Market Statistics

| Study Period | 2019 - 2032 |

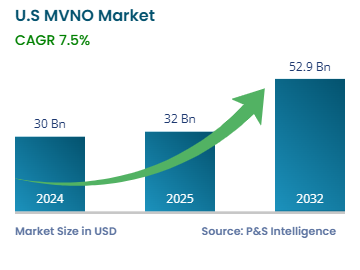

| 2024 Market Size | USD 30 billion |

| 2025 Market Size | USD 32 billion |

| 2032 Forecast | USD 52.9 billion |

| Growth Rate(CAGR) | 7.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13474

This Report Provides In-Depth Analysis of the U.S. MVNO Market Report Prepared by P&S Intelligence, Segmented by Payment Model (Postpaid MVNO, Prepaid MVNO), Service Type (Discount, Telecom, Media & Entertainment, Business, Retail, Migrant, Cellular Machine-to-Machine, Roaming), Business Model (Full MVNO, Service MVNO, Reseller MVNO), Subscribers (Consumer, Enterprise), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 30 billion |

| 2025 Market Size | USD 32 billion |

| 2032 Forecast | USD 52.9 billion |

| Growth Rate(CAGR) | 7.5% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. MVNO market size was USD 30 billion in 2024, and it will grow by 7.5% during 2025–2032, reaching USD 52.9 billion by 2032.

This market is driven by the increasing customer need for economical mobile services. These providers deliver plans that cost less than those offered by regular mobile operators. Customers’ preference in regards to mobile services is now higher for prepaid options without any contractual obligations.

The freedom to provide customization and specialized services to customers enables MVNOs to capture unique market segments. The introduction of 5G networks and technological advancements allow MVNOs to offer customers fast services at affordable prices. Their strategic partnerships with the major carriers provide MVNOs with the capability to deliver reliable coverage without having to build their own network infrastructure.

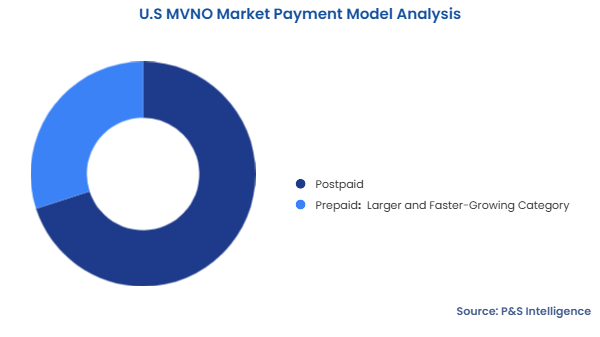

The prepaid category held the larger market share, of 70%, in 2024, and it will grow at the higher CAGR, during the forecast period. This is because they offer flexibility and affordable service to customers. These alternatives bring significant advantages to price-conscious customers, who reject extended agreements, credit assessments, and want lower fees than what postpaid plans charge.

Prepaid MVNOs satisfy consumers’ demands for budget-friendly and adaptable wireless services. Prepaid plans have gained popularity especially among young users, immigrants, and individuals whose poor credit scores make it challenging to get standard postpaid packages from leading mobile operators.

The payment models analyzed in this report are:

The telecom category held the largest market share, of 30%, in 2024. This is because the primary MVNO offerings include standard mobile voice, text messaging, and data services, which are offered to individual consumers. Telecom MVNOs cater to various customer groups, which include price-sensitive individuals and customers who need adaptable plans.

The discount category will grow at the highest CAGR, during the forecast period. This is because more customers now want affordable mobile services amidst the rising voice and data charges.

The service types analyzed in this report are:

The reseller category held the largest market share, of 65%, in 2024. This is because the conventional model needs minimal network infrastructure, which reduces market entry costs and makes business implementation simpler.

The full category will grow at the highest CAGR, during the forecast period. This is because full MVNOs maintain higher independence than reseller MVNOs due to their ownership of the core network systems. Full MVNO operators gain full control over their product offerings and independence in managing their network infrastructure.

The business models analyzed in this report are:

The consumer category held the largest market share, of 60%, in 2024, because people want affordable mobile services. A large number of MVNOs focus on individual customers who require voice plans with texting and data features for personal use. MVNOs serve families, youngsters, and grown-ups who want affordable phone services without big carriers.

The enterprise category will grow at the highest CAGR, during the forecast period. Business organizations’ mobile service demand is quickly rising for operational support, better communication, and connected device deployment. Enterprises’ mobile service needs have increased notably because of the rise in remote work and rapid digital transformation. Enterprise MVNOs customize their offerings to businesses to include communication tools, fleet management capabilities, employee plan solutions, and IoT-enabled solutions for connected devices.

The subscribers analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Southern region held the largest market share, of 45%, in 2024. This is because Texas, Florida, Georgia, North Carolina, and other states in this region are among the country's most populated. The consistent population growth in the South is because of low living and supportive business policies. MVNOs get to target a diverse population, consisting of urban and rural residents, in this region. People here are seeking economical mobile solutions that are adaptable to various purposes.

The Western region will grow at the highest CAGR, during the forecast period. Technological innovation and mobile adoption rates are high in California because it is a significant technological center. The established infrastructure of major MNOs enables MVNOs to easily lease access and offer cost-effective voice and data plans to subscribers.

The regions analyzed in this report are:

The market is highly fragmented in nature because a huge number of small-, medium-, and large-scale MVNOs operate. The variations in plans and customer needs allow numerous MVNOs to thrive by offering tailored services and plans. The non-requirement to own the expensive and high-tech telecommunications infrastructure lowers the barriers to entry, allowing even non-telcos to function as an MVNO. Hence, tech firms and even retailers have entered the country’s MVNO market, making it even more fragmented.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages