Key Highlights

| Study Period | 2019 - 2032 |

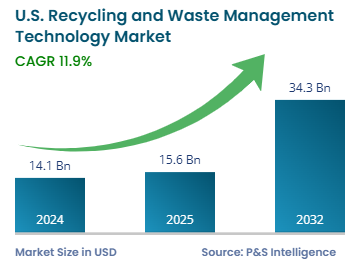

| Market Size in 2024 | USD 14.1 Billion |

| Market Size in 2025 | USD 15.6 Billion |

| Market Size by 2032 | USD 34.3 Billion |

| Projected CAGR | 11.9% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13532

This Report Provides In-Depth Analysis of the U.S. Recycling and Waste Management Technology Market Report Prepared by P&S Intelligence, Segmented by Waste Type (Municipal Solid Waste, Industrial Waste, Electronic Waste, Hazardous Waste, Organic Waste, Plastic Waste), Service Type (Collection Services, Transportation Services, Treatment Services, Disposal Services, Recycling Services), Technology (Mechanical Recycling, Chemical Recycling, Waste-To-Energy, Landfill Management, Composting & Biodegradation, AI & Robotics in Waste Sorting), End User (Residential, Commercial & Industrial, Government & Municipalities, Healthcare, Agriculture), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 14.1 Billion |

| Market Size in 2025 | USD 15.6 Billion |

| Market Size by 2032 | USD 34.3 Billion |

| Projected CAGR | 11.9% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. recycling and waste management technology market size was USD 14.1 billion in 2024, which is expected to reach 34.3 billion by 2032, growing at a CAGR of 11.9% during the forecast period 2025–2032. The market is driven by population growth, increasing waste generation, and heightening commitment to sustainability.

The market is also influenced by government policies and regulations. The Resource Conservation and Recovery Act (RCRA) and the Environmental Protection Agency's National Recycling Policy are designed to increase recycling rates, encourage safety, and reduce waste. As per estimates, over 300 million tonnes of solid municipal waste is generated in the country each year. To enhance efficiency and cut down on environmental damage, governments and companies are investing in AI-enabled waste sorting systems, smart waste management software, and other advanced solutions for waste management.

In May 2024, ISB Global launched its Waste and Recycling One software in the U.S. to enable better operational efficiency. Moreover, in November 2024, Waste Management Inc. acquired Stericycle for USD 7.2 billion to diversify its services and market presence.

Municipal solid waste is the largest category, with a market share of 30% in 2024, since it includes all regular trash generated from residential areas, commercial spaces, and public facilities. The management of mixed waste needs recycling, composting, waste-to-energy solutions, and landfills.

E-waste is the fastest-growing category, with 5% CAGR, because of technological innovation and reduced product durability. Each year, millions of smartphones, laptops, and electrical appliances become obsolete, which contain useful metals and dangerous substances. Governments and the manufacturers of these products are increasing their recycling activities to extract materials from e-waste.

Here are the categories of the segment:

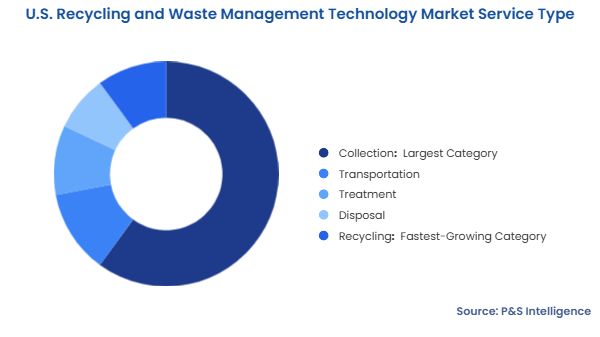

Collection is the largest category, with a market share of 60% in 2024. Collection is the fundamental element of waste management since all subsequent operations, such as recycling, treatment, or disposal, depend on it. Consequently, it needs extensive resources and covers the widest service area. Municipal agencies and private recycling firms provide waste collection services throughout the U.S. on a daily basis.

Recycling is the fastest-growing category, with 5.5% CAGR. Due to the environmental rules and citizen calls for sustainability, an increasing amount of waste is being directed away from landfills for recycling. The rising investment of companies and municipalities in upgraded recycling systems aims to enhance material sorting and reprocessing efficiency. The materials in the most urgent need of recycling are plastics, metals, and ceramics, as they do not degrade on their own.

Here are the categories of this segment:

Mechanical recycling is the largest category, with a market share of 65% in 2024. Physically sorting, cleaning, and processing raw materials helps the products maintain their chemical integrity. The method is popular due to its simplicity, cost-effectiveness, and available infrastructure support.

AI & robotics waste sorting is the fastest-growing category, with 5.8% CAGR due to labor shortages and the need of operators to enhance efficiency and decrease contamination in recycling streams. AI-powered systems and robotic arms lead to quicker waste sorting, higher precision in the overall process, and reduced facility expenses. The increasing corporate investments in automation drive the modernization of waste management and recycling operations.

The following technologies are analyzed in this segment:

Commercial & industrial is the largest category, with a market share of 60% in 2024. This sector produces substantial volumes of packaging waste, scrap material, bulky items, and hazardous waste. The diverse nature of waste the produced in this sector demands multiple management solutions. The problem worsens in the chemical, healthcare, and energy sectors, which generate substantial quantities of toxic waste.

Healthcare is the fastest-growing category, with 6% CAGR. Hospitals, clinics, and labs generate high volumes of biological, electronic, and general waste and growing restrictions on their disposal. The increase in the demand for healthcare since the COVID-19 pandemic has led to a substantial growth in the volume of medical waste, which needs proper disposal and management. The CDC says that the country produces 3.5 million tonnes of medical waste each year.

The following end users are analyzed in this segment:

Drive strategic growth with comprehensive market analysis

South is the largest category, with a market share of 45% in 2024. Texas, Florida, and Georgia have large populations, which produce considerable amounts of waste due to the fast urban expansion and growing industrial operations. The increasing size of metropolitan areas with large-scale commercial operations drives the demand for effective waste collection, treatment, and recycling services.

The West is the fastest-growing category, with 6.5% CAGR due to the stringent environmental regulations and adoption of modern, sustainability-focused approaches. California, Oregon, and Washington have large unmet recycling requirements and aggressive climate policies. Public organizations and private companies in the region are implementing AI sorting technologies, chemical recycling, and zero-waste approaches.

Here are the categories of this segment:

The market is severely fragmented as there are a huge number of stakeholders, from governments to product manufacturers themselves. Moreover, not every player conducts all the operations along the recycling and waste management value chain. Waste collection is generally done at the local level by municipalities or small, local service providers. Moreover, most recyclers operate standalone and independent facilities serving a particular city or county. Additionally, waste management and recycling companies do not necessarily handle all kinds of waste. While MSW is easier and cost-effective to process, e-waste, chemical waste, and medical waste requires advanced technologies and specific expertise.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages