Market Statistics

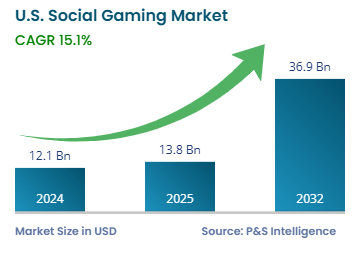

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 12.1 billion |

| 2025 Market Size | USD 13.8 billion |

| 2032 Forecast | USD 36.9 billion |

| Growth Rate(CAGR) | 15.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13455

This Report Provides In-Depth Analysis of the U.S. Social Gaming Market Report Prepared by P&S Intelligence, Segmented by Game Type (Casual Games, Strategy & Role-Playing Games (RPGs), Action & Adventure Games, Simulation Games, Casino & Gambling Games, Sports & Racing Games, Multiplayer Online Battle Arena (MOBA)), Platform (Mobile, PC/Desktop, Consoles, Cloud-Based Gaming Services), Revenue Model (Advertisements, Virtual Goods, Lead Generation, Subscription Services, In-App Purchases), Age Group (13-18 Years, 19-25 Years, 26-35 Years, 36-45 Years, 46 Years and Above), Gender (Male, Female), Game Mode (Single-Player Social Games, Multiplayer Competitive Games, Co-op & Team-Based Games, Live Streaming & Esports Integrated Games), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 12.1 billion |

| 2025 Market Size | USD 13.8 billion |

| 2032 Forecast | USD 36.9 billion |

| Growth Rate(CAGR) | 15.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. social gaming market valued USD 12.1 billion in 2024, and this number is expected to increase to USD 36.9 billion by 2032, advancing at a CAGR of 15.1% during 2025-2032. This is because, nowadays, online games have become a tool for social interaction and new experiences. Moreover, the rising youth population, the availability of ample leisure time, their shifting preferences and definitions of what constitutes ‘fun’, and easy access to smartphones, laptops, and high-speed internet connectivity drive the market

Games on social networks, mobiles, and gaming platforms enable users to connect and enjoy multimedia entertainment together, on a dedicated gaming platform. The market attracts players who love simple games and use social networks to play and compete with others for fun. These games are popular for their accessibility and casual gameplay, as well as people’s dependence on social media features, such as sharing, competition, and collaboration. Mobile game developers use multiple ways to earn money, such as digital product sales, advertisements, and integrated purchase options.

The market growth is driven by the people’s increasing usage of smartphones and social media platforms, which enable seamless connectivity and social interaction. The rise of live-streaming, esports, and marketing also impacts social gaming by creating new pathways for engagement and monetization.

The casual games category dominates the market with a revenue share of 40% in 2024 due to their broad appeal, accessibility, and easy-to-learn gameplay. These games serve different demographics, from young players to older adults, by taking minimal time, which makes these games ideal for entertainment. The expansion of mobile gaming and social media platforms drives revenue for developers through advertisements, in-app purchases, and social engagement features. The increasing sale of mobile gamers makes casual games popular owing to their convenient access on smartphones as well as tablets.

The report examines the following game types:

The mobile category represents the largest category with a share of around 60% in 2024, and this category is further expected to maintain its position during the forecast period. Mobile devices provide convenience and portability, which transform gaming habits by allowing players to engage in social experiences anytime and anywhere. The integration of socialization, in-app chat, sharing, and leaderboards further enhances the interaction aspect of mobile games.

Here are the platforms studied in the report:

The virtual goods category had the largest revenue share, of around 45%, fueled by the widespread adoption of in-app purchases in all major gaming categories. The option of digital assets, including cosmetic skin enhancements for the gaming avatars, power-up features, virtual currencies, strategic promotions, temporary offers, and special content access motivate gamers to spend money. This payment system works by satisfying players’ needs for personalization and advancement.

These are the revenue models analyzed in the report:

The 26–35 years category holds the largest revenue share, of around 30%, and it is further expected to maintain its position during the forecast period. This is because of their high engagement with digital entertainment and sufficient purchasing power. This age group generally includes young professionals or early-stage families, who were raised using digital technology and immediately take up social gaming. Due to their dual understanding of online communities and available disposable funds, they make in-app purchases and subscribe to revenue-generating features. Because this population uses gaming platforms for social interactions and entertainment, they serve as the main audience for game developers.

The report examines the following age group types:

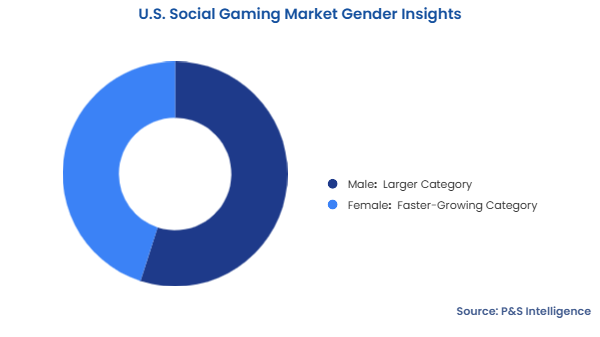

Males held the larger revenue share, of 55%, in 2024 they control key gaming genres, such as action-adventure, strategy, and multiplayer. The male gaming audience mostly participates in competitive gameplay, which results in increased spending on virtual goods, premium features, and subscription services. The involvement of male gamers on social platforms and livestream activities drives the market in this category.

The gender types covered in the report are:

The multiplayer competitive games category dominates the market with a revenue share of 45% in 2024, driven by the increasing demand for interactive and engaging gameplay experiences. This category is also dominant due to the high popularity of competitive games, especially e-sports and online multiplayer games, which offer immersive gameplay, team-based strategies, and real-time interaction with other players. The integration of live-streaming and social interaction has enhanced the reach of these games across different communities. This category derives its revenue from the purchase of virtual items, advertisements, and game upgrades.

The game modes covered here in the report are:

Drive strategic growth with comprehensive market analysis

The Southern region leads the market With 40% revenue, fueled by its large population, high internet penetration, and strong gaming culture. States such as Texas, Florida, and Georgia serve as main targets for major gaming companies focused on e-sports. The region achieves lower expenses of living and a fast-growing tech industry to draw more investments for gaming infrastructure development. The rising adoption of mobile phones or playing games is another pivotal driver for the market in the cultural heart of the U.S.

The report examines the following region types:

The U.S. social gaming market is fragmented, with a wide range of players generating revenue via various modes, such as virtual goods, advertisement, lead generation, and subscription services. Major gaming companies, including Zynga, Activision Blizzard, and Electronic Arts, use AR, VR, and cloud gaming features to create better player experiences. However, smaller developers also play an important role by catering to specific demographics and offering innovative social gaming experiences. The fragmentation is further driven by the integration of social media platforms and the rise of user-generated content. Moreover, as there are a huge variety and genres of games, so there are a large number of U.S.-based, European, as well as Asian gaming companies with a significant fanbase in the country.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages