Key Highlights

| Study Period | 2019 - 2032 |

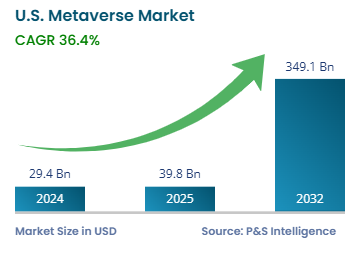

| Market Size in 2024 | USD 29.4 Billion |

| Market Size in 2025 | USD 39.8 Billion |

| Market Size by 2032 | USD 349.1 Billion |

| Projected CAGR | 36.4% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13515

This Report Provides In-Depth Analysis of the U.S. Metaverse Market Report Prepared by P&S Intelligence, Segmented by Component (Hardware, Software), Platform (Desktop, Mobile, Console), Offering- (Avatars, Virtual Platforms, Asset Marketplaces, Financial Services), Technology (Virtual Reality, Artificial Reality, Mixed Reality), Vertical (Gaming, Manufacturing, Entertainment and Media, Healthcare, Education, Retail, Fashion, Aerospace and Defense), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 29.4 Billion |

| Market Size in 2025 | USD 39.8 Billion |

| Market Size by 2032 | USD 349.1 Billion |

| Projected CAGR | 36.4% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. metaverse market size was USD 29.4 billion in 2024, and it will grow by 36.4% during 2025–2032, reaching USD 349.1 billion by 2032.

The market growth is fueled by the continuous progress in immersive technologies, such as virtual and augmented reality. Devices such as Meta Quest, Apple Vision Pro, and HoloLens make it easier for users to access high-quality, realistic virtual environments. These experiences are further enhanced by the rise of 5G networks and advanced cloud infrastructure, which support seamless rendering and real-time interaction within digital worlds. Artificial intelligence is also playing a central role, enabling intelligent avatars, dynamic virtual environments, and personalized user experiences.

Additionally, as the world becomes more digitally connected, people are looking for virtual spaces where they can do more than just watch or scroll; they want to explore and interact. The metaverse has become popular because it gives users fun and immersive digital experiences and new ways to connect and enjoy entertainment with others.

In January 2024, Meta Platforms Inc. contracted Nvidia Corporation for 350,000 H100 GPUs. This move was aimed at improving its metaverse services and devices via artificial general intelligence (AGI).

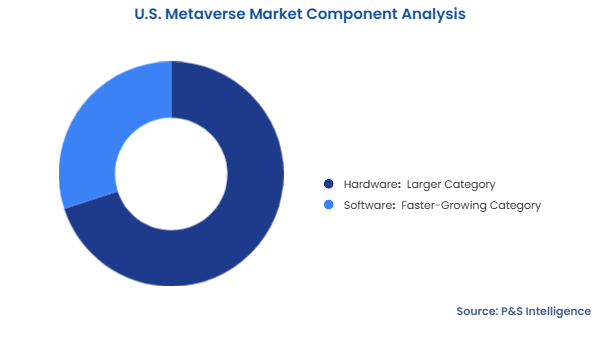

The hardware category held the larger market share, of 70%, in 2024. This is because of the essential need for VR headsets, AR glasses, and other pieces of equipment to access and experience the metaverse.

The software category will grow at the higher CAGR, of 37.5%, during the forecast period. This is because a virtual world depends on software to create and manage how users interact with it. As technology continues to improve, there is a growing demand for metaverse platforms, apps, and systems that work within these virtual spaces.

The components analyzed here are:

The desktop category held the largest market share, of 45%, in 2024. This is because computers have the greatest capabilities to manage the demanding requirements of VR and AR applications and high-definition 3D environments. Desktop systems also support the complex metaverse software with their ample memory and processing power.

The console category will grow at the highest CAGR, of 37%, during the forecast period. Users are migrating toward consoles for metaverse access because immersive experiences work better with consoles and VR headsets.

The platforms analyzed here are:

The avatars category held the largest market share, of 50%, in 2024, and it will grow at the highest CAGR, of 36.8%, during the forecast period. This is because virtual worlds enable users to connect through their digital self-representations, called avatars, which let people join social interactions and take part in online activities. User demand for personalized realistic avatars is rising continuously because more people are joining the metaverse.

The offerings analyzed here are:

The VR category held the largest market share, of 35%, in 2024. This is because it locks users completely into virtual simulations, which work best for gaming, virtual events, digital world exploration, and social interaction. The increasing affordability and improving technology of VR hardware drive its sale around the country.

The AR category will grow at the highest CAGR, of 37.2%, during the forecast period. This is because through AR technology, users can place digital information directly over real objects, to enrich their views with virtual elements. The combination of real-world interaction and digital landscape exists in Pokémon Go, AR navigation, and AR shopping applications.

The technologies analyzed here are:

The gaming category held the largest market share, of 30%, in 2024. This is because the growth of virtual worlds and digital experiences started with video games, even before the metaverse became popular. The idea of the metaverse already existed in gaming platforms, such as Fortnite, Roblox, and Minecraft.

The education category will grow at the highest CAGR, of 37.4%, during the forecast period. This is because following the COVID-19 pandemic, the development of online and hybrid learning methods made the metaverse better than traditional online learning tools. A virtual learning environment allows students to interact in real time with their instructors and each other. Virtual classrooms help students and teachers interact with each other better and more deeply during distance learning.

The verticals analyzed here are:

Drive strategic growth with comprehensive market analysis

The Western region held the largest market share, of 35%, in 2024. This is because California and other states in the Western region host numerous global technology giants, such as Meta, Google, Apple, Nvidia, and Microsoft. People here are also more tech-savvy than in other parts of the world, which is why they have been quick to adopt metaverse concepts.

The Southern region will grow at the highest CAGR, of 38%, during the forecast period. Southern states are seeing rapid growth in technology because more tech companies and startups are setting up their offices in Texas, Florida, and Georgia. Investment, research, and development for metaverse technologies are growing in these states. Moreover, the reducing prices of metaverse hardware and software are making them increasingly affordable for the massive population of the South.

The regions analyzed in this report are:

The market is fragmented in nature because it includes manufacturers of hardware, developers of software, and providers of IT services. Various companies are working on important technologies for the metaverse, including VR, AR, blockchain, and NFTs. Multiple small businesses concentrate on specialized metaverse applications, such as digital learning, virtual art, and digital clothing & fashion, leading to market decentralization and diversity.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages