Key Highlights

| Study Period | 2019 - 2032 |

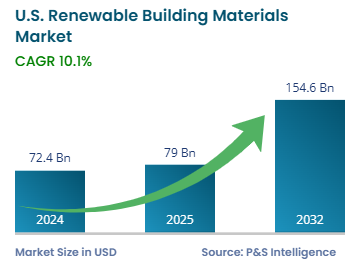

| Market Size in 2024 | USD 72.4 Billion |

| Market Size in 2025 | USD 79.0 Billion |

| Market Size by 2032 | USD 154.6 Billion |

| Projected CAGR | 10.1% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13601

This Report Provides In-Depth Analysis of the U.S. Renewable Building Materials Market Report Prepared by P&S Intelligence, Segmented by Material Type (Wood based Materials, Bioplastics & Bio-composites, Recycled Materials, Natural Insulation Materials, Other Eco friendly Materials), Application (Structural Components, Insulation & Cladding, Interior Finishing, Furniture & Fixtures), End-User (Residential, Commercial, Industrial, Institutional & Government), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 72.4 Billion |

| Market Size in 2025 | USD 79.0 Billion |

| Market Size by 2032 | USD 154.6 Billion |

| Projected CAGR | 10.1% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. renewable building materials market was valued at USD 72.4 billion in 2024, and this number is expected to increase to USD 154.6 billion by 2032, advancing at a CAGR of 10.1% during 2025–2032.

This is because of the rising environmental consciousness, implementation of regulatory guidelines, and new technology development. These factors drive the interest in engineered wood products, bamboo, recycled metal, and bio-based insulation. Self-healing concrete, algae-based insulation, and LEED-certified and net-zero buildings are steadily gaining popularity in the country. The development of circular economy models and advanced material science are speeding up building construction practices despite the initial investment-related obstacles and supply chain complexities. As per the Census Bureau, construction spending in the U.S. stood at USD 2,196.1 billion in March 2025.

Recycled materials are the largest category, with 60% share, since they are affordable and easily accessible due to the strong government support. Recycled metals, glass, plastics, and rubber find wide use for structural, insulation, and flooring in residential and commercial buildings. Contemporary waste reduction laws, the circular economy approach, and high investment in closed-loop recycling lead to substantial market growth in this category. The infrastructure to collect such materials at the end of their life and reprocess it into usable products is also well established in the country.

The material types covered in this report are:

Structural components are the largest category with 65% share because these materials form an essential foundation for construction. Reclaimed wood, cross-laminated timber (CLT), and recycled metal are widely utilized in beams, flooring, and roofing components in residential and commercial buildings. The urge for low-carbon construction and green building certifications, as well as government benefits supporting sustainable development and renewable material durability, strengthen the market.

Major application areas covered in this report are:

Residential is the largest category with 70% share because homeowners now seek ecological houses to meet energy standards and lower energy bills. The usage of reclaimed wood, bamboo flooring, bio-based insulation, and recycled materials is growing in homes to decrease the environmental impact. The adoption of renewable building materials has gained momentum due to the availability of tax incentives for energy-efficient homes and LEED and Energy Star certification programs initiated by the government. The rising residential construction and renovation activities drive the market. In March 2025, the construction of 940,000 single-family homes began in the country.

The end users covered in this report are:

Drive strategic growth with comprehensive market analysis

The West region is the prime revenue contributor with 40% share because of the dedicated environmental laws and adoption of advanced, green construction methods. The green building codes and net-zero energy requirements in California, Oregon, and Washington drive the usage of bio-based materials, recycled content, and low-carbon building elements. The presence of major technology centers and environment-focused cities increase the demand for sustainable residential and commercial buildings.

These regions are covered:

The market is fragmented because many national and international companies provide a wide range of sustainable and eco-friendly building products. The industry encompasses manufacturers of reclaimed wood, bio-based composites, recycled materials, and natural insulation. The rapid innovation, changing green building requirements, and different regional regulations keep companies from holding significant shares. The competitive industry includes large market players in addition to numerous smaller and specialized companies. The market fragmentation has sustained due to the rising customer needs for locally sourced, customized, and sustainable building materials, which results in fierce competition.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages