Market Statistics

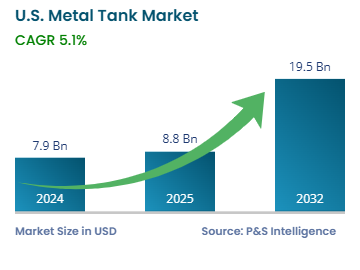

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 7.9 billion |

| 2025 Market Size | USD 8.8 billion |

| 2032 Forecast | USD 19.5 billion |

| Growth Rate(CAGR) | 5.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13506

This Report Provides In-Depth Analysis of the U.S. Metal Tank Market Report Prepared by P&S Intelligence, Segmented by Pressure Type (Pressure, Non-Pressure), Material Type (Steel Tanks, Aluminum Tanks, Other), Product Type (Storage Tanks, Processing Tanks, Transport Tanks, Custom Fabricated Tanks), End-use (Industrial & Manufacturing, Energy & Utilities, Transportation & Logistics, Agriculture, Municipal & Government, Commercial & Residential), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 7.9 billion |

| 2025 Market Size | USD 8.8 billion |

| 2032 Forecast | USD 19.5 billion |

| Growth Rate(CAGR) | 5.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. metal tank market size was USD 7.9 billion in 2024, and it will grow by 5.1% during 2025–2032, to reach USD 19.5 billion by 2032.

The market is driven by the expanding industrial production, rising demand for electricity and heat, increasing demand for water supply, and expanding need to store an array of liquid and gaseous chemicals. The rising agricultural production also drives the demand for metal tanks for storing grains, fertilizers, biocides, and other farming inputs and products. All this is itself credited to the rising demand for all kinds of goods due to a booming population, which is increasingly moving to cities.

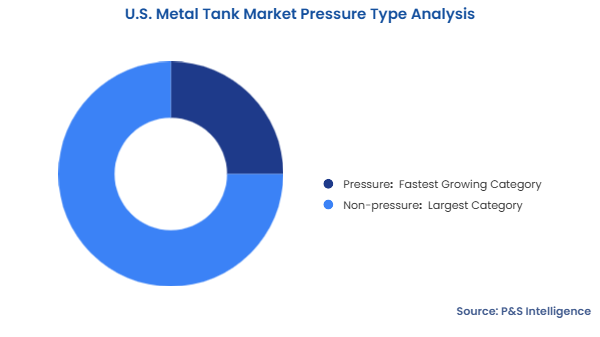

The non-pressure tanks had the larger share, of 75%, in 2024. This is due to their versatility, cost-effectiveness, simple construction, and wide usage for storing water and wastewater in municipal systems. They are also used to store bulk liquids, chemicals, agricultural products, and crude oil. They are also used in the food & beverage sector to store chemicals and in dairies to store milk and milk products.

The pressure tanks category will grow at the higher CAGR during the forecast period. This is because of the rising usage of cryogenic tanks in the energy, aerospace, and advanced manufacturing industries for storing and transporting LNG, compressed hydrogen and oxygen, and other volatile chemicals under high pressures. The shale gas boom and the growing need for LNG are driving the demand for cryogenic pressure tanks. The rise of the hydrogen economy, supported by clean energy initiatives, is creating opportunities for high-pressure storage solutions.

The pressure types analyzed in this report are:

The steel tanks had the larger share, of 70%, in 2024, because steel offers a high structural strength relative to its cost. Its high strength-to-weight ratio allows the construction of bigger tanks that can handle extreme pressure and harsh environments. Steel is used in the majority of the storage tanks in the oil and gas industry because of its ability to contain crude oil, refined products, and liquefied natural gas safely.

The aluminum tanks category will grow at the highest CAGR during the forecast period, because of the changing needs and preference of industries with technological advancements. Its low weight makes it ideal for tanker trucks and railcars, helping save fuel and still delivering larger payloads. In the aerospace sector, aluminum is preferred for fuel storage. Its naturally corrosion-resistant nature reduces the need for protective coatings, thus lowering maintenance costs in marine and coastal applications.

The material types analyzed in this report are:

The storage tanks category held the larger market share, of 60%, in 2024, because of the high demand for crude oil storage, municipal water supply, and industrial liquid storage, where standardized, high-capacity tanks are needed. The rise in the usage of shale oil & gas for energy production and increasing investments in the infrastructure for water conservation drive the demand for large and durable storage solutions that meet environmental regulations.

The custom-fabricated tanks category will grow at the highest CAGR during the forecast period. This is because of the demand of emerging industries, such as pharmaceuticals, renewable energy, and food processing, for material compatibility, advanced coatings, and modular designs.

The product types analyzed in this report are:

The energy & utilities category held the largest market share, of 65%, in 2024, and it will also witness the fastest growth during the forecast period This is due to the increasing production, refining, and supply of crude oil, distillates, natural gas, LNG, and CNG. These applications require tanks capable of handling high pressures and boasting a certain degree of fire-resistance. Metal tanks are widely installed at fuel dumps and installed on railcars, ships, and trucks for long-distance transport. Certain kinds of installations store oil & gas onsite, such as airports, military bases, rolling stock maintenance and supply yards, thermal power plants, ports, and shipping terminals.

The end uses in this report are:

Drive strategic growth with comprehensive market analysis

The South region held the largest market share, of 40%, in 2024. This is due to the robust energy and industry in Texas, Louisiana, and Oklahoma. These states boast high-volume crude production, liquefied natural gas exports, and refining capacity, which creates a huge demand for large steel tanks for storing crude oil, refined products, and natural gas liquids.

The West region has the highest CAGR during the forecast period. A major challenge here is water shortage, which is leading to huge investments in water infrastructures. California, Arizona, and Nevada are leading the adoption of steel water storage tanks and desalination systems. The region is also rapidly transitioning to renewable energy, thus increasing the demand for hydrogen storage tanks, biofuel containers, and carbon capture solutions.

The geographical breakdown of the market is as follows:

The market is fragmented because of the presence of few major players and lots of small and mid-scale ones. Large multinational players, regional manufacturers, and specialized fabricators compete in various segments. The reason for the fragmentation is the diversity in the requirements and regulations on different industries. Small local companies can cater to food & beverage companies and municipal entities with tanks that meet the minimum safety criteria for leakage-proofing and moisture-resistance. On the other hand, multinational companies generally cater to the oil & gas, pharmaceutical, hazardous chemical, and other industries that must comply with stricter regulations for the storage of various commodities.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages