Key Highlights

| Study Period | 2019 - 2032 |

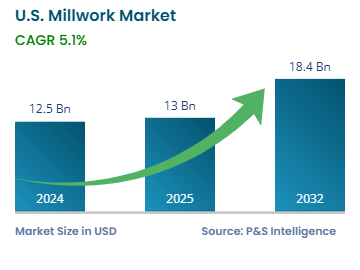

| Market Size in 2024 | USD 12.5 Billion |

| Market Size in 2025 | USD 13.0 Billion |

| Market Size by 2032 | USD 18.4 Billion |

| Projected CAGR | 5.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13586

This Report Provides In-Depth Analysis of the U.S. Millwork Market Report Prepared by P&S Intelligence, Segmented by Customer Type (Residential Customers, Commercial Customers, Contractors & Builders, Architects & Designers, Government & Institutional Buyers), Product Type (Doors & Windows, Moldings & Trim, Cabinetry & Casework, Wall Paneling & Partitions, Staircases & Railings, Custom Architectural Millwork), Material (Solid Wood, Engineered Wood, Laminates & Veneers, Reclaimed & Sustainable Wood), Application (Residential Interiors, Commercial Spaces, Institutional Buildings, Restoration & Historical Projects), Distribution Channel (Direct Sales, Retail Stores & Showrooms, Online Sales & E-Commerce, Wholesale & Distribution), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 12.5 Billion |

| Market Size in 2025 | USD 13.0 Billion |

| Market Size by 2032 | USD 18.4 Billion |

| Projected CAGR | 5.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. millwork market size in 2024 was USD 12.5 billion, and it will reach USD 18.4 billion by 2032 at a CAGR of 5.1% during 2025–2032. This growth is because of the increase in construction and remodeling activities and government funding for through the Infrastructure Investment and Jobs Act (IIJA) and the CHIPS and Science Act. Key companies, such as Builders FirstSource, JELD-WEN, and Woodgrain, are investing to expand manufacturing capacities and enhancing their distribution networks.

Millwork production is growing because people want the best quality wood they can for new and existing homes. Car manufacturers are using advanced technologies, such as CNC machining and 3D modeling, to provide customized and sophisticated designs to customers, especially for premium models. The push for sustainability is leading more businesses to adopt environment-friendly materials, such as reclaimed and engineered wood.

Residential customers are the leading category with 65% share. People in the country love wooden doorways, windows, and flooring because it enhances property design and functionality. The usage of advanced techniques to create personalized home aesthetics also drives this category. CNC machining, 3D modeling, and automated finishing systems improve product precision, customization capability, and efficiency. Several companies use smart milling systems to integrate electronic locks, sensors, and cameras into traditionally crafted doors.

The customer types analyzed here are:

Doors & windows hold the largest share, of 60%, owing to their crucial applications in residential and commercial. The need for advanced doors & windows is increasing for energy conservation, visual benefits, and better safety capabilities. Homeowners and builders are increasingly choosing insulated doors & windows to meet national energy efficiency standards.

The product types analyzed here are:

Solid wood has the largest share, of 70%, because of its aesthetic appeal, durability, and structural strength. Residential developers and designers select solid wood for doors, moldings, and cabinetry because it elevates the property’s worth by giving it a classic look. Moreover, it offers the advantages of multiple refinishes, which eliminates the need to buy new wooden products during renovations.

The material analyzed here are:

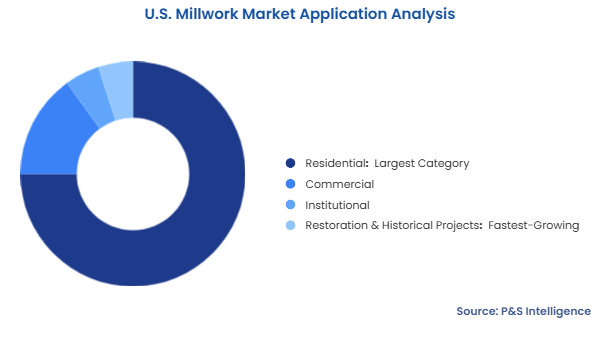

The residential category leads the market with a share of 75% because homeowners prefer unique, handcrafted, and appealing interiors. The demand for custom-made cabinetry, moldings, and trim work is high because they improve functionality and are visual appealing. The increasing spending on home renovations in the U.S. drives the market in this category.

The applications analyzed here are:

Direct sales dominate the market with a share of 80%, as the distribution of millwork products throughout the U.S. is primarily done by retail stores and showrooms, especially major home improvement chains, such as Home Depot and Lowe's. They provide affordable prices and access to a wide range of standardized and customizable products.

The distribution channels analyzed here are:

Drive strategic growth with comprehensive market analysis

The Southern region leads the market with a share of 40% because of the growth in construction activity due to quick urban development and increasing population in Texas, Florida, and Georgia. The Southern region also benefits from its extensive forest resources, which enables an easy supply of wood for millwork. Regional businesses, which already maintain a strong presence, are expanding their operations even more in the south.

The regions analyzed here are:

The U.S. market is fragmented because woodworking is an ancient art, known to a large number of people. Both major companies and thousands of individual artisans and carpenters create a huge variety of standard and customized wooden products for residential, commercial, and institutional spaces. The individual artisans either work on their own on independent projects or under a contractor as part of larger projects, which is generally the case with commercial construction. Moreover, many people buy standardized branded products and have independent carpenters work on them for aesthetic and practical customization and modifications.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages