Key Highlights

| Study Period | 2019 - 2032 |

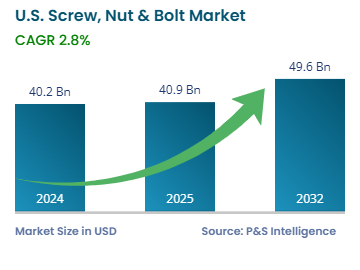

| Market Size in 2024 | USD 40.2 Billion |

| Market Size in 2025 | USD 40.9 Billion |

| Market Size by 2032 | USD 49.6 Billion |

| Projected CAGR | 2.8% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13514

This Report Provides In-Depth Analysis of the U.S. Screw, Nut & Bolt Market Report Prepared by P&S Intelligence, Segmented by Product Type (Screws, Nuts, Bolts, Washers & Rivets), Material (Metal, Plastic), Distribution Channel (Direct Sales, Distributors & Wholesales, Retail), End-Use (Construction, Automotive & Transportation, Aerospace & Defense, Industrial Machinery & Equipment, Electronics & Appliances, Marine), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 40.2 Billion |

| Market Size in 2025 | USD 40.9 Billion |

| Market Size by 2032 | USD 49.6 Billion |

| Projected CAGR | 2.8% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. screw, nut & bolt market size was USD 40.2 billion in 2024, and it will grow by 2.8% during 2025–2032, to reach USD 49.6 billion by 2032.

This market is driven by the rise in the number of renewable energy projects, the advent of electric vehicles, and the support for the construction, repair, and maintenance of aging infrastructure. All this is itself credited to the growth in population, rapid urbanization & industrialization, rise in people’s disposable income, and changes in their daily preferences.

Screws, nuts, and bolts are universal mechanical fasteners used everywhere from buildings and furniture to vehicles, electronics, and industrial machines. They are cheap, wide available, well-understood, and easy to use, making them preferred across applications. The availability of electric hand tools to screw and unscrew bolts enhance ease of usage, especially for DIY enthusiasts.

The screw category held the largest market share, of 20%, in 2024, because they are essential in construction, automotive assembly, electronics, and consumer goods. Many kinds of screws, such as self-tapping, machine, wood, and security screws, are suitable for everything from lightweight to heavy-duty applications.

The bolts category will grow at the highest CAGR, of 3%, during the forecast period. This is due to the strong focus of the U.S. government on infrastructure upgrades, such as bridges, renewable energy projects, and transportation projects. This propels the demand for high-strength bolting systems for applications where heavy loads must be borne. The growing sale of EVs is another major growth driver as it increases the demand for high-tensile bolts for battery enclosures and the chassis.

The product types analyzed in this report are:

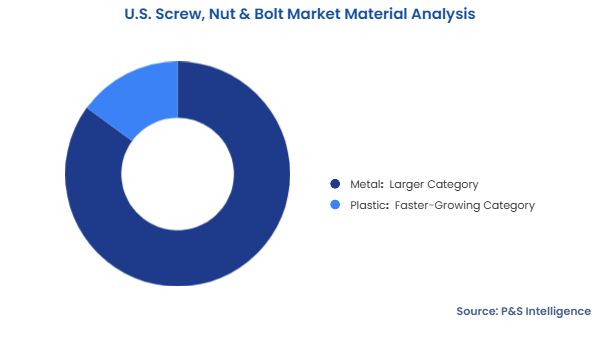

The metal category held the larger market share, of 85%, in 2024, due to their high strength, durability, and adaptability to almost every kind of application. Carbon steel, stainless steel, and various alloys are majorly used to make high-tensile strength and cost-effective bolts for applications such as structural components of buildings, automobiles, industrial machines that must bear high pressure and temperature, and railway tracks.

The plastic category will grow at the higher CAGR, of 3.5%, during the forecast period. Engineering plastics, such as nylon, PEEK, and PTFE, are gaining popularity in electronics, EVs, and medical devices for lightweighting, electrical insulation, and mechanical resistance. Plastic screws, nuts, and bolts resist chemicals, display superior vibration absorption, and block EMI/RFI, making them suitable for aerospace interiors, automotive sensors, and MRI machines.

The materials analyzed in this report are:

The distributors & wholesalers category held the largest market share, of 60%, in 2024. This is because these intermediaries connect manufacturers with the actual users in fragmented industries. They add value by enabling bulk supplies, logistics, and just-in-time inventory for small and mid-sized manufacturers that lack direct sourcing and capabilities.

The direct sales category will grow at the highest CAGR, of 3.2%, during the forecast period, because of the increasing domestic production with a focus on supply chain resilience. Many manufacturers, especially in the aerospace, automotive, and defense sectors, are making long-term deals directly with suppliers to ensure precision and traceability. Digital transformation, including e-commerce platforms and ERP systems, has made this shift faster and easier.

The distribution channels analyzed in this report are:

The construction category held the largest market share, of 35%, in 2024. This is due to the large public and private investment that support the development of roads, bridges, and energy projects. This creates a requirement for millions of fasteners of different sizes, lengths, diameters, and ribbing.

The aerospace & defense category will grow at the highest CAGR, of 3.8%, during the forecast period. This is because the U.S. defense budget reached USD 841.1 billion in 2024, rising to USD 850 billion in 2025. This will fund next-gen fighter jets, naval ships, and satellites, all of which require high-performance fasteners. The strong focus of the country on aircraft production, military modernization, and space exploration is driving the demand for defense fasteners.

The end uses analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South category held the largest market share, of 30%, in 2024. This is because of the large-scale industrial and construction development in the highly populated states of Texas, Georgia, and Florida. Infrastructure projects such as highways, data centers, and energy sites, which require a huge quantity of fasteners.

The West category will grow at the highest CAGR, of 4% during the forecast period, because of the development of industries and the strong focus on renewable energy. California's tech sector needs micro-fasteners for electronics, drones, and electric vehicles, while solar farms in Arizona and Nevada require corrosion-resistant bolts for large assemblage. The aerospace industry, led by Boeing in Washington and SpaceX in California, as well as post-wildfire rebuilding efforts also drive the market.

The geographical breakdown of the market is as follows:

The market share is fragmented because of a wide range of manufacturers, from small specific companies to large global players, each catering to different industries and applications. Screws, nuts, and bolts are nothing new; hence, they are well known and easily manufactured in the country. It does not require too much capital to produce them in bulk, which essentially leads to the dominance of small, local companies. The varying requirements of industries also allow newer companies to enter the market with specific and customized fasteners.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages