Market Statistics

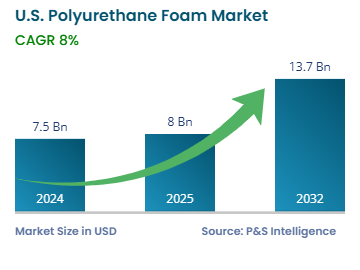

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 7.5 billion |

| 2025 Market Size | USD 8 billion |

| 2032 Forecast | USD 13.7 billion |

| Growth Rate(CAGR) | 8% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Consolidated |

Report Code: 13458

This Report Provides In-Depth Analysis of the U.S. Polyurethane Foam Market Report Prepared by P&S Intelligence, Segmented by Type (Rigid Foam, Flexible Foam, Spray Foam), End Use (Bedding & Furniture, Building & Construction, Automotive, Electronics, Footwear, Packaging, Textile & Apparel, Transportation), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 7.5 billion |

| 2025 Market Size | USD 8 billion |

| 2032 Forecast | USD 13.7 billion |

| Growth Rate(CAGR) | 8% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. polyurethane foam market size was USD 7.5 billion in 2024, and it will grow by 8% during 2025-2032, to reach USD 13.7 billion by 2032.

The market is growing because of the broad application of this material in furniture, bedding, construction, electronics, automobiles, packaging, and textiles. As per the Census Bureau, construction spending in the U.S. stood at USD 2,196.1 billion in March 2025. Moreover, OICA notes that 10,562,188 vehicles were produced in the country in 2024, which is a significant rise from 10,611,555 units in 2023. Further, people in the country spend an average of USD 619 on furniture in 2023.

Polyurethane offers effective insulation and cushioning to lightweight auto components, energy-efficient buildings, and protective packaging. This foam comes in the flexible, rigid, and spray variants, each having specific uses, such as air sealing, seating, and insulation.

The market is driven, in part, by the need for more comfort in beds and furniture, increasing demand for fuel-efficient and lightweight automobiles, and rising construction activities with a focus on energy efficiency. The production of bio-based polyurethane foam is rising with the government support for green materials in the form of tax credits and incentives, in order to promote sustainability and innovation.

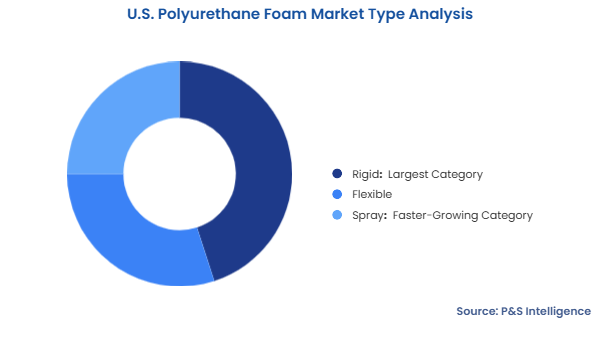

The rigid category held the largest market share, of 45% in 2024, because of the extensive usage in construction and buildings as thermal insulation. Residential and commercial buildings generate a great demand for rigid foam because of the need for high-performance insulation amidst the stringent energy efficiency rules. These foams are also used on packaging products, offering long-lasting, lightweight yet protective solutions.

The spray category will have the highest CAGR, because it provides better insulation, energy efficiency, and moisture control, making it extremely popular for energy-efficient buildings. SPFs have the ability to reduce heating and cooling expenses, which leads to their increasing use in both new construction and retrofitting projects. Further, government subsidies, specifically the Residential Energy Efficiency Tax Credit, support energy-efficient products and technological improvement in spray foam systems.

The types analyzed in this report are:

The furniture & bedding category held the largest market share, of 35% in 2024, because this foam provides comfort and durability in cushioned furniture, pillows, and mattresses. The dominance of this category is credited to the great demand for premium, comfortable home furniture and furnishings.

The building & construction category will have the greatest CAGR, because of the growing demand for environment-friendly building materials. Excellent thermal insulating value and efficient closure of gaps make this foam ideal for improving building energy economy. As per the EIA, buildings use up to 75% of the electricity in the country and lead to USD 370 billion in yearly electricity bills.

The applications analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South region held the largest market share, of 40%, in 2024 because of the high-volume usage of these foams to make furniture, automobile seating, and building insulation. This region has major cities such as Atlanta, Houston, Dallas, and Miami, which have large populations, a high number of automobiles in operation, and expansive industries. The rising demand for polyurethane foam for auto seats and interior components follows from the growth in auto manufacturing in Alabama and Tennessee.

The geographical breakdown of the market is as follows:

The market is consolidated with a smaller number of players holding larger shares. Due to their varied product lines, strong worldwide presence, and ongoing research and development investment, major players, including BASF SE, Dow Inc., Huntsman Corporation, and Covestro AG, hold sizable market shares. These companies sell polyurethane foam for different uses in building, insulation, automobiles, packaging, and furniture. The high entry barriers, such as capital requirements and regulatory standards related to the environment, restrict new entries.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages