Market Statistics

| Study Period | 2019 - 2032 |

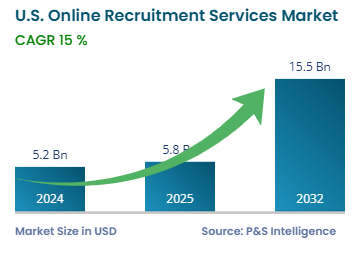

| 2024 Market Size | USD 5.2 Billion |

| 2025 Market Size | USD 5.8 Billion |

| 2032 Forecast | USD 15.5 Billion |

| Growth Rate(CAGR) | 15% |

| Largest Region | Northeast |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13422

This Report Provides In-Depth Analysis of the U.S. Online Recruitment Services Market Report Prepared by P&S Intelligence, Segmented by Type of Service (Job Portals & Job Boards, Staffing & Recruitment Agencies, Freelance & Gig Work Platforms, Employer Branding & Recruitment Marketing Services, Background Verification & Candidate Screening Services), Technology (Traditional Online Job Boards, AI-Driven Recruitment Platforms, Video Interviewing & Virtual Hiring Tools, ATS Integration, Mobile-First Recruitment Solutions, Social Media Recruiting, Blockchain-Based Recruitment Solutions, Chatbot & Automated Screening Tools), Hiring Model (Full-Time Employment, Part-Time Employment), Company Size (Large Enterprises, Mid-Sized Companies, Small Businesses & Startups), Industry (IT & ITeS, Healthcare, BFSI, Manufacturing, Retail & E-Commerce, Education, Hospitality), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 5.2 Billion |

| 2025 Market Size | USD 5.8 Billion |

| 2032 Forecast | USD 15.5 Billion |

| Growth Rate(CAGR) | 15% |

| Largest Region | Northeast |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. online recruitment services market revenue in 2024 was USD 5.2 billion, and it will reach USD 15.5 billion by 2032 at a CAGR of 15% during 2025–2032. Online recruitment has changed the way job seekers find opportunities and the way companies hire. Online recruiting Platforms have become essential as they make talent hunt easy for companies.

With AI-driven recruitment, video interviewing tools, and applicant tracking Systems (ATS), technology is enhancing and quickening up the hiring process. Companies of different sizes, from startups to MNCs, now use online recruiting platforms to find the right person for the right job.

Job portals & job boards lead the market with a share of 45%. Employers from different industries benefit from these platforms as they offer job advertisement posting, resume storage, and automated candidate search functionality. Hiring managers can access large candidate pools, which is important amidst the rising competition in every industry. These platforms are now embedded with artificial intelligence and machine learning, which provide them with better candidate job matching tools at higher speeds.

The types of services analyzed here are:

AI-driven recruitment platforms dominated the market in 2024 with a share of 35% because they provide state-of-the-art solutions for candidate matching, screening, and hiring. Through AI algorithms, LinkedIn, ZipRecruiter, and Hire speed up the hiring process and boost job candidate compatibility assessment. These recruitment platforms assess candidates through big data analysis to evaluate their skills and experience, before determining their suitability through cultural assessments. AI adoption is increasing because it handles repetitive work, eliminates biases, and generates important insights, which together provide essential operational tools to companies while they hire staff.

The technologies analyzed here are:

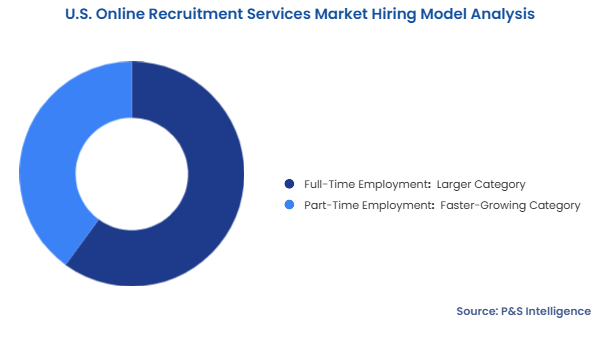

Full-time employment is the leading category with a share of 60%, because people seek stability and growth through long-term hires. Some job portals even provide extensive job listings and AI candidate-matching tools. The usage of AI-powered recruitment platforms and applicant tracking systems (ATS) is expanding because of the growing demand for skilled professionals in the technology, healthcare, and finance sectors. Since such employees are hard to come by, companies like having them on their roster for long periods.

The hiring models analyzed here are:

Large enterprises lead the market, with 55% share, and they are implementing modern technologies, including AI, ATS, and video interviewing, to optimize their large-scale recruitment procedures. The total recruitment solutions offered by Google, Amazon, and Microsoft help these companies manage large hiring volumes and recruit worldwide talent. The usage of AI and automation enables these big organizations to boost their recruitment applicant assessment, while minimizing hiring time requirements and achieving better recruiting effectiveness.

The company sizes analyzed here are:

The information technology sector leads the market with a share of 40% because of the strong demand for software developers, cyber experts, and data scientists. The tech industry seeks top talent from LinkedIn and other AI-powered platforms, to fast-track their recruitment. Since the country has a gross shortage of such professionals, companies in the country seek out talent from outside, especially India and China.

The industries analyzed here are:

Drive strategic growth with comprehensive market analysis

The Northeast is the leading region with a share of 45%. This is because this region contains a dense concentration of company headquarters, technology centers, and financial institutions. New York, Boston, and Philadelphia draw professionals from around the world for different industries, which is why the companies here depend on online recruitment services to get the best talented individuals.

The regions analyzed here are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages