Market Statistics

| Study Period | 2019 - 2032 |

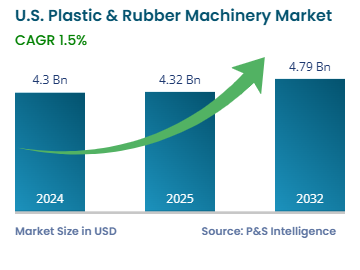

| 2024 Market Size | USD 4.30 billion |

| 2025 Market Size | USD 4.32 billion |

| 2032 Forecast | USD 4.79 billion |

| Growth Rate(CAGR) | 1.5% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13468

This Report Provides In-Depth Analysis of the U.S. Plastic & Rubber Machinery Market Report Prepared by P&S Intelligence, Segmented by Machinery (Plastic, Rubber), Technology (Hydraulic, Electric, Hybrid), End Use (Packaging, Automotive, Medical Devices, Construction, Electronics, Aerospace & Defense, Apparel & Textile), Automation (Manual, Semi-Autonomous, Fully Autonomous), Material (Thermoplastics, Thermosetting Plastics, Rubber Compounds, Biodegradable & Bioplastics), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 4.30 billion |

| 2025 Market Size | USD 4.32 billion |

| 2032 Forecast | USD 4.79 billion |

| Growth Rate(CAGR) | 1.5% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. plastic & rubber machinery market size was USD 4.30 billion in 2024, and it will grow by 1.5% during 2025-2032, to reach USD 4.79 billion by 2032.

This market is primarily driven by the growing population, its migration to cities, its rising disposable income, the increase in its standard of living, and rampant industrialization. All these factors lead to a massive demand for plastic and rubber products in the automotive, packaging, construction, medical, electronics, and many other industries.

The application of smart manufacturing technologies, such as IoT, AI, and predictive maintenance, in machines that make products out of polymers and rubber is transforming every industry. These technologies help monitor production in real-time, optimize efficiency, and drastically reduce downtime, allowing companies to enhance profitability and sustainability in their operations.

However, the industry encounters several challenges. The large capital investments for advanced technologies are a financial burden, especially for small and medium-sized manufacturers. With the increasingly stringent environmental regulations on plastics and rubber waste, machines will need to have higher energy and material processing efficiency, which might make them even costlier in the short term.

The plastics machinery category held the larger market share, of 60% in 2024 because they find application in different industries that use plastics, such as automotive, packaging, medical devices, and consumer goods. These industries depend on high-precision, complex plastic parts produced in large volumes with little wastage.

The rubber machinery category will have a higher CAGR, of 2.5%, due to the growing demand for rubber for automotive components, construction, and industrial applications. Apart from tires, rubber is widely used to make pipes & hoses, other automotive parts, footwear, toys, gloves, condoms, and many other common objects.

The machinery analyzed in this report are:

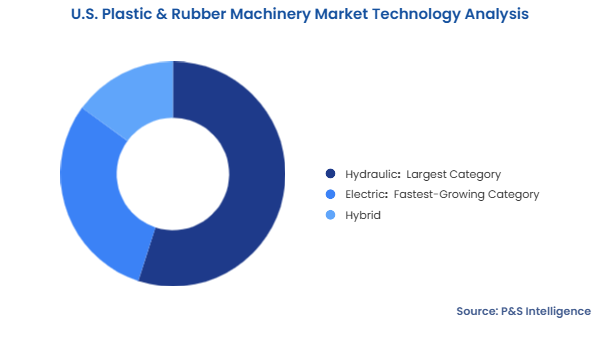

The hydraulic category held the largest market share, of 55%, in 2024 due to their high clamping force, which is ideal for heavy-duty applications. Therefore, these machines are widely used in the automotive and construction industries for the mass production of plastic and rubber parts. Although electric machines are more efficient, hydraulic machines remain more popular because they are relatively cheaper, easy to use, and technically simpler.

The electric category will have the higher CAGR, of 3%, due to their energy efficiency, accuracy, and environmental sustainability. Most industries are now focused on sustainability and cost savings, driving the usage of electric machines for making high-precision plastic and rubber parts for medical devices, electronics, aircraft, and automobiles.

The technologies analyzed in this report are:

The packaging category held the largest market share, 35%, in 2024 because of the growing demand for food, beverage, drug, and consumer goods packaging. In the e-commerce sector, the demand for lightweight, durable, and cheap packaging solutions is rising unabated. Both rigid (bottles, containers) and flexible (films, pouches) packaging are made by extrusion, blow-molding, and thermoforming machines. Sustainability concerns, the developments in bioplastic packing, and the usage of smarter machinery define the packaging sector of the U.S.

The medical devices will have a highest CAGR, of 2%, due to the increasing healthcare expenditure, advancing medical technology, and rising focus on infection control and hygiene. Medical disposables, such as syringes, IV bags, and catheters, are used in huge numbers around the country each day. Similarly, the usage of silicone implants and other kinds of medical devices is increasing. Further, the high device efficacy and patient safety standards of the FDA lead manufacturers to use high-precision, automated machines to ensure compliance.

The end uses analyzed in this report are:

The semi-autonomous category held the largest market share, of 40%, in 2024 because they demand a lower initial investment and are easy to use. Manufacturers engaged in low-volume production or those that offer highly customized goods often use these machines since full automation might be out of their reach in terms of costs. The popular approach of using robots alongside humans in factories drives the adoption of semi-autonomous plastic and rubber machines.

The fully automated category will have the highest CAGR, of 2.5%, due to the advent of Industry 4.0 and smart manufacturing. AI-equipped systems improve production efficiency by reducing human intervention, errors, and wastage. Such machines incorporate real-time monitoring and predictive maintenance to enhance uptime and reduce operational costs.

The levels of automation analyzed in this report are:

The thermoplastic category held the largest market share, of 60%, in 2024 because of their flexibility, ease of processing, and recyclability. The use of thermoplastics in the fields of packaging, automotive, consumer goods, and electronics is wide and includes injection-molding, extrusion, and blow-molding. Common thermoplastics include polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), all of which are preferred because of their lightweight nature, durability, and cost-effectiveness.

The biodegradable & bioplastics category will have the highest CAGR, of 3%, because of the nationwide sustainability drives, restrictions on single-use plastics, and increasing demand of consumers for green products. All these products continue to drive the consumption of bioplastics, including polylactic acid (PLA) and polyhydroxyalkanoates (PHA).

The material analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Midwest held the largest market share, of 35%, in 2024 because this region has a huge number of automotive, industrial equipment, and packaging manufacturers, well-built infrastructure, and a skilled workforce. In addition, the government incentives to encourage manufacturing drive the demand for plastic and rubber working machines in almost every industry in the region.

The South will have the highest CAGR, of 2%, due to its low production costs, pro-business policies, and increasing foreign investment in manufacturing. Tax incentives and the lowering of energy prices are encouraging many businesses to relocate to Texas, Georgia, or Tennessee. The automotive and packaging industries continue to boom in the region, thus creating a huge demand for machines to process rubbers and plastics into a range of products.

The geographical breakdown of the market is as follows:

The market is highly fragmented, with a large number of domestic and international players catering to diverse industries, such as automotive, packaging, and medical equipment. Different industry demands, such as precision injection-molding for automotive parts, high-speed extrusion for packaging, and micro-molding for medical devices, allow niche players the opportunity to thrive in the market alongside bigger companies. The market fragmentation is also owed to the differences in the technology of these machines, vis-a-vis, hydraulic, electric, and hybrid.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages