Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 57.1 Billion |

| Market Size in 2025 | USD 58.9 Billion |

| Market Size by 2032 | USD 77.8 Billion |

| Projected CAGR | 4.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13527

This Report Provides In-Depth Analysis of the U.S. Shipping Cargo Market Report Prepared by P&S Intelligence, Segmented by Cargo (Containerized Cargo, Dry Bulk Cargo, Liquid Bulk Cargo, General & Breakbulk Cargo, Perishable & Refrigerated Cargo), Vessel (Container Ships, Bulk Carriers, Tanker Ships, Roll-on/Roll-off Ships, General Cargo Ships, Passenger Ships, Naval & Defense Vessels, Fishing Vessels, Offshore Support Vessels), Service Type (Shipping & Freight Services, Port Operations & Management, Maritime Safety & Security, Shipbuilding & Maintenance, Dredging & Port Development, Logistics & Warehousing), End User (Retail & Consumer Goods, Industrial & Manufacturing, Energy & Oil & Gas, Government & Defense), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 57.1 Billion |

| Market Size in 2025 | USD 58.9 Billion |

| Market Size by 2032 | USD 77.8 Billion |

| Projected CAGR | 4.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. shipping cargo market size was USD 57.1 billion in 2024, and it will grow by 4.1% during 2025–2032, reaching USD 77.8 billion by 2032.

The market is growing with the rise in global trade and rising domestic requirement for all kinds of goods for the growing population, urbanization, and rising disposable income. The boom in e-commerce has made fast and reliable deliveries important. The use of technology is also helping the market grow, with tools such as digital tracking, automated systems, and smart devices make shipping faster and more efficient.

Another reason the market is growing is the push for more environment-friendly shipping. Companies are using cleaner fuels and building energy-efficient ships to follow stricter rules on pollution. These changes are not only helping the environment but also keeping shipping companies competitive.

International trade depends on commercial shipping as it is the most-efficient way to move large quantities of goods across the globe. Without it, industries would not be able to get their products to the market. The industry uses containerized cargo and bulk carriers to make the transportation of goods reliable and affordable. As per the Census Bureau, the U.S. exported USD 278.5 billion and imported USD 419.0 billion worth of goods in March 2025, reflecting a massive need for shipping services.

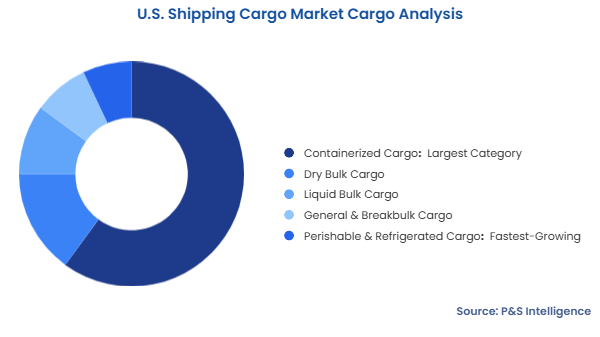

The containerized cargo category held the largest market share, of 65%, in 2024. Standard-sized containers can carry a wide variety of goods, be it electronics, clothing, or food. These containers can be loaded and unloaded quickly and moved easily between ships, trucks, and trains, making the shipping process cheaper. Anything can be shipped easily, which makes them a flexible part of international trade.

The perishable & refrigerated cargo category will grow at the highest CAGR during the forecast period. This is because of the rising need for refrigerated shipping and fresh food. With more people buying food online, there is a growing need for refrigerated cargo to keep the products fresh during transportation. This is also one of the earliest forms of cargo shipping, which facilitated globalization in the late 19th and early 20th centuries.

The cargoes analyzed here are:

The container ships category held the largest market share, of 60%, in 2024. This is because they carry a wide variety of goods in large containers, making them the most-commonly used vessel type for moving goods across oceans. The largest ships can carry over 18,000 TEUs across long distances, offering cost-effectiveness in international trade.

The offshore support vessels category will grow at the highest CAGR during the forecast period. This is because they help build and maintain the wind turbines in the sea. New technology makes these vessels more efficient and able to do more jobs, which increases their popularity. They help produce more oil and gas by bringing supplies and equipment to drilling rigs in deep-water and ultra-deep-water regions.

The vessels analyzed here are:

The shipping & freight services category held the largest market share, of 70%. This is because it handles the movement of goods from one place to another by truck, rail, air, and sea. It can carry a large volume of goods, and every industry relies on it to move millions of tonnes of cargo domestically and internationally. Moreover, it covers a broad range of needs from heavy shipping to specialized transport.

The logistics & warehousing category will grow at the highest CAGR during the forecast period. This is because e-commerce is booming with lots of people shopping online, which has resulted in a high demand for in logistics. Advances in technology, such as automated warehouses and tracking systems, have made it easier to manage and move goods. Warehousing services are becoming more important with the need of people for faster deliveries.

The service types analyzed here are:

The industrial & manufacturing category held the largest market share, of 75%, in 2024. This is because they produce massive goods, such as machinery, equipment, raw materials, and finished products, which need to be shipped both domestically and internationally. Moreover, it involves multiple suppliers and parts that need to be moved to factories, assembly plants, and distribution centers.

The energy & oil & gas category will grow at the highest CAGR during the forecast period. This is due to the rise of renewable energy, especially wind and solar power. The rising investment in oil & gas exploration raises the requirement for tankers and pressurized bulk carriers. The shift to renewable energy creates the requirement for specialized ships to carry turbines and other parts. As the world uses more energy, companies are drilling for oil and gas in deeper waters, which drives the need for specialized offshore support vessels.

The end users analyzed here are:

Drive strategic growth with comprehensive market analysis

The Southern region held the largest market share, of 40%, in 2024. This is because it is home to major ports, such as the Port of Houston, the Port of Savannah, and the Port of Miami, which are some of the busiest in the country. These ports handle large volumes of international trade from Latin America, Asia, and Europe, making the South a central hub for cargo shipping. Moreover, it has well-connected transportation networks, including highways, railroads, and airports. Moreover, the cost of doing business in the South is lower, making it an attractive location for the market players.

The market in the Western region will grow at the highest CAGR during the forecast period. This is because it is a hub for technology companies and e-commerce companies, such as Amazon, eBay, and start-ups, which drives the demand for quick delivery services. There have been heavy investments in the region to handle domestic and international trade. The population increase has also led to the demand for more consumer goods.

The regions analyzed in this report are:

The market is fragmented as there are many types of companies, including large international companies and small regional ones. Each company focuses on different services, such as small shipments or full truckloads. As shipping takes place by truck, rail, air, or ship the market is divided into different parts. It is easy for small companies to start with new technologies, such as online tracking and automated systems. Moreover, small businesses and big companies have different shipping needs, such as fast delivery and special handling, which encourages more companies to enter the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages