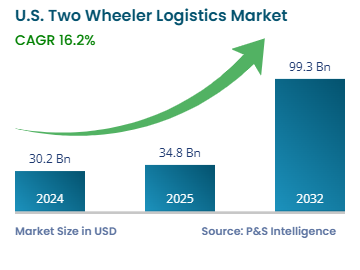

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 30.2 billion |

| 2025 Market Size | USD 34.8 billion |

| 2032 Forecast | USD 99.3 billion |

| Growth Rate (CAGR) | 16.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13472

This Report Provides In-Depth Analysis of the U.S. Two Wheeler Logistics Market Report Prepared by P&S Intelligence, Segmented by Vehicle Type (Moped, Scooter, Motorcycle, E-Bikes), Propulsion Type (Conventional-Fuel-Based, Electric Two-Wheelers), End user (B2B, B2C, C2C), Service Type (Food Delivery, Grocery Delivery, E-Commerce Delivery, Parcel Delivery), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 30.2 billion |

| 2025 Market Size | USD 34.8 billion |

| 2032 Forecast | USD 99.3 billion |

| Growth Rate (CAGR) | 16.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. two-wheeler logistics market revenue was USD 30.2 billion in 2024, and it is expected to witness a CAGR of 16.2% from 2025 to 2032, reaching USD 99.3 billion in 2032.

The growing e-commerce industry, which offers faster deliveries, is primarily driving the market's growth. The demand for two-wheeler logistics services will also grow with the increasing adoption of electric two-wheelers in the U.S. due to the rising environmental concerns and race to meet sustainability goals.

Additionally, with the improvement in battery technology, electric two-wheelers now have an improved range and efficiency, which makes them more reliable for logistics operations. Furthermore, government support for the promotion of EV technology helps the market grow.

In August 2024, the U.S. government invested USD 521 million to expand the EV charging network. The funding is to be distributed across 29 states, and it is for installing 9,200 EV charging ports.

The scooter category held the largest market share, of 35%, in 2024, due to the affordability of scooters and their popularity among small-to medium-sized enterprises. Scooters now come with larger spaces for carrying goods and are integrated with modern technologies, such as GPS and integrated communication systems.

Bikes will grow at a highest CAGR, of 17%, during the forecast period. This is due to the U.S.’s push for environmental sustainability, as e-bikes reduce carbon emissions more compared to the other vehicles. Additionally, the advancement in battery technology is increasing the range of e-bikes and making them fit for logistics purposes.

Based on vehicle type, the market has the following categories:

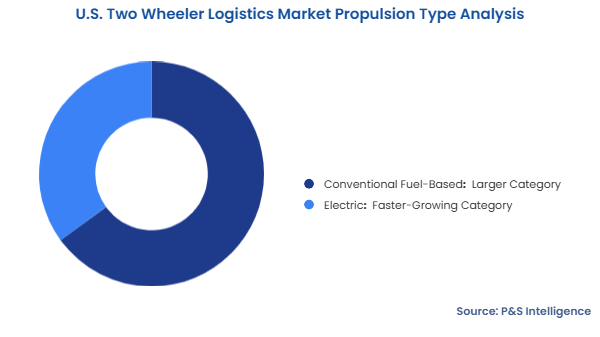

The conventional fuel-based two-wheelers held the larger market share, of 65%, in 2024 due to the well-established infrastructure for gasoline stations in the U.S. Moreover, ICE scooters and motorcycles have been around for a long time, and people find them convenient to drive and maintain. They are also cheaper than electric variants, and gasoline is more-easily available than EV charging stations.

The electric category will grow at the higher CAGR, of 17.5%, during the forecast period, attributed to the rising environmental concerns and implementation of sustainability goals at the public and enterprise levels. As per the Department of Energy, 1.1 million e-bikes were bought in the country in 2022, which was 400% more than the sales in 2019.

Based on propulsion type, the market has the following categories:

The B2C category held the largest market share, of 55%, in 2024, and it will grow at the highest CAGR, of 16.4%, during the forecast period. This growth can be attributed to the rising usage of e-commerce platforms among consumers. Cars and delivery vans are not always able to negotiate the dense traffic and narrow alleys, which forces delivery firms to use two-wheelers. The rise in the demand for fast deliveries of goods, such as food, groceries, and cosmetics, drives the growth of the B2C category.

Based on end user, the market has the following categories:

Food delivery held the largest market share, of 30%, in 2024. The growth of online food delivery platforms, such as DoorDash and Uber Eats, drives the demand for two-wheelers for delivery as they are the fastest means of transportation. Furthermore, the demand for late-night delivery and on-demand services leads to the category’s dominance.

Grocery delivery will grow at the highest CAGR, of 16.3%, during the forecast period. Grocery delivery services are gaining rapid popularity due to the rising preference of consumers for online shopping as it provides diverse product offerings. The major players in the U.S., such as Instacart, Amazon Fresh, and Walmart Grocery, are utilizing two-wheelers for efficient last-mile deliveries, especially in urban areas with heavy traffic.

Based on service, the market has the following categories:

Drive strategic growth with comprehensive market analysis

The Western region in the U.S. held the largest market share, of 35%, in 2024. This is due to the presence of highly urbanized states and their high population densities, which create a strong demand for last-mile deliveries. Additionally, the region has urban centers, such as Los Angeles, San Francisco, and Seattle, which are witnessing a mass transition toward e-commerce activities.

The Southern region will grow at the highest CAGR, of 17.2%, during the forecast period. The growth of the economy and online platforms, such as Uber Eats, DoorDash, and Instacart, in the southern region drives the growth of the market. Moreover, the huge population of the region is shifting to online shopping for its numerous conveniences and encouraged by the easy availability of smartphones and high-speed internet.

The market has been categorized into the following regions:

The U.S. two-wheeler logistics market is fragmented due to the presence of many players, including both international and local companies. There is no one company that holds a dominant share. This is because the major shippers and e-commerce companies often outsource their deliveries to 3PL companies, to save on operational costs and expand their regional reach.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages