Key Highlights

| Study Period | 2019 - 2032 |

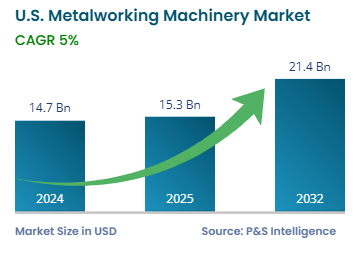

| Market Size in 2024 | USD 14.7 billion |

| Market Size in 2025 | USD 15.3 billion |

| Market Size by 2032 | USD 21.4 billion |

| Projected CAGR | 5% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13510

This Report Provides In-Depth Analysis of the U.S. Metalworking Machinery Market Report Prepared by P&S Intelligence, Segmented by Product Type (Machine Tools, Cutting Tools & Equipment, Forming Machines, Welding & Joining Equipment, Accessories & Attachments), Automation Level (Manual Machines, Semi- Automated Machines, Fully Automated & Smart Machines), Distibution Channel (Direct Sales, Distributors & Dealers, Online Sales), End-Use (Automotive, Aerospace & Defense, Consturction & Heavy Equipment, Medical Devices), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 14.7 billion |

| Market Size in 2025 | USD 15.3 billion |

| Market Size by 2032 | USD 21.4 billion |

| Projected CAGR | 5% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. metalworking machinery market size was USD 14.7 billion in 2024, and it will grow by 5% during 2025–2032, to reach USD 21.4 billion by 2032.

This market is driven by the expansion of advanced manufacturing sector, adoption of automation & Robotics, reshoring and localization of supply chains, government incentives and infrastructure investment, labor shortages, adoption of automation, rising demand for high-precision components, and growth in used and refurbished machinery market.

The CHIPS and Science Act and infrastructure investments are broadening demand through policy incentives for local manufacturing and the reshoring of manufacturing operations.

Machine tools have the largest market share, with 35%, in 2024, because lathes, mills, and grinders, are widely used in industries such as automotive, aerospace, and manufacturing. This is because they offer high precision for making parts that require high tolerance. With automation, manual machines are being replaced with CNC systems to enhance productivity and make advanced, complex parts, especially for EVs and aerospace markets.

The cutting tools & equipment category will grow at the highest CAGR during the forecast period. This is because advancement in technology, such as fiber laser cutters, waterjet systems, and plasma-cutting machines, have made metal fabrication faster, cleaner, and more efficient. These systems are used in the automotive industry for lightweight EV parts, aerospace sector for detailed metal structures, and electronics industry for micro-cutting.

The product types analyzed in this report are:

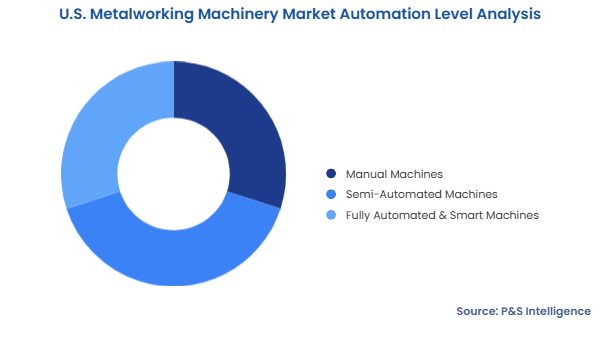

The semi-automated category has the largest market share, with 40%, in 2024. These systems are preferred by small and medium-scale manufacturers as they offer good productivity at a low cost. Semi-automated machines still need an operator, making them flexible for job shops and mid-level production, where full automation is not economically viable.

The fully automated and smart machines category will grow at the highest CAGR during the forecast period. The progress of Industry 4.0 and small manufacturing raise the demand for unmanned production, increased operational efficiencies, and AI precision. This is the most apparent in high-volume industries, such as aerospace, electric vehicles, and electronics. Labor shortages and the rising wages are also pushing manufacturers to invest in CNC systems with self-adjustment, robotics automation, and IoT-enabled predictive maintenance features.

The automation levels analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Midwest region held the largest market share, of 35%, in 2024. This is because Michigan, Ohio, and Illinois have a long manufacturing history and concentration of heavy industries. These states support automotive OEMs, producers of industrial equipment, and suppliers of machinery.

The South region has the highest CAGR, of 5.5%, during the forecast period. Texas, Tennessee, and Georgia are witnessing huge investments in the EV, aerospace, and energy sectors due to their low operating costs, tax incentives, and business-friendly environment. The rising competition creates new manufacturing hubs, such as battery plants in Kentucky and aerospace facilities in Alabama, thus increasing the demand for metalworking machinery.

The geographical breakdown of the market is as follows:

The market is fragmented because a large number of small and large companies operate in it. The large variety of metalworking machinery fragments the market as no company offers everything. Moreover, end users differ in their requirements for throughput, actual process, precision, and safety, which offers opportunities to multiple players. End users that have less-specialized requirements buy from local and regional firms, whereas those that must meet strict safety and performance requirements generally contract the established players.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages