Market Statistics

| Study Period | 2019 - 2032 |

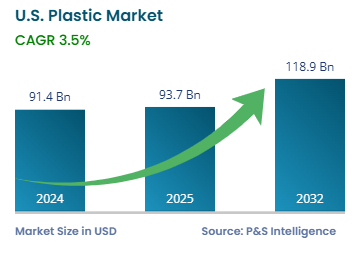

| 2024 Market Size | USD 91.4 billion |

| 2025 Market Size | USD 93.7 billion |

| 2032 Forecast | USD 118.9 billion |

| Growth Rate(CAGR) | 3.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13465

This Report Provides In-Depth Analysis of the U.S. Plastic Market Report Prepared by P&S Intelligence, Segmented by Product (Thermoplastic, Thermosetting Plastics), Application (Packaging, Healthcare & Medical, Automotive & Transportation, Building & Construction, Electrical & Electronics, Consumer Goods, Textile & Fibres, Agriculture), Processing Method (Injection Molding, Extrusion, Blow Molding, Rotational Molding, Thermoforming, Compression Molding, 3D Printing), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 91.4 billion |

| 2025 Market Size | USD 93.7 billion |

| 2032 Forecast | USD 118.9 billion |

| Growth Rate(CAGR) | 3.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. plastic market size was USD 91.4 billion in 2024, and it will grow by 3.5% during 2025–2032, to reach USD 118.9 billion by 2032. The market is driven by the growing demand for all kinds of polymers in the packaging, automotive, construction, healthcare, and many other industries.

With the growing need for lightweight yet strong materials, the automotive industry is using more plastic than ever to decrease vehicle weight and improve fuel economy. Such advanced plastics also feature in the aerospace industry for interior components and several structural body parts, to improve durability and overall fuel efficiency.

The packaging industry is responding to the boom of e-commerce by increasing the consumption of safe and efficient packaging for the transportation of products. Moreover, the restrictions at the state and federal levels on single-use plastics and foam products force both players and end users to innovate the recycling technology and look for sustainable alternatives, such as bioplastics.

The thermoplastic category held the larger market share, of 70%, in 2024 since they are widely used in packaging, automobiles, and consumer goods due to their durability, flexibility, and cost-effectiveness. An important thermoplastic is polyethylene, which has wide applications in the food & beverage sector, mainly flexible packaging.

The thermosets category will have the higher CAGR, of 4.8%, because of the increasing environmental issues, government rules, and corporate sustainability initiatives. With the expanding prohibitions on single-use plastics and the introduction of renewable bioplastics, the demand for thermosetting polymers is rising.

The products analyzed in this report are:

The packaging category held the largest market share, of 45%, in 2024 owing to the growing demand for lightweight, durable, and protective materials for food, pharmaceutical, and e-commerce packaging. The growing trend of online shopping and home delivery services further strengthens the demand for plastics in this area. The F&B sector is a significant consumer of plastics, especially for packaging applications, to ensure food safety, extend shelf life, and enhance convenience.

Plastic-based packaging materials, such as PET bottles, flexible LDPE films, and PP containers remain in high demand for their low cost and durability. The rapid shift in customer preference toward ready-to-eat and packed food drives the demand for plastics for packaging.

The healthcare & medical category will have the highest CAGR, of 4%, owing to the increase in the demand for plastic-based medical devices, such as syringes, IV bags, and personal protective equipment (PPE). The COVID pandemic significantly boosted this growth, which is now aided by the continuous advancement in technology for medical-grade plastics.

The applications analyzed in this report are:

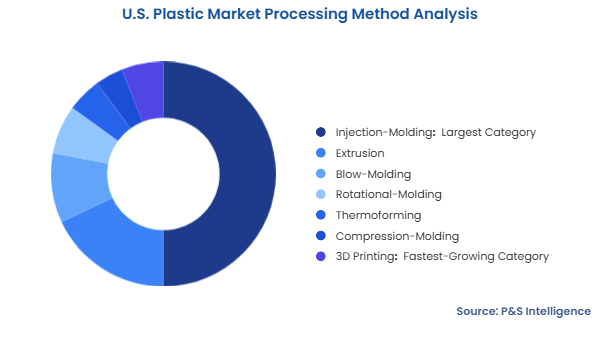

The injection-molding category held the largest market share, of 50%, in 2024 because it is the most-utilized processing method for manufacturing high-volume plastic components with precise dimensions. As a result, this method finds applications in the automotive, consumer goods, and healthcare industries, where efficiency, repeatability, and low cost are major requirements.

The 3D printing category will have the highest CAGR, of 3.8%, due to the advancements in additive manufacturing technology. 3D printing is increasingly being used for the fabrication of complex parts with little wastage of materials, short lead times, and design flexibility. Aerospace components and medical devices are the key applications of 3D plastic printing, chiefly for its benefits in custom designing, rapid prototyping, and weight reduction.

The Processing methods analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South held the largest market share, of 30%, in 2024 because it hosts numerous plastic manufacturing and petrochemical refining facilities. The automotive, construction, and packaging industries, which are key consumers of plastics, are also strong and productive in the region. Texas, in particular, is home to a large number of vast polymer resin production facilities, which leads to easy feedstock availability for regional industries.

The West will have the highest CAGR, of 5%, because of the increasing count of sustainability initiatives and strict regulations against traditional plastics. California and other states are increasingly advocating for biodegradable and recycled plastics, thus encouraging green innovations. Investments in advanced recycling technologies and circular economy models lead to the increasing use of bioplastics and post-consumer recycled material.

The geographical breakdown of the market is as follows:

The U.S. plastic market is fragmented because a large number of multinational corporations and regional manufacturers compete across product segments. The presence of several types of plastics, such as thermoplastics, thermosetting plastics, biodegradable plastics, and special polymers, is the root of the fragmentation. The large resin producers include Dow, ExxonMobil, LyondellBasell, SABIC, BASF, and a few more, but even more smaller producers exist. The import of cheap plastic resins from the MEA and Asia also fragments the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages