Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 41.8 billion |

| Market Size in 2025 | USD 43.8 billion |

| Market Size by 2032 | USD 64.4 billion |

| Projected CAGR | 5.7% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

Report Code: 13511

This Report Provides In-Depth Analysis of the U.S. Space Vehicle & Missile Market Report Prepared by P&S Intelligence, Segmented by Platform (Air-Based, Land-Based, Sea-Based, Space-Based), Propulsion Type (Solid Propulsion, Liquid Propulsion, Hybrid Propulsion, Electric Propulsion, Hypersonic Propulsion), Product Type (Space Vehciles, Missiles), End-User (Military & Defense, Civil Government, Commercial, Allied & Export Markets), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 41.8 billion |

| Market Size in 2025 | USD 43.8 billion |

| Market Size by 2032 | USD 64.4 billion |

| Projected CAGR | 5.7% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. space vehicle & missile market size was USD 41.8 billion in 2024, and it will grow by 5.7% during 2025–2032, to reach USD 64.4 billion by 2032.

The market is driven by the increasing defense spending and modernization efforts, advancements in hypersonic technologies, innovation and investments by the private sector, geopolitical tension and global conflicts, expansion of military satellite constellations, and government contracts.

This market is witnessing increasing investments by governments in defense and space capabilities, especially from NASA, the DoD, and Space Force. The increasing engagement by private organizations, such as SpaceX, Blue Origin, and Lockheed Martin, also propels the market.

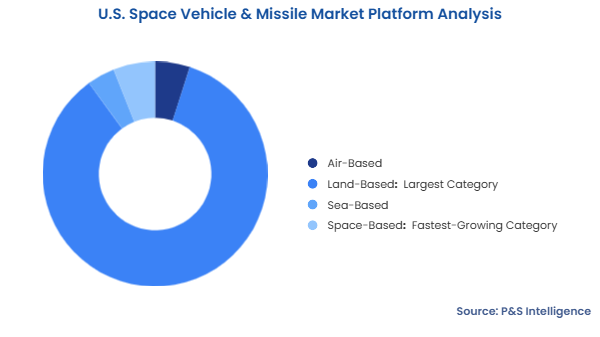

The land-based category held the largest market share, of 85%, in 2024. The country maintains a large inventory of surface-launched missile systems, including intercontinental ballistic missiles, such as the Minuteman III, and its planned replacement, the Ground-Based Strategic Deterrent (GBSD). Missile defense systems, such as THAAD and the Patriot, are well-known around the world. The U.S. maintains a potent nuclear triad and capabilities for long-range strikes and protection against missile attacks.

The space-based category will grow at the highest CAGR, of 6%, during the forecast period. This is due to the increasing militarization of space and the advancements in satellite technology. The major factors have been the creation of the U.S. Space Force in 2019 and the increasing spending on military satellites, space surveillance, and missile tracking systems. The Space Development Agency (SDA) is developing the Proliferated Warfighter Space Architecture (PWSA), a constellation of low-Earth orbit (LEO) satellites for enemy missile detection.

The platforms analyzed in this report are:

The solid category held the largest market share, of 45%, in 2024, because their reliability, simplicity, and speed make them critical for ballistic and tactical weapons, such as the Minuteman III ICBMs, Trident II submarine-launched missiles, and Patriot missiles. Solid rocket engines also play an important role to space launch vehicles, like the increasingly being used in the Space Launch System and the space shuttle.

The hypersonic category will grow at the highest CAGR of 6.5% during the forecast period because the U.S. government is investing billions in hypersonic missile development. China and Russia have deployed hypersonic missiles, and the U.S. is working to catch up. New hypersonic technologies, such as scramjets or boost glide vehicles, can fly faster than Mach 5, and they are highly maneuverable, making them nearly impossible to stop with current missile defenses.

The propulsion types analyzed in this report are:

The missiles category held the largest market share, of 60%, in 2024. This is due to the continuous investments in missile development, procurement, and technological superiority. The U.S. Department of Defense invests billions in missile programs to counter threats from China, Russia, and North Korea. These include the AGM-183A ARRW, LRHW, hypersonic missiles, THAAD, ballistic missiles, and precision-guided weapons, such as Tomahawk and JASSM.

The space vehicles category will grow at the highest CAGR, of 5.8%, during the forecast period, because government-led space missions and private sector progress are driving continued growth in space exploration. The Artemis program of NASA aims to take astronauts back to the Moon and eventually, Mars. This increases the demand for heavy-lift rockets, lunar landers, and crew capsules, such as Orion. The private sector, especially SpaceX, Blue Origin, and Rocket Lab, is expanding commercial space efforts, aiming to increase satellite launches and reduce costs using reusable rockets.

The product types analyzed in this report are:

The military & defense category held the largest market share, of 60%, in 2024 because of the consistently high funding from the federal government. Each year, the U.S. Space Force and DoD invest billions to advance technology, counter emerging threats, and protect the U.S.’s interests in space. It includes key programs in missile defense systems, such as THAAD and Aegis; hypersonic weapons, and military satellite networks for communication and surveillance. The increasing geopolitical tension with countries China and Russia leads to a strong focus on the military & defense sector.

The commercial category will grow at the highest CAGR, of 6.2%, during the forecast period. This is because of the rapid innovation and private investment in space technologies. SpaceX, Blue Origin, and Amazon are developing advanced technologies, including reusable rockets, low-cost satellite launch systems, and global internet satellite constellations. Private lunar missions, space tourism, and earth observation services offer opportunities in this sector.

The end users analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South held the largest market share, of 40%, in 2024. This is because of its strong aerospace and defense infrastructure, including NASA's Marshall Space Flight Center in Alabama, Kennedy Space Center in Florida, and Redstone Arsenal in Alabama.

The West will grow at the highest CAGR, of 6.8%, during the forecast period, because of the expanding private space innovation and advanced defense activity in the region. California is a hub for aerospace startups and major companies, including SpaceX, Rocket Lab, and Relativity Space, which lead in reusable rockets and small satellite launches. Silicon Valley's tech ecosystem also drives progress in AI-driven space systems and hypersonic research.

The geographical breakdown of the market is as follows:

The market share is consolidated because of a few major players have large market shares. This is because of the long-term, high-value government contracts given by the Department of Defense (DoD), NASA, and Space Force. Only major defense companies, such as Lockheed Martin, Boeing, Northrop Grumman, and Raytheon, have the capabilities to win these contracts and cater to the government’s requirements. These companies have deep space experience, secure sites for classified programs, and long-term relationships with federal agencies, which sets a high barrier for new competitors.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages