Market Statistics

| Study Period | 2019 - 2032 |

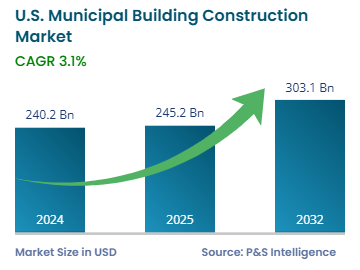

| 2024 Market Size | USD 240.2 billion |

| 2025 Market Size | USD 245.2 billion |

| 2032 Forecast | USD 303.1 billion |

| Growth Rate(CAGR) | 3.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13449

This Report Provides In-Depth Analysis of the U.S. Municipal Building Construction Market Report Prepared by P&S Intelligence, Segmented by Building Type (Government Offices, Courthouses, Police & Fire Stations, Schools & Universities (Public), Libraries, Community Centers, Transportation Hubs, Water & Waste Management Facilities), Construction Type (New Construction, Renovation & Rehabilitation, Retrofit & Upgrades), Materials (Concrete, Steel, Wood, Glass & Advanced Composites, Sustainable & Green Materials), Funding Source (Federal Government, State & Local Governments, Public-Private Partnerships (PPP), Bond Issuance & Grants), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 240.2 billion |

| 2025 Market Size | USD 245.2 billion |

| 2032 Forecast | USD 303.1 billion |

| Growth Rate(CAGR) | 3.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The size of the U.S. municipal building construction market in 2024 was USD 240.2 billion, and it will reach USD 303.1 billion by 2032 at a CAGR of 3.1% during 2025–2032. The market is growing because of the increasing rate of urbanization and rising funding by the government in developing public infrastructure. New entrants and existing companies have opportunities to modernize the aging infrastructure with new, energy-efficient designs and smart technologies to make them sustainable and resilient.

The Bipartisan Infrastructure Law has earmarked USD 550 billion for municipalities to construct new facilities and modernize their outdated infrastructure by 2026. One of the projects underway as part of this initiative is for the aging wastewater treatment facilities in Reed City, Michigan, which received USD 35 million in March 2025. A month ago, the city of Laredo in Texas received a federal investment of USD 20 million to identify and replace faulty supply lines.

The market is led by public schools & universities with a share of 45%. Modern educational facilities receive hefty funds from public and private investors for construction and modernization. For instance, a USD 7-billion construction initiative funded by the Los Angeles Unified School District is working to establish new educational institutions with modern facilities. The University of California is constructing new campuses to support more academic and research programs. In December 2023, according to the National Center for Education Statistics, around 21% of the U.S. public schools were undergoing renovations/upgrades, as these buildings are almost half a century old, on average.

The U.S. Department of Energy has launched the Renew America’s Schools Program with a funding of USD 500,000,000 grant for renewable energy integration in public K–12 schools. Moreover, investments in school upgradation include renovating old educational buildings with contemporary HVAC technologies, earthquake protection solutions, and eco-friendly construction materials. The LA Unified School District has received USD 750 million for green energy and climate-resilient schools, while the Houston Independent School District has allocated USD 100 million for technological upgrades at schools.

The building types analyzed here are:

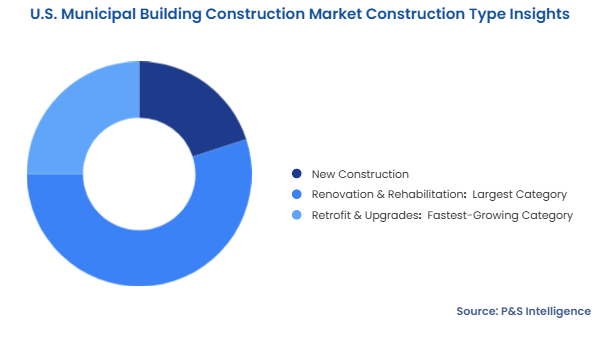

The renovation & rehabilitation category has the largest revenue share, of 55%. Most government offices, schools, and public facilities were constructed several decades ago, and they need modernization to satisfy the present standards for safety, accessibility, and energy efficiency. The government has already initiated the renovation of over 135,000 miles of roads, 7,800 bridges, and 190 airport terminals by November 2023. Historic courthouses and government buildings are going through renovation to retain their architectural heritage and deploy modern technologies. In 2022, the USD 200-million project to renovate the Dallas County Records Building was completed. Renovation projects cost less than new construction, due to which municipalities choose it due to budget restrictions.

The construction types analyzed here are:

Concrete is the leading material with a share of 45% due to its durability, fire resistance, and robust performance in harsh weather. According to the American Concrete Institute (ACI), Concrete usage in municipal development represents 60% of the construction Spending due to its solidity and low cost. The duration of big municipality construction projects has decreased due to the developments in precast and reinforced concrete. Concrete forms the key structures of highways, transportation centers, water facilities, and fire protection networks.

The material analyzed here are:

State and local governments are the main funders with a share of 70% because they control infrastructure developments in their assigned areas. As per the Congressional Budget Office (CBO), state and local governments account for 75% of the spending on public infrastructure in the U.S., including schools, courthouses, police stations, transportation hubs, and water treatment facilities. State governments derive their budget from local tax collections as well as their assigned funds for construction. The majority of the municipalities have specific funds for building public facilities. State and local governments are increasing their project funding by accepting federal grants and issuing bonds, to finance big construction projects. State and local governments lead the market because they own, construct, and maintain most of the municipal infrastructure in the country.

The funding source analyzed here are:

Drive strategic growth with comprehensive market analysis

The Southern region has the largest revenue share, of 40%, because of its quick population growth, increase in construction activities in Texas, Florida, and Georgia, and strong economic conditions in regional states. According to the U.S. Census Bureau, 39% of the country’s population, equaling 132,665,693 people, lived in the South in 2024. Texas, Florida, and Georgia have rising public infrastructure development needs, including educational establishments, transportation facilities, and water supply networks. New municipal structures are required across the South region because it has the most immigrants, led by Texas and Florida. The region also attracts construction firms for municipal projects because of tax rebates, favorable construction prices, and large infrastructure investments from state governments. Public service expansions in major cities, such as Houston, Atlanta, and Miami, drive investments in government buildings and emergency facilities.

The regions analyzed here are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages