Key Highlights

| Study Period | 2019 - 2032 |

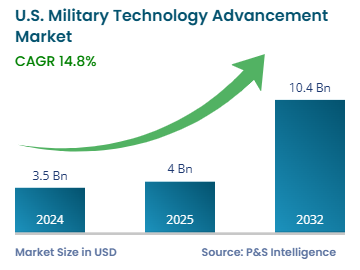

| Market Size in 2024 | USD 3.5 Billion |

| Market Size in 2025 | USD 4.0 Billion |

| Market Size by 2032 | USD 10.4 Billion |

| Projected CAGR | 14.8% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

Report Code: 13530

This Report Provides In-Depth Analysis of the U.S. Military Technology Advancement Market Report Prepared by P&S Intelligence, Segmented by By Application (Autonomous Systems, Unmanned Vehicles, Cyber Intelligence, Hypersonic weapons, SensorNetwork, Training and Simulation, On-Demand Manufacturing, Intelligence Analysis), By Deployment (Cloud-based, On-Premises), By Technology (Artificial Intelligence, Robotics & Autonomous Systems, Cyber Warfare, Advanced Defense Equipment, Internet of Military Things, Immersive Technologies, Additive Manufacturing, Big Data & Analytics), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 3.5 Billion |

| Market Size in 2025 | USD 4.0 Billion |

| Market Size by 2032 | USD 10.4 Billion |

| Projected CAGR | 14.8% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. military technology advancement market size stood at USD 3.5 billion in 2024, and it is expected to grow at a CAGR of 14.8% during 2025–2032, to reach USD 10.4 billion by 2032.

This market is driven by the increasing defense spending, emphasis on emerging technologies, rife geopolitical tension and global conflicts, rising number of public–private partnerships for innovation, and focus on supply chain resilience.

The U.S. military is strongly focused on joint missions, capability development at speed and scale, and research and development. The U.S. Department of Defense (DoD) is upgrading military capabilities, battlefield effectiveness, and counterstrategies against adversaries. The key areas of focus currently are hypersonic weapons, next-generation fighter aircraft, robotic combat vehicles, directed energy, and quantum computing applications for secure communications.

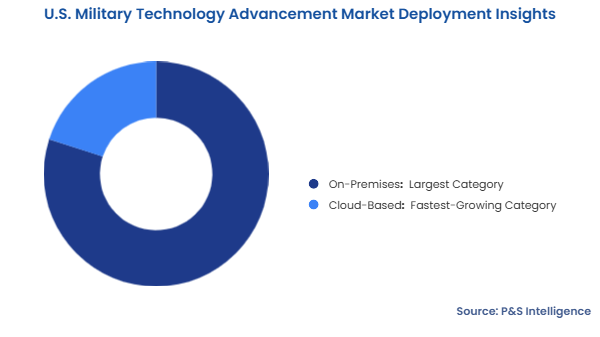

The on-premises bifurcation held the larger market share, of 80%, in 2024, because of the proven efficiency and safety of IT systems already in use at military bases, command centers, and defense agencies. In operation or remote locations, where network connectivity are weak, locally hosted systems work on their own, without needing cloud services. The high demand for HPC, real-time data analytics, and secure communications make it the dominant category.

The cloud-based bifurcation will have the higher CAGR during the forecast period. The DoD works with leading cloud providers, such as Amazon Web Services, Microsoft Azure, and Google Cloud, to modernize defense IT systems and ensure seamless data integration across military branches. Rising volumes of data are being used in modern warfare for real-time intelligence processing, situational awareness enhancement, and AI-driven decision-making, which drives the adoption of cloud deployment.

These deployments were analyzed:

Artificial intelligence held the largest market share, of 65%, in 2024. This is because of the wide application of autonomous system applications, intelligence, inspection, predictive analysis, and decision-making support. To improve operations, AI-equipped robotic combat systems, drones, and self-driving vehicles are widely used by the U.S. military.

Cyber warfare will have the highest CAGR during the forecast period. This is because of the rise in cyberattacks, surveillance threats, and digital warfare by adversaries and hostile nations. As modern warfare is being fought on the digital battlefield, the demand for cybersecurity solutions, encrypted communications, AI-driven threat detection, and cyber defense systems is increasing.

These technologies were analyzed:

Autonomous systems held the largest market share, of 60%, in 2024. This is because of their applications across all branches of the Armed Forces of the U.S., including UAVs, UGVs, autonomous ships, and AI-powered robotic systems. They carry out operations with enhanced efficiency, human risk mitigation, and real-time battlefield intelligence. The DoD invests heavily in the development of AI-powered autonomous warfare, through programs such as the Joint Artificial Intelligence Centre and Project Maven.

These applications were analyzed:

Drive strategic growth with comprehensive market analysis

South held the largest market share, of 40%, in 2024, because of the high concentration of military bases, defense contractors, and government research facilities. Major installations, such as the Pentagon, Fort Hood, and Mac Drill Air Force Base, are in the states are Virginia, Texas, and Florida, respectively, as are major defense industry players, including Lockheed Martin, Boeing, and Northrop Grumman.

West will have the highest CAGR during the forecast period. This is due to its rapid advancements in space defense technology, AI in military tech, and cyber-security innovations. California, Washington, and Colorado are home to leading companies in aerospace and defense technology, such as SpaceX, Blue Origin, and Raytheon Technologies, which are driving military modernization.

The regions and countries analyzed for this report include:

The market is consolidated due to the presence of a few major players with dominating shares. Lockheed Martin, Northrop Grumman, GE Aerospace, BAE, Boeing, RTX, and General Dynamics win most of the government contracts and invest heavily in R&D. These companies also practice effective networking with other divisions of the Department of Defense and a variety of other federal agencies. This allows them to receive contracts worth billions of dollars for advanced military technologies, which include space-based defense systems, AI-driven warfare, hypersonic weapons, and cyber solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages