Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 25.5 billion |

| 2025 Market Size | USD 26.9 billion |

| 2032 Forecast | USD 41.7 billion |

| Growth Rate(CAGR) | 6.5% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13459

This Report Provides In-Depth Analysis of the U.S. Roofing Market Report Prepared by P&S Intelligence, Segmented by Type (Material, Chemicals), Roofing Type (Flat Roof, Slope Roof), End-use (Residential, Commercial, Industrial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 25.5 billion |

| 2025 Market Size | USD 26.9 billion |

| 2032 Forecast | USD 41.7 billion |

| Growth Rate(CAGR) | 6.5% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

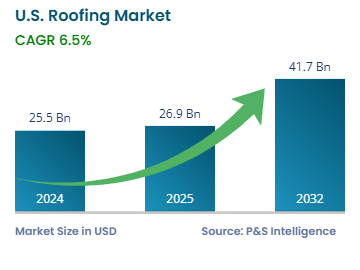

The U.S. roofing market size stood at USD 25.5 billion in 2024, and it is expected to grow at a CAGR of 6.5% during 2025–2032, to reach USD 41.7 billion by 2032.

This market is driven by the increasing residential & commercial construction activities, frequent weather-related damage, growing renovation & remodeling trends, government support for energy-efficient buildings, and adoption of advanced roofing technologies. The government also offers loan guarantees to support manufacturing projects. For instance, in July 2024, a USD 182-million loan guarantee was announced for a plastic recycling plant in Erie, Pennsylvania.

However, the biggest driver for the market is the country’s growing population, which reached 340.1 million in 2024. This leads to a large unmet need for permanent and temporary accommodation, which continues to propel residential construction. Similarly, the rapid urbanization drives the building of office spaces, hotels, shopping malls, hospitals, and other kinds of commercial infrastructure. Public facilities, such as airports, railway stations, bus terminals, power stations, police stations, and fire stations, are also being built. Further, industrial expansion drives the need for new factories, warehouses, and logistics terminals, all of which need strong and energy-efficient roofs in the current scenario.

Material held the larger market share, over 80%, in 2024. This is mainly because of the high cost and volume of roofing materials used compared to chemicals. Asphalt shingles, metal, tiles, and underlayment are important for both construction and reroofing activities, which drives their consumption across the country. They are the main material used for roofing, while the chemicals are mostly used for specific purposes or to add a quality in lower amounts.

Chemicals will have the higher CAGR during the forecast period due to the increasing use of roofing adhesives, sealants, coatings, and insulation materials. These and many other kinds of chemicals improve roof durability, energy efficiency, and weather resistance, which are important for regions with extreme weather, such as the south and northeast. Additionally, growth in the number of green building initiatives and demand for reflective or cool roofing systems increases the consumption of chemicals such as elastomeric coatings and polyurethane foams.

These types were analyzed:

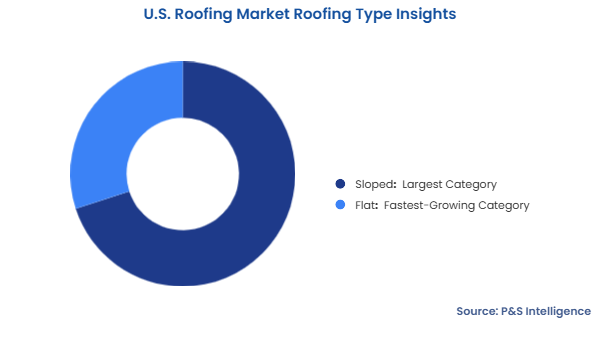

Sloped roofs hold the larger market share, of 70%, in 2024, because they are widely used in residences. They are mainly installed in single-family homes to ensure better water drainage, durability, and aesthetics. Asphalt shingles are one of the most-widely used materials for sloped roofs. These roofs are preferred in areas with heavy rainfall or snowfall, as their design prevents water accumulation, which, in turn, limits the risk of leakages and devastating structural damage.

Flat roofs will have the higher CAGR during the forecast period. They are economical and easy to install, making them a preferred choice for office buildings, warehouses, retail spaces, and multi-family residential complexes. They also provide adequate space for solar panels, green roofing systems, and HVAC units, thus meeting the rising demand for efficient and sustainable roofing systems.

These roofing types were analyzed:

The residential category has the largest market share, of 65%, in 2024, due to the huge number of homes undergoing construction, renovation, or disaster repairs. Homeowners significantly spend on roof maintenance and improvement due to weather damage and for enhancing the energy-saving potential. The use of asphalt shingles is prevalent in the U.S. because of their affordability, durability, and simple installation. Residents receive encouragement from building regulations and official programs to adopt water-efficient roofing technologies, which have solar-integrated systems.

The commercial category will have the highest CAGR during the forecast period due to the increasing investments in office buildings, warehouses, retail centers, and industrial facilities receives rising investments. Business growth and city development lead to a rising demand for long-lasting, power-efficient, and economical roofing solutions in urban areas.

These end uses were analyzed:

Drive strategic growth with comprehensive market analysis

The South held the largest market share in 2024, and it will also witness the highest CAGR over the forecast period. The is because of the rapid urban development, rising construction activities, increasing frequency of extreme hurricanes, and government incentives for fortified roofs. Texas, Florida, North Carolina, and Georgia are 4 of the most-populated states in the country. Moreover, Georgia, Oklahoma, Alabama, and Louisiana bear the maximum brunt of hurricanes, driving a constant demand for roof maintenance and repair.

The regions analyzed for this report include:

The market is fragmented because of a large number of small firms and only a handful of established companies, such as GAF Materials Corporation, Owens Corning, CertainTeed, TAMKO Building Products, and Carlisle Companies. Many local and regional contractors and materials suppliers possess wide distribution networks and strong brand presence. Moreover, people generally buy roofing materials from the companies operational in their area for cost purposes. Additionally, these materials are well known and not technically or financially demanding to produce, which lowers entry barriers and allows multiple companies to proliferate.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages