Key Highlights

| Study Period | 2019 - 2032 |

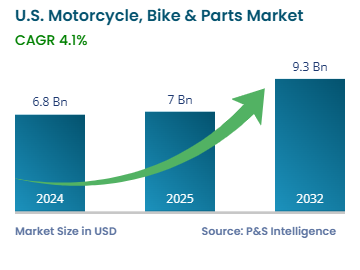

| Market Size in 2024 | USD 6.8 Billion |

| Market Size in 2025 | USD 7 Billion |

| Market Size by 2032 | USD 9.3 Billion |

| Projected CAGR | 4.1% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13600

This Report Provides In-Depth Analysis of the U.S. Motorcycle, Bike & Parts Market Report Prepared by P&S Intelligence, Segmented by Product Type (Motorcycle & Bike Components, Accessories & Safety Gear, Performance & Customization Parts), Sales Channel (OEM, Aftermarket), Powertrain (Internal Combustion Engine (ICE) Motorcycles & Bikes, Electric Motorcycles & E-Bikes, Hybrid Motorcycles & Bikes), Price (Entry-Level, Mid-Range, Premium & Luxury), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 6.8 Billion |

| Market Size in 2025 | USD 7 Billion |

| Market Size by 2032 | USD 9.3 Billion |

| Projected CAGR | 4.1% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. motorcycle & bike parts market size in 2024 was USD 6.8 billion, and it will reach USD 9.3 billion by 2032 at a CAGR of 4.1% during 2025–2032.

The growth of the market is primarily driven by the increasing adoption of electric bicycles (e-bikes) due to environmental concerns, government incentives on their purchase, and demand for sustainable transportation solutions. The improving infrastructure, such as more charging stations, also supports the use of electric motorcycles and e-bikes.

Technological advancements in motorcycles, including AI-based rider assist systems, adaptive cruise control, and enhanced electric powertrains, also make them popular. The strong cultural affinity toward motorcycle ownership in the U.S., supported by iconic brands, such as Harley-Davidson, Yamaha, Ducati, Honda, and Indian, also drives parts sales.

The rising fuel costs are encouraging consumers to shift toward fuel-efficient motorcycles and e-bikes. Moreover, the growing popularity of personalization and customization drives the demand for aftermarket parts and accessories. The expanding level of urbanization leads to a surge in people commuting on two-wheelers. An increase in leisure riding and adventure biking activities post-pandemic, boost motorcycle sales and upgrades. Motorcycle owners regularly buy fittings and components to enhance their vehicle’s performance and safety.

The accessories & safety gear category dominates the market with a share of 45%. Motorcycle riders need helmets, riding gloves, and jackets as common accessories; gloves and jackets are optional, while helmets are a mandate. Riders purchase these accessories to meet their personal preferences and enhance safety.

The product types analyzed here are:

Within the aftermarket, specialty stores dominate the market with a share of 50%. Brand-specific stores and authorized dealers provide customers with technical advice, high-quality services, and, above all, genuine parts. The reliability, authenticity, and warranties provided by them make them popular among both riders and DIY enthusiasts. Moreover, these firms offer a wide range of parts in varying price ranges from both OEMs and private-label companies.

The sales channels analyzed here are:

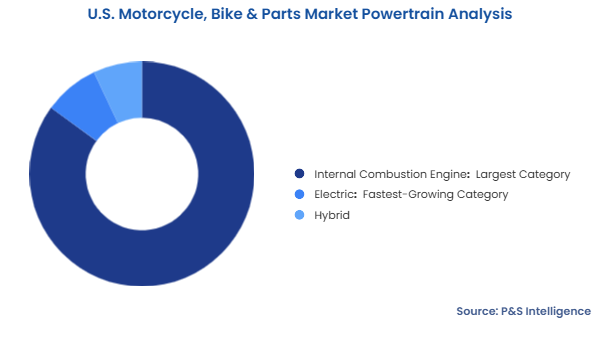

Internal combustion engine is the leading category with a share of 85% because consumers are comfortable with them. Their established network support and diverse model range also drive ICE two-wheeler sales in the country. These models offer high performance, extended range, and easy refueling at gas stations. Moreover, conventional automobiles are cheaper than electric ones, which are not also available in as many models. The inadequate charging infrastructure leads to range anxiety, further discouraging citizens from buying EVs.

The Powertrain analyzed here are:

The mid-range category dominates the market with a share of 55%. Most OEMs focus on motorcycles that cost between USD 5,000 and USD 10,000, to serve riders looking for affordable two-wheelers with advanced features. Nearly every customer uses mid-range motorcycles for both daily transportation and weekend recreation. Their parts are also cheaper, which is the key driver for the market.

The prices analyzed here are:

Drive strategic growth with comprehensive market analysis

The West region of the U.S. dominates the market with a share of 35%. The growth is due to nice weather, varied landscapes, and an active motorcycle culture among residents. The Western region also has an extensive chain of dealerships and specialty stores. Moreover, people in this area value innovation and environmental consciousness, which drive their interest in electric motorcycles and their components. The California Air Resources Board (CARB) offers up to USD 1,500 in subsidies to consumers purchasing electric bikes.

The regions analyzed here are:

The market is fragmented with prestigious manufacturers, aftermarket suppliers and specialized retailers competing on various aspects. Different types of vendors, including independent repair shops, online retailers, and customization brands, maintain market decentralization and make it competitive through diversification. Moreover, companies that make bikes do not mostly make motorcycles as well, which splits the market share for aftermarket parts.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages