Non-Current Carrying Devices, Circuit Protection Devices, Control Devices), Application Type (Residential, Commercial, Industrial), Functionality (Standard Devices, Smart Devices, Heavy-Duty Devices, Weatherproof Devices), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 10.8 billion |

| Market Size in 2025 | USD 11.3 billion |

| Market Size by 2032 | USD 16.8 billion |

| Projected CAGR | 5.8% |

| Largest Region | West |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

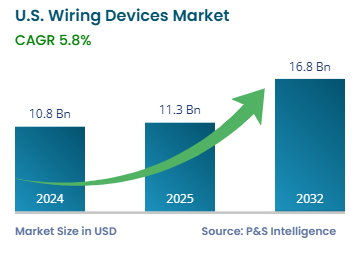

The U.S. wiring devices market size was USD 10.8 billion in 2024, and it will grow by 5.8% during 2025-2032, to reach USD 16.8 billion by 2032.

The market growth is primarily ascribed due to the increasing construction in the commercial and residential sectors, technological advancements, and the rising usage of smart devices for energy efficiency.

Various government initiatives help in developing safe and effective wiring systems. For example, the National Electrical Code has issued new rules for using GFCI and AFCI, which ensure safety in all sectors. Also, the U.S. Department of Energy and private organizations promote the use of smart wiring systems.

The current carrying category held the larger market share, of 65%, in 2024, because of need for efficient outlets, electric switches, and connectors for industrial, residential, and commercial space. According to 2024 reports, around 27% of the wiring devices produced were current-carrying devices, which are widely used in all sectors for proper power distribution. The automated electrical appliances increasingly being used in offices and houses include kitchen gadgets, entertainment systems, HVAC systems, and lights. Their rising adoption propels the demand for power outlets and devices that carry a current.

The non-current carrying category will have the higher CAGR, of 6%, because of the rising demand for conduits and faceplates. The rise in infrastructure construction, stricter building codes, and safety rules increase the demand for these items as they help in the protection of electrical systems. Additionally, the shift toward modern buildings with smart devices is propelling the growth.

The products analyzed in this report are:

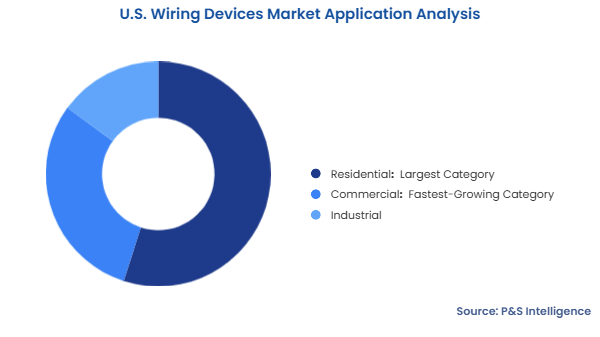

The residential category held the largest market share, of 55%, in 2024 because of the rising urbanization, increasing domestic electrification, and surging retrofit and new construction. As per the Census Bureau, the construction of 927,000 single-family homes began in the U.S. in April 2025. The emergence of smart homes with advanced smart devices and IoT systems also helps in the market growth. Government programs, such as tax policies and subsidies, promote better residential electrification and cost-effective housing.

The commercial category will have the highest CAGR, of 5.9%, because of the growing of office spaces, hotels, data centers, and retail stores. Further, the rapid usage of smart electrical systems increases the demand for advanced wiring devices in this sector.

The applications analyzed in this report are:

The standard devices category held the largest market share, of 60% in 2024, due to its high demand in industrial, commercial, and household environments. These basic devices, such as outlets and switches, have affordable pricing with an easy installation method for all electrical systems. Also, they are reliable and durable, making them preferable among customers.

The smart devices category will have the highest CAGR, of 6.5%, due to the increasing use of smart home technologies. Also, the rising awareness among consumers about safety features, remote-control capabilities, energy efficiency, and home automation is increasing the demand for smart devices. The ENERGY STAR program promotes smart energy management, while expansion of 5G connectivity enables smart power technology.

The functionalities analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The West region held the largest market share, of 40%, in 2024, and it will also have the highest CAGR, of 7%, during the forecast period. This is mainly due to the high disposable income, adoption of new technologies, an efficient retail supply chain, increasing demand for electronics, especially in Silicon Valley, which demands smart home devices. Additionally, the high construction activity in Los Angeles, Seattle, and San Francisco boosts the need for these advanced devices.

The geographical breakdown of the market is as follows:

The market is fragmented due to the presence of several players catering to different applications and performance standards. Also, the niche and emerging players provide personalized solutions to compete effectively. This means that no single company holds a major share of the market. The market fragmentation is also attributed to the large number of small and mid-sized companies offering standardized wiring devices bereft of smart features.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages