Market Statistics

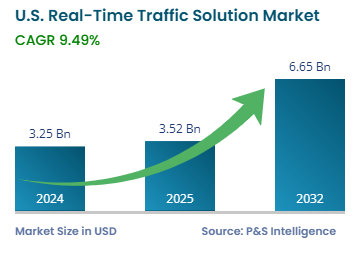

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 3.25 Billion |

| 2025 Market Size | USD 3.52 Billion |

| 2032 Forecast | USD 6.65 Billion |

| Growth Rate(CAGR) | 9.49% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13328

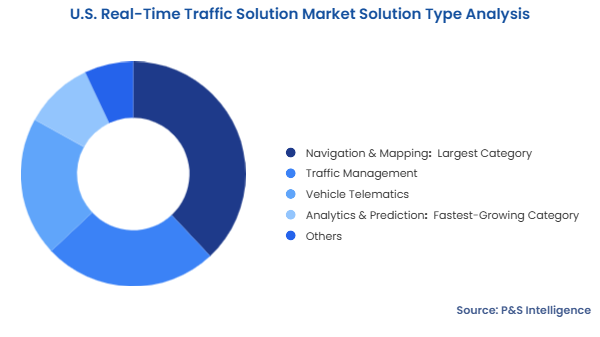

This Report Provides In-Depth Analysis of the U.S. Real-Time Traffic Solution Market Report Prepared by P&S Intelligence, Segmented by Solution Type (Navigation & Mapping, Traffic Management, Vehicle Telematics, Analytics & Predictive), Data Source (GPS, Cellular Network, Sensors & Cameras, Crowdsourced Data), Application (Traffic Congestion Monitoring, Fleet & Logistics Management, Public Transporation Optimization, Emergency Responses & Road Safety), End User (Government Agencies & Transporation Departments, Automotive OEM & Connected Vahicles, Logistics & Transportation Companies, Telecom & IT Service Providers), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 3.25 Billion |

| 2025 Market Size | USD 3.52 Billion |

| 2032 Forecast | USD 6.65 Billion |

| Growth Rate(CAGR) | 9.49% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. real-time traffic solution market size was USD 3.25 billion in 2024, and it will grow by 9.49% during 2025–2032, to reach USD 6.65 billion by 2032. Urbanization and population growth put such solutions in the limelight, with the growing need to improve traffic management, reduce congestion, and enhance road safety. Real-time systems for traffic are now integral for handling transportation in the major metropolitan cities of the country. Real-time solutions use cutting-edge technologies, such as GPS, AI, big data analytics, IoT, and cloud computing, to send live traffic updates for navigation purposes and smart city development and sustenance.

The stakeholders in this market are mainly government authorities, automotive OEMs, logistics companies, and public transport providers. The evolving needs create innovation opportunities in AI-backed predictive traffic analytics for connected vehicles and convoy management solutions. Further, the initiatives surrounding intelligent transportation systems (ITS) and vehicle-to-everything (V2X) communications open new avenues for collecting, analyzing, and utilizing traffic data.

With the traffic worsening in New York, Los Angeles, Chicago, Boston, and other major cities, the opportunities for developers of real-time traffic information solutions are increasing, as the demand rises for interconnected and efficient transportation.

AI-based algorithms in real-time analyze traffic data and come up with predictive insights and possible solutions for lessening traffic congestion and traffic flow optimization. IoT sensors, cameras, and GPS devices gather real-time information on roads, vehicles, and infrastructure, so that traffic monitoring can be carried out more accurately.

Big data analytics process this information to find patterns, predict traffic congestion, and offer solutions for better mobility. All these technologies are of importance to smart city initiatives, intelligent transportation systems, and connectivity vehicle networks as they bring traffic management away from reactive to proactive and data driven. Increasingly, as urban populations swell and traffic congestion mounts, new technology is being adopted to smooth and make transportation safer for everyone.

The continuing urbanization has forced government agencies and municipal planners to work on intelligent transportation systems for the improvement of traffic efficiency, reduction of congestion, and enhancement of road safety.

Direct monitoring of traffic in real-time with AI-based analysis and IoT-enabled infrastructure, such as smart traffic signals and connected road sensors, is critical to ensuring smooth urban traffic. Furthermore, V2X communication is being utilized for uninterrupted data exchange among vehicles, infrastructure, and pedestrians, with the objective of optimizing traffic flow.

As federal and state budgets are allocating billions to smart transportation and sustainability programs, there is an increasing demand for real-time traffic solutions, which have now become integral to next-generation urban planning. One of the most-prominent initiatives in this regard is the SMART grants program of the U.S. Department of Transportation, which offers funding to entities developing and demonstrating smart traffic management technologies. Launched as a cornerstone initiative of the Infrastructure Investment and Jobs Act, the program has allocated a total of USD 100 million in direct funding for the 2022–2026 period. The program offers an initial funding of up to USD 2 million for 18 months, with eligible projects having the option of gaining an additional USD 15 million over 36 months.

The solution types analyzed in this report are:

The data sources analyzed in this report are:

The applications analyzed in this report are:

The end users analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The geographical breakdown of the market is as follows:

The market is fragmented due to the presence of numerous players, each holding a relatively small share. Several factors produce this fragmentation, including variations in traffic data sources and technological progress and multiple service providers, who focus on specific regions, technologies, applications, and end users. The industry procures data from various sources, which include GPS, sensors, cameras, and individuals, thus enabling different companies to create specialized solutions for specific requirements.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages