Key Highlights

| Study Period | 2019 - 2032 |

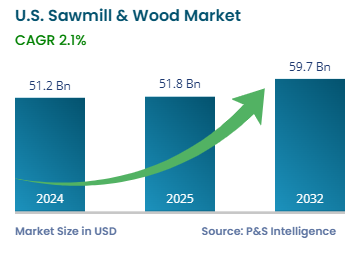

| Market Size in 2024 | USD 51.2 Billion |

| Market Size in 2025 | USD 51.8 Billion |

| Market Size by 2032 | USD 59.7 Billion |

| Projected CAGR | 2.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13513

This Report Provides In-Depth Analysis of the U.S. Sawmill & Wood Market Report Prepared by P&S Intelligence, Segmented by Product Type (Lumber, Wood Panels, Engineered Wood Products, Wood Pellets& Biomass), Processing Method (Sawmilling, Planing, Kiln Drying, Treating), Application (Construction, Furniture, Industrial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 51.2 Billion |

| Market Size in 2025 | USD 51.8 Billion |

| Market Size by 2032 | USD 59.7 Billion |

| Projected CAGR | 2.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. sawmill & wood market size was USD 51.2 billion in 2024, and it will grow by 2.1% during 2025–2032, to reach USD 59.7 billion by 2032.

This market is driven by strong demand from the construction sector, shift toward sustainable and engineered wood products, urbanization, massive housing shortage, supportive government policies and regulations, vertical integration and modernization, strategic export capabilities, and renovation and remodeling demand.

The lumber category held the largest market share, of 55%, in 2024. This is because in residential construction, structural timber is consumed in huge volumes. Softwoods, such as Southern yellow pine and Douglas fir, are best suited for structural framing.

The engineered wood products category will grow at the highest CAGR, of 2.5%, during the forecast period. This is because cross-laminated timber (CLT), glulam beams, and laminated veneer lumber (LVL) are being adopted quickly in construction. They are strong, design-flexible, and more sustainable than traditional materials.

The product types analyzed in this report are:

The sawmilling category held the largest market share, of 65%, in 2024. Timber processing begins at sawmills, where raw logs are turned into lumber, planks, and beams for use in the construction and manufacturing industries. The industry is strongly supported by the large U.S. construction industry, which uses a lot of softwood lumber for housing frames, roofing, and structural applications.

The kiln drying category will grow at the highest CAGR, of 2.8%, during the forecast period. The growing demand for high-quality wood for various uses is driving a shift toward precision-engineered products with uniform moisture content and stability. This is leading to the increasing timber construction using CLT and glulam, where the precise drying of lumber is necessary for structural stability.

The processing methods analyzed in this report are:

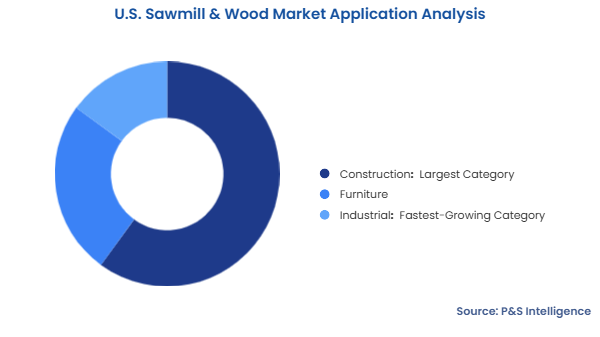

The construction category held the largest market share, of 60%, in 2024, and it will grow at the highest CAGR, of 2.6%, during the forecast period, because of the currently favorable economic and industry trends. Construction drives the demand for lumber as it is widely used in residential, commercial, and infrastructure projects. Timber is the top choice for structural frames, sheathing, and finishes because it is affordable, versatile, and easy to use. In addition, the worsening housing shortage with population growth and urbanization ensures a strong demand for lumber for single- and multi-family housing developments.

The applications analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South category held the largest market share, of 40%, in 2024. This is because of large, well-maintained pine plantations, which provide a steady and abundant supply of softwood timber, especially Southern yellow pine. This region’s climate is favorable for fast tree growth, allowing shorter harvest cycles. Major players, such as Weyerhaeuser and Georgia-Pacific, operate large sawmills with modern technologies in the South. The region has a strong need for housing, commercial, and industrial infrastructure owing to its huge and growing population.

The West category will grow at the highest CAGR, of 3%, during the forecast period, because of the innovations in wood products with a focus on sustainability. The states of Oregon and Washington lead the increasing production of cross-laminated timber (CLT) and glulam. The strict regulations for the conservation of the environment and corporate sustainability goals are boosting the usage of wood as a low-carbon alternative to traditional building materials, including steel and concrete.

The geographical breakdown of the market is as follows:

The market is severely fragmented as operating a sawmill is not hard at all. Woodworking is an ancient art and can be practiced with simple machines. Moreover, thousands of independent lumberjacks operate small-scale sawmills across the country, especially in and around forested areas. Several large operators also own plantations specially to provide timber. The availability of a huge variety of trees to retrieve timber for various purposes also fragments the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages