Key Highlights

| Study Period | 2019 - 2032 |

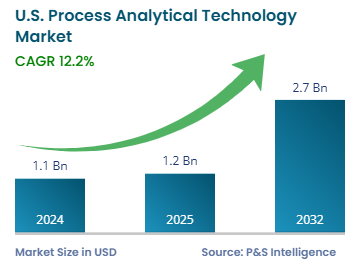

| Market Size in 2024 | USD 1.1 Billion |

| Market Size in 2025 | USD 1.2 Billion |

| Market Size by 2032 | USD 2.7 Billion |

| Projected CAGR | 12.2% |

| Largest Region | Northeast |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13557

This Report Provides In-Depth Analysis of the U.S. Process Analytical Technology Market Report Prepared by P&S Intelligence, Segmented by Service (Planning and Consulting, Operations and Maintenance, System Integration), Application (Technology, Media, Telecommunication), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 1.1 Billion |

| Market Size in 2025 | USD 1.2 Billion |

| Market Size by 2032 | USD 2.7 Billion |

| Projected CAGR | 12.2% |

| Largest Region | Northeast |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. process analytical technology market size was USD 1.1 billion in 2024, and it will grow by 12.2% during 2025–2032, reaching USD 2.7 billion by 2032.

This market is driven by the escalating requirements for superior laboratory products in the pharmaceutical, biotechnology, and food processing industries. These sectors require strict control of product quality; PAT delivers essential monitoring and control tools that help manufacturers keep their processes stable in real time. Through process control, PAT enhances product quality standards and manufacturing safety.

The pharmaceutical and biopharmaceutical industries must follow the stringent regulations of the FDA and other agencies for process safety and product quality. PAT enables compliance with the FDA’s guidelines as it monitors processes continuously, collecting data for quality assurance measures and minimizing product recall possibilities.

The U.S. NIST has awarded USD 2.08 million to seven organizations across six states to create manufacturing technology roadmaps, to boost innovation and productivity across various sectors.

The spectroscopy category held the largest market share, of 50%, in 2024, and it will grow at the highest CAGR, of 12.5%, during the forecast period. This is because small-scale industries commonly use it for real-time product monitoring to guarantee quality control throughout manufacturing operations. The system is ideal for businesses that require strict production control standards. The healthcare and pharmaceutical sectors require real-time information to manage factory operations and verify product quality and safety.

The techniques analyzed here are:

The pharmaceutical manufacturers category held the largest market share, of 30%, in 2024 because they have adopted PAT extensively for traditional drug production. The pharmaceutical industry heavily employs PAT techniques to track temperature, pH, chemical composition, and particle size during the production of tablets, capsules, and other dosage forms.

The biopharmaceutical manufacturers category will grow at the highest CAGR, of 12.4%, during the forecast period. This is because of the rising biologics demand and adoption of patient-centered healthcare practices, such as precision medicine. The production of biopharmaceuticals is more complicated than that of traditional pharmaceutical manufacturing because of the usage of living cells and organisms, which results in higher variability.

The applications analyzed here are:

The in-line category held the largest market share, of 40%, in 2024. This is because in-line sensors and analyzers function directly within production processes for real-time critical parameter analysis, without disrupting the production stream. The real-time feedback about processes helps manufacturers adjust the parameters right away, for delivering a consistent product quality and decreasing manufacturing waste.

The on-line category will grow at the highest CAGR, of 12.2%, during the forecast period. This is because on-line sensors reside in the process area but not as part of it, since they do not directly connect to the system. On-Line systems offer more-instantaneous data collection and rapid control adjustments without stopping production.

The applications analyzed here are:

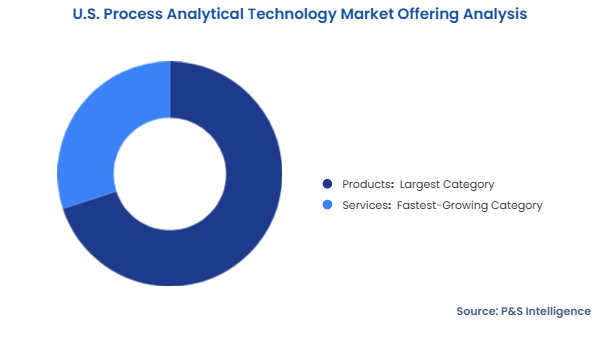

The products category held the larger market share, of 70%, in 2024. This is because analyzers serve as indispensable tools for chemical substance examination. This way, they enable companies to obtain vital information regarding raw material, ingredients, and quality aspects. Similarly, continuous-monitoring systems rely heavily on sensors and probes to measure multiple variables, including temperature, pressure, pH, and concentration. Production samples are collected using samplers, which help manufacturers check product quality at different stages of the process.

The services category will grow at the higher CAGR, of 12.3%, during the forecast period. This is because of the rising requirements for technical assistance, consulting services, and customized solutions for PAT system implementation and optimization.

The offerings analyzed here are:

Drive strategic growth with comprehensive market analysis

The Northeast region held the largest share, of 35%, in 2024, because of the presence of numerous pharmaceutical facilities, research organizations, and educational institutions in Massachusetts, New Jersey, and Pennsylvania. The development and manufacturing of biologics, pharmaceuticals, and biotechnology products have had a long history in the region.

The Western will grow at the highest CAGR, of 12.6%, during the forecast period, mainly driven by the increasing demand for biopharmaceuticals, personalized medicine, and advanced manufacturing methods. Many top biotech companies, research centers, and tech firms located in the Western region in the U.S. are developing gene therapy, nanotechnology, and biologics.

The regions analyzed in this report are:

The market is fragmented in nature because a few major players and multiple smaller companies supply comprehensive solutions for analyzers, sensors, probes, samplers, and services. The customer base includes many industries, such as pharmaceuticals, biotechnology, chemicals, and food processing, each with specific needs and areas of focus. As a result, many players focus on specific products and services to meet the needs of different types of customers.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages