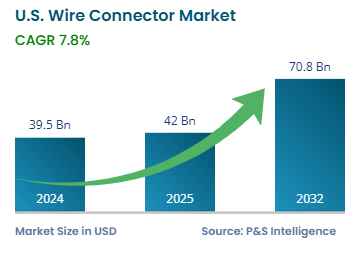

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 39.5 Billion |

| 2025 Market Size | USD 42 Billion |

| 2032 Forecast | USD 70.8 Billion |

| Growth Rate(CAGR) | 7.8% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13442

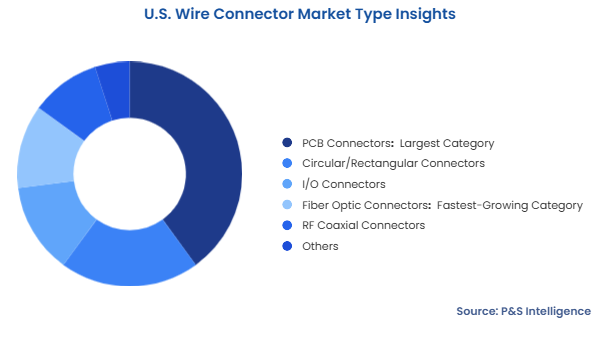

This Report Provides In-Depth Analysis of the U.S. Wire Connector Market Report Prepared by P&S Intelligence, Segmented by Type (PCB Connectors, Circular/Rectangular Connectors, I/O Connectors, Fiber Optic Connectors, RF Coaxial Connectors), End User (IT & Telecommunication, Automotive, Commercial, Aerospace & Defense, Consumer Electronics, Industrial, Energy & Power, Oil & Gas), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 39.5 Billion |

| 2025 Market Size | USD 42 Billion |

| 2032 Forecast | USD 70.8 Billion |

| Growth Rate(CAGR) | 7.8% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. wire connector market valued USD 39.5 billion in 2024, and it is expected to reach USD 70.8 billion by 2032, growing at a CAGR of 7.8% from 2025–2032. This is because of the rising demand for EVs, 5G connections, and IoT devices. The development of technology demands dependable connectors for powering devices and transmitting data. The expansion of the market receives additional momentum from the government investments in modernizing power, transportation, and communications infrastructure.

5G networks, IoT, and automated systems create an increasing demand for immediate communication between machines and humans. Self-driving cars, smart factories, and advanced medical equipment depend on flawless data transmission.

The demand for wire connectors that offer high performance at greater data speeds with no failures is surging. Companies are focused on developing superior connectors that provide dependable and secure network connections for challenging conditions. These connectors enable device operation efficiency in high-speed internet setups, robotic assembly lines, and smart home systems.

PCB connectors are the largest category with a market share of 40%, in 2024 because of their reliable design, compact construction, and wide functionality. These connectors are fundamental for the electronics, automotive, and telecom industries as they enable the operation of smartphones and industrial machines. The dominance of PCB connectors results from their signal-handling capability and expanding high-speed data transmission needs.

Fiber-optic connectors are the fastest-growing category, with 8.5% CAGR, because customers require quick data transmission at rising volumes. The adoption of 5G, cloud computing, and IoT technology drives the demand for fiber-optic connectors as they deliver swift and reliable network connections for contemporary communication systems.

Here are the types studied in the report:

The IT & telecommunications sector is the largest with a market share of 35%, in 2024 because of the expanding 4G/5G networks, rising high-speed internet demands, and construction of data centers. All of them require reliable high-performance connectors.

Automotive is the fastest-growing sector, with 9% CAGR due to the rising sales of electric vehicles, connected vehicles, and autonomous driving technology. This creates a requirement for highly advanced connectors for efficient power distribution, system management, and safety.

The following end users are analyzed in the report:

Drive strategic growth with comprehensive market analysis

The West region is the largest with a market share of 40% in 2024 because of the swift technology development in Silicon Valley and rising renewable energy investments. The presence of numerous technological startups and green energy projects throughout the West drives market expansion.

The South is the fastest growing, with 9.5% CAGR, because it contains established automotive, aerospace, and energy sectors. Texas and Alabama operate significant production facilities, which create a high demand for connectors.

Here are the regions covered in the report:

A fragmented structure defines the U.S. wire connector market since multiple companies operate, instead of a dominant few large player. Wire connectors provide solutions to multiple industries, such as automotive, aerospace, IT & telecommunications, and energy, which need specialized products. Due to the diverse sector requirements, no business can address all needs, which results in multiple manufacturers and suppliers.

The need for new connector solutions resulting from fast technological progress in 5G, electric vehicles, and automation drives competition among market participants. The wire connector market consists of large firms, such as Amphenol, TE Connectivity, and Molex, alongside numerous smaller companies, which produce specialized and high-performance connector solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages