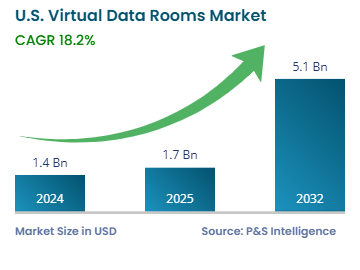

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 1.4 Billion |

| 2025 Market Size | USD 1.7 Billion |

| 2032 Forecast | USD 5.1 Billion |

| Growth Rate (CAGR) | 18.2% |

| Largest Region | Northeast |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13441

This Report Provides In-Depth Analysis of the U.S. Virtual Data Rooms Market Report Prepared by P&S Intelligence, Segmented by Component (Solution, Service), Deployment (Cloud-Based, On-Premises), Business Function (Legal & Compliance, Financial Management, Intellectual Property Management, Sales and Marketing), End User (BFSI, IT & Telecommunication, Healthcare, Government and Legal Services, Energy & Utilities, Retal & E-Commerce), Organization Size (SMEs, Large Organizations), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 1.4 Billion |

| 2025 Market Size | USD 1.7 Billion |

| 2032 Forecast | USD 5.1 Billion |

| Growth Rate (CAGR) | 18.2% |

| Largest Region | Northeast |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. virtual data rooms market size was USD 1.4 billion in 2024, and it will grow by 18.2% during 2025–2032, reaching USD 5.1 billion by 2032.

The market is driven by the expanding requirement for secure data sharing and collaboration to meet legal requirements across many industries and private business needs, especially during mergers and acquisitions. The BFSI, real estate, legal, and healthcare industries widely use these solutions for secure data storage, regulatory compliance, and remote team collaboration.

The market’s growth is also propelled by the nationwide digital transformation, shift toward cloud-based solutions, and heightening concerns over cyberthreats. As businesses seek to minimize risks associated with data breaches, they are using VDRs to gain advanced encryption, access controls, and real-time monitoring, to safeguard critical information.

Businesses now place data security as a key priority, prompting VDR providers to upgrade security features to safeguard sensitive information. Advanced encryption techniques, multi-factor authentication systems, and granular access controls are the main security measures being taken. The progress in the AI, ML, and blockchain technologies will boost VDR capabilities.

Remote work trends drive the demand for secure collaborative document-sharing solutions. Organizations are increasingly committing to remote work and AI-powered VDRs, thus creating a growing need for data automation, enhanced cybersecurity measures, and compliance protocols.

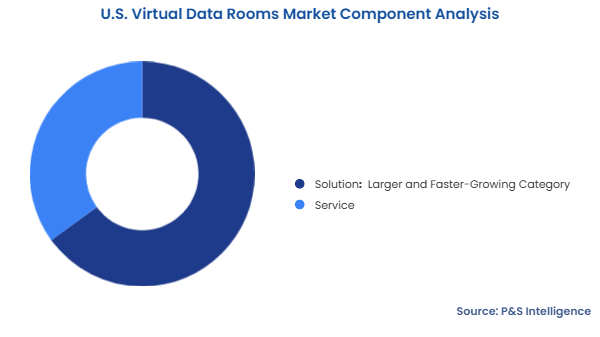

The solution category held the larger market share, of 65%, in 2024, and it will grow at the higher CAGR, of 21%, during the forecast period. This is because VDR solutions deliver three core benefits: safe document management, efficient file sharing, and detailed activity tracking. These functionalities are essential for secure information management in the BFSI, legal, and healthcare sectors.

The components analyzed here are:

The cloud-based category held the larger market share, of 70%, in 2024, and it will grow at the higher CAGR, of 20%, during the forecast period. This is due to the cost reductions, customizability to customer needs, scalability, and better safety protocols enabled by cloud-based solutions. BFSI, healthcare, and legal businesses depend on cloud-based solutions for collaborative work and regulatory compliance.

The deployments analyzed here are:

The legal & compliance category held the largest market share, of 45%, in 2024. This is due to the widespread implementation of virtual data rooms for M&A, due diligence, regulatory compliance, litigation, and secure document management. Law firms, financial institutions, and corporations utilize VDRs to secure sensitive legal documents.

The financial management category will grow at a highest CAGR, of 19.5%, during the forecast period. This is because of the growing application of VDRs in investment banking, IPOs, private equity, and fundraising functions. The necessity of financial operation digitization and the requirement for immediate access to sensitive financial data are credited for this.

The business functions analyzed here are:

The BFSI category held the larger market share, of 35%, in 2024 because banks and financial institutions use deal rooms for secure document management. Security must be highly advanced, and all operations must meet the regulatory standards in this sector. Businesses rely on secure deal rooms to distribute monetary documents and investor communications, through which they maintain confidentiality.

The healthcare category will grow at a highest CAGR, of 21%, during the forecast period. This is because of the increase in the usage of electronic health records (EHR) to handle the sensitive health data of patients. VDRs are also used to collaborate on clinical trials, research papers, and new drug development, as well as protecting intellectual property.

The end users analyzed here are:

The large organizations category held the larger market share, of 70%, in 2024. This is because large organizations constantly carry out mergers, regulatory filings, and high-volume data exchange and must follow strict rules for managing data.

The SME category will grow at the higher CAGR, of 22%, during the forecast period because SMEs are growing quickly in number and economic contribution. SMEs often need to collaborate with external partners, suppliers, and investors. Secure deal rooms, especially those available over the cloud, are affordable for them; so, more are using them to protect sensitive information.

The sizes analyzed here are:

Drive strategic growth with comprehensive market analysis

The market in the U.S. is fragmented as VDR solutions are provided by numerous entities, which include both big players and newer emerging service providers. Businesses present distinct requirements; so, VDR providers create different, often customized, solutions to match their particular needs. Intralinks, Merrill Corporation, and Citrix Systems provide broad all-encompassing VDR solutions for industrial use. The market consists of numerous specialized. Smaller firms, including ShareVault and Ansarada, which serve specific sectors with customized features for legal, financial, or M&A needs.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages