Market Statistics

| Study Period | 2019 - 2032 |

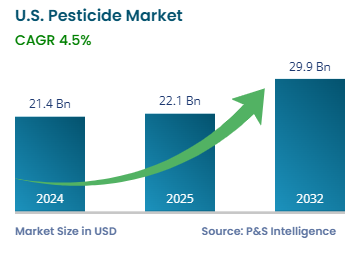

| 2024 Market Size | USD 21.4 billion |

| 2025 Market Size | USD 22.1 billion |

| 2032 Forecast | USD 29.9 billion |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13457

This Report Provides In-Depth Analysis of the U.S. Pesticide Market Report Prepared by P&S Intelligence, Segmented by Product (Synthetic pesticides, Biopesticides), Crop (Cereals & Grains, Fruits & Vegetable, Oilseeds & Pulses, Turf & Ornamentals), Application (Agriculture, Non Agriculture), Distribution Channel (Direct Sales, Retail Sales, Online and e-commerce, Agricultural Corporatives), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 21.4 billion |

| 2025 Market Size | USD 22.1 billion |

| 2032 Forecast | USD 29.9 billion |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | Midwest |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. pesticide market size was USD 21.4 billion in 2024, and it will grow by 4.5% during 2025–2032, to reach USD 29.9 billion by 2032.

The huge requirement for agricultural produce and the need to protect crops during the growth stages and while in the warehouse from damage drive the market. As per the U.S. Census Bureau, the population of the country rose by 3,304,757 in 2024 from 2023, which was the highest rate of growth since 2001. This continues to push up the demand for food amidst the expansion of cities, the constriction of farming areas, and the move of people from rural pockets to urban areas. As per the USDA, the number of farms in the country dwindled from 2.04 million in 2017 to 1.88 million in 2024.

The adoption of precision agriculture will drive the adoption of biopesticides and integrated pest management (IPM) techniques to achieve higher efficiency, environment-friendliness, and target orientation.

The synthetic category held the larger market share, of 80%, in 2024 because they are commonly used in large corn, soybean, and wheat farms to effectively combat weeds and enhance productivity. Easy availability, low costs, and high effectiveness make synthetic herbicides popular for controlling weeds, which compete with crops through nutrient, water, and sunlight uptake.

The biopesticides category will have the higher CAGR, of 5%, due to the severe environmental regulations and increasing resistance in pests against synthetic pesticides. Biopesticide usage is driven by efforts for organic farming, sustainability, and environmentally safe pest control with specific targeting. A wide variety of biopesticides, including microbial, plant-derived, and biochemical ones, are available and being used on vast tracts of farmland.

The products analyzed in this report are:

The cereals & grains category held the largest market share, of 45%, in 2024 because of the large-scale cultivation of corn, wheat, and other such crops. They require a high volume of diverse pesticides for controlling weeds, insects, and diseases, to secure high yields. The expansion of large-scale commercial farming and growth in the biofuel sector drive pesticide consumption in this category. Wheat, soybeans, and maize are the three largest crops in the country by yield.

The fruits & vegetables category will have the highest CAGR, of 5.6%, driven by consumers increasing desire for fresh and organic produce due to their rising awareness of health and immunity. The increasing consumption of biopesticides, strengthening government policies for food safety, and rising focus on effective pest management for these high-value crops propel this category.

The crops analyzed in this report are:

The agricultural category held the larger market share, of 70%, in 2024 because they are used in huge volumes to protect crops from weeds, insects, and diseases, to secure high yields and food supply. In the large-scale farming of corn, soybeans, and wheat, pest control is a must to prevent compromised productivity. Furthermore, climate change and pest resistance are driving the search for new herbicides, fungicides, and insecticides.

The non-agricultural category will have the higher CAGR, of 5%, because of the rising awareness of more effective remedies against mosquito-borne diseases, such as the Zika, rabies, and West Nile viruses, as well as malaria and Chagas parasites. The demand for pest control in residential and commercial properties, as well as food processing facilities, storage warehouses, and other industrial areas, is rising to achieve hygiene and safety.

The applications analyzed in this report are:

The direct sales category held the largest market share, of 50%, in 2024 because commercial farms and agribusinesses usually purchase pesticides in bulk from manufacturers. They do so to ensure the regularity of supply and cost efficiency in their farming operations.

The online category category will have the highest CAGR, of 5.5%, because e-commerce improves access for smallholder farmers and residential consumers at competitive pricing. Moreover, pest control is significantly supported by agricultural input retailers and programs sponsored by government agencies.

The distribution channels analyzed in this report are as follows:

Drive strategic growth with comprehensive market analysis

The Midwest category held the largest market share, of 45%, due to the massive acreage for corn, soybean, and wheat. These crops need a significant amount of pesticides for weed, insect, and disease control. Midwestern farmers depend on herbicides, fungicides, and insecticides to sustain a high-yield and healthy crop. The high fertility of the soil, coupled with a moderate climate, makes farming attractive in the region.

The West category will have the highest CAGR, of 5.7%, as several specialty crops, such as fruits, vegetables, and grapes, are grown here. These crops need strong protection against damage from pests for farmers to be able to charge high prices for them. The famed Napa Valley in California contains 18,300 hectares (45,275 acres) of vineyards, which reflects a high demand for pesticides, especially organic and bio-based ones.

The geographical breakdown of the market is as follows:

The market is consolidated because a few major multinational corporations, including Bayer, Syngenta, BASF, Corteva Agriscience, and FMC, hold a major cumulative share. This consolidation is due to the high entry barriers, including stringent regulatory requirements, high investment in R&D, and the need for extensive distribution networks. The recent mergers and acquisitions, especially Bayer's acquisition of Monsanto, have also contributed to the concentration of power among these major players.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages