Key Highlights

| Study Period | 2019 - 2032 |

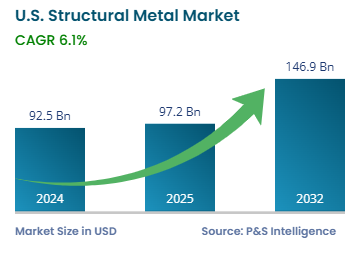

| Market Size in 2024 | USD 92.5 Billion |

| Market Size in 2025 | USD 97.2 Billion |

| Market Size by 2032 | USD 146.9 Billion |

| Projected CAGR | 6.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13612

This Report Provides In-Depth Analysis of the U.S. Structural Metal Market Report Prepared by P&S Intelligence, Segmented by Product Type (Support and Structure, Prefabricated Buildings, Metal Doors, Window Frames, Shutters), Type (Steel, Aluminum, Iron), End Use (Residential, Commercial, Industrial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 92.5 Billion |

| Market Size in 2025 | USD 97.2 Billion |

| Market Size by 2032 | USD 146.9 Billion |

| Projected CAGR | 6.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. structural metal market size was USD 92.5 billion in 2024, and it will grow by 6.1% during 2025–2032, to reach USD 146.9 billion by 2032.

The market is primarily driven by the growing construction industry due to the increasing population and its move to cities, rising purchasing power, government initiatives for infrastructure development, advancements in metalworking technologies, and strengthening focus on energy efficiency and emission reduction.

From foundations to walls, floors, and roofs, metals are important parts of a building’s structure. The trend of prefabricated buildings further drives the demand for structural metal products in the country. Moreover, using metallic structures instead of bricks and cement boosts the speed of construction and drives down rental/purchase prices. The advent of 3D printing and CNC machining technologies enables the creation of complex and customized shapes for structural metal products.

The support & structure category held the largest market share, of 50%, in 2024, because they are an integral part of construction in almost all sectors. Beams, columns, trusses, and metal framing systems comprise the skeletal framework of almost all major kinds of infrastructure, from high-rise buildings, industrial facilities, and warehouses to bridges, power plants, and dams.

The prefabricated buildings category will grow at the highest CAGR, of 6.5%, due to the growing demand for economical and quick construction. Modular and pre-engineered metal buildings (PEMBs) tackle labor shortages, demand for speed, and scalability during the building of warehouses, data centers, and affordable housing.

The product types analyzed in this report are:

The steel category held the largest market share, of 50%, in 2024, because of its easy availability, cost-effectiveness, and high strength, durability, and corrosion resistance. The high load bearing capacity of steel makes it vital in modern infrastructure projects, such as skyscrapers, bridges, and industrial buildings.

The aluminum category will grow at the highest CAGR, of 6.4%, during the forecast period because of its corrosion resistance, low weight, flexibility, energy efficiency, and environment-friendly design. These qualities make it easy to transport and install. This material is finding increasing usage in the construction of green buildings, of solar panels, and projects that are designed for LEED certification.

The types analyzed in this report are:

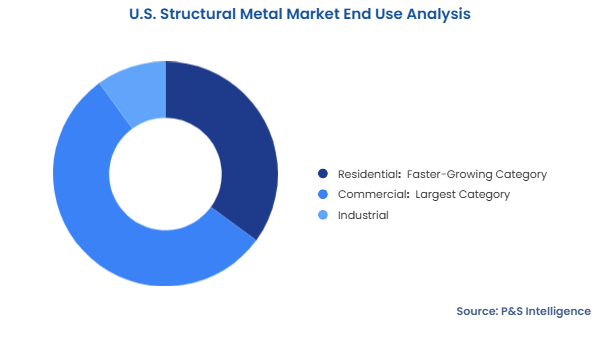

The commercial sector category held the largest market share, of 55%, in 2024, due to the high demand for high-rise buildings, retail complexes, offices, and institutional infrastructure. These projects mainly use steel and aluminum due to their strength, durability, and ability to bear large spans and loads. The growth of urban centers and the need for energy-efficient commercial spaces drive the market.

The residential category will grow at the highest CAGR, of 6.3%, because of the shortage of housing and move toward affordable, sustainable, and disaster-resistant construction. Light-gauge steel framing is replacing timber in single-family homes and multi-family apartments due to its resistance to fire, termites, and extreme weather. The increase in the development of modular and prefabricated houses propels the demand for structural metal products.

The end uses analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The south category held the largest market share, of 40%, in 2024, and it will grow at the highest CAGR, of 6.5%, during the forecast period. The rapidly growing population of Texas, Florida, Georgia, and North Carolina creates a rising demand for residential, commercial, and infrastructural construction. The south is home to 39% of the country’s population, which comes out to be 132,665,693 people in 2024, says the U.S. Census Bureau. In addition, industrial companies are relocating to the South to take advantage of lower operating costs, business-friendly policies, and access to major ports.

The geographical breakdown of the market is as follows:

The market is fragmented because of the presence of many regional competitors, minimal product variations, and low entry barriers. The standardization in structural metal components allows most firms create comparable products through identical raw materials and production techniques. Firms are focused on achieving lower costs and improving service and delivery. This specific market structure allows numerous companies to compete for smaller market shares instead of enabling just a few major players.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages