Key Highlights

| Study Period | 2019 - 2032 |

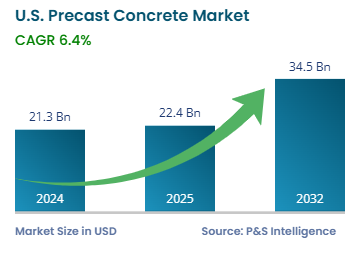

| Market Size in 2024 | USD 21.3 Billion |

| Market Size in 2025 | USD 22.4 Billion |

| Market Size by 2032 | USD 34.5 Billion |

| Projected CAGR | 6.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13602

This Report Provides In-Depth Analysis of the U.S. Precast Concrete Market Report Prepared by P&S Intelligence, Segmented by Product Type (Structural Building Components, Architectural Building Components, Transportation & Infrastructure Products, Utility & Industrial Products), Material Type (Cement, Aggregates, Admixtures, Reinforcements), Application (Residential, Commercial, Industrial, Infrastructure), End-User (Construction Contractors, Real Estate Developers, Government & Public Sector, Industrial Manufacturers, Infrastructure Developers), Installation Type (On-Site Precast, Off-Site Precast), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 21.3 Billion |

| Market Size in 2025 | USD 22.4 Billion |

| Market Size by 2032 | USD 34.5 Billion |

| Projected CAGR | 6.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. precast concrete market size in 2024 was USD 21.3 billion, and it will reach USD 34.5 billion by 2032 at a CAGR of 6.4% during 2025–2032.

The market is growing because of the numerous advantages of this material, such as durability, cost efficiency, and faster construction. This construction method has become the first choice for multiple civil construction projects, such as bridges, highways, buildings, and underground utilities.

The growing federal investments in infrastructure, urbanization, and increasing focus on sustainability drive the market growth. The Infrastructure Investment & Jobs Act (IIJA) has invested over USD 550 billion in new transportation infrastructure, creating a voluminous demand for precast concrete.

Structural building components dominate the market with a share of 40%, because builders extensively use these components in residential, commercial, and industrial projects. These offer longevity and fast project completion capabilities. The trend of affordable homes and quick urban expansion drive builders to use precast structural elements. Such components need minimal care and have extended lives. Tindall Corporation’s USD 60-million plant in Spartanburg, South Carolina, manufactures large, complex precast components for infrastructure megaprojects.

The product types analyzed here are:

Cement leads the market with 35% share because it functions as the main adhesive in concrete fabrication, providing strength, durability, reliable performance, and a well-established distribution system.

The material types analyzed here are:

Infrastructure is the largest sector with a share of 40% due to the high-volume usage of precast concrete in roads, highways, bridges, tunnels, railways, airports, and ports. The material is preferred because of its durability, strength, and large-scale construction efficiency. The government investments to infrastructure increase the demand for precast concrete due to its resistance to extreme weights, eco-friendliness, and long life. In 2024, the Federal Aviation Administration invested USD 427 million in 245 airport infrastructure projects.

The applications analyzed here are:

Infrastructure developers dominate the market with a share of 40% because of the increasing investments in roads, bridges, tunnels, and public transportation projects. The government releases tenders, which are picked up by infrastructure developers of varying scales.

The end users analyzed here are:

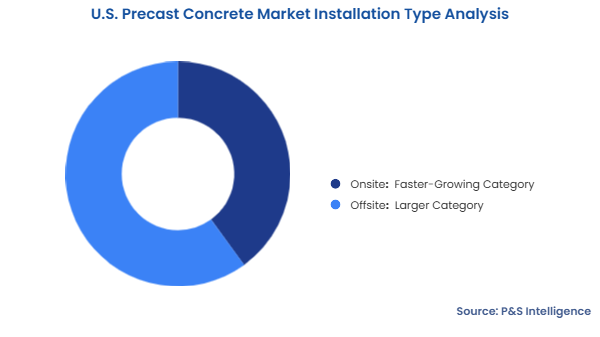

The offsite Category is the largest, with a share of 60%, because it is efficient and beneficial for quality management and demands lower labor expenses. This installation method creates concrete components in controlled conditions before their shipment to construction sites, which leads to higher precision and durability. The acceptance of offsite concrete pre-casting is growing because of the need for faster project deliveries for infrastructure, residential, and commercial buildings. The advances in prefabrication technology and the advent of automated systems have made off-site precast construction popular for large-scale projects. The labor shortages and cost management issues persistent in the country’s construction sector drive the usage of off-Site precast construction.

The installation types analyzed here are:

Drive strategic growth with comprehensive market analysis

The Southern region dominates with a share of 40% because of its rapid urban growth, expanding infrastructure needs, and increasing resident population. Texas and Florida are constructing residential buildings, commercial structures, and large-scale infrastructure projects on a massive scale. Year-round construction in this region is possible due to the favorable climatic conditions, raising the demand for precast concrete components because of their proven durability and efficiency.

The regions analyzed here are:

The concrete market is fragmented as it consists of major national manufacturers and various regional operators. The major companies include Holcim, CEMEX, and Oldcastle Infrastructure, which compete with various mid-sized and local producers. The market is fragmented because heavy precast products become more affordable when suppliers are located near construction sites.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages