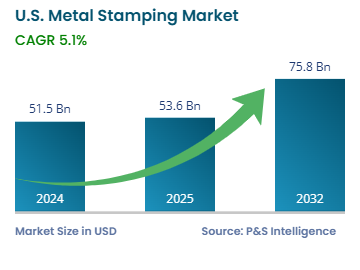

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 51.5 billion |

| 2025 Market Size | USD 53.6 billion |

| 2032 Forecast | USD 75.8 billion |

| Growth Rate(CAGR) | 5.1% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13505

This Report Provides In-Depth Analysis of the U.S. Metal Stamping Market Report Prepared by P&S Intelligence, Segmented by Process Type (Blanking, Embossing, Bending, Coining, Flanging), Material (Steel, Aluminium, Copper & Brass, Other), Application (Bracket & Mounts, Electrical & Electronic Components, Automotive Parts, Aerospace Components, Medical Devices), Press Type (Mechanical Press, Hydraulic Press, Servo Press), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 51.5 billion |

| 2025 Market Size | USD 53.6 billion |

| 2032 Forecast | USD 75.8 billion |

| Growth Rate(CAGR) | 5.1% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. metal stamping market size was USD 51.5 billion in 2024, and it will grow by 5.1% during 2025–2032, to reach USD 75.8 billion by 2032.

The market is driven by automotive industry expansion, technological advancements, consumer electronics demand, construction and infrastructure development, aerospace and defense sector growth, favorable trade and domestic manufacturing policies, and focus on sustainability and lightweight materials.

End users are making significant investments to improve their metal casting operations. For instance, in June 2023, General Motors Company announced over USD 500 million investment in its Arlington, Texas Assembly plant to upgrade equipment for metal stamping and other assembly parts.

The market growth is also promoted by the collaboration between the government, private companies, and research institutions for the development of new metal forming techniques.

The blanking category held the largest market share, of 75%, in 2024. This is because it produces flat, precise metal components accurately, at a low cost. It is important for making items such as brackets, washers, electrical contacts, and automotive panels. It is mainly used in the automotive sector, where fast and efficient production of standardized metal parts is needed in high volumes.

The bending category will grow at the highest CAGR during the forecast period. The growth of the EV, aerospace, and consumer electronics industries is driving the demand lighter, more-complex parts, such as battery enclosures, heat sinks, and structural components. The emergence of robotic bending systems and AI-driven precision control improves efficiency in the bending process.

The process types analyzed in this report are:

The steel category held the largest market share, of 70%, in 2024, as it offers high structural integrity, cost-efficiency, and versatility for automotive manufacturing, industrial machinery, and construction. Steel is the metal of choice to produce heavy-duty frames, brackets, and machine parts due to its high tensile strength and durability. It is also relatively cheaper to fabricate, making it popular for mass production, where material costs directly affect profits.

The aluminum category will grow at the highest CAGR during the forecast period, because of the requirement for lightweight, fuel-efficient, and sustainable parts and components. A major driver for this category is the rapid shift to electric vehicles (EVs), as aluminum’s high strength-to-weight ratio helps extend battery range and lower emissions without sacrificing safety.

The materials analyzed in this report are:

The automotive parts category held the larger market share, of 60%, in 2024. This is because vehicle manufacturing requires a large volume of stamped parts, such as structural body panels, chassis reinforcements, brackets, and engine parts. The Federal Reserve Bank of St. Louis estimates vehicle sales in the U.S. at 195.434 units in 2024, compared to 192.122 million units in 2023. The shift toward EVs has increased demand for specialized stamped parts, including battery cases, motor housing, and aluminum lightweight components, to improve energy efficiency.

The medical devices category will grow at the highest CAGR during the forecast period, because of the advances in minimally invasive surgery, implantable devices, and diagnostic tools. This propels the need for precision-stamped parts, as surgical tools, catheter guides, and implant casings. The growing disposable income, rising prevalence of chronic and acute diseases, and increasing popularity of wearable medical devices, themselves due to the expanding population and increasing healthcare investments, drive this category.

The applications analyzed in this report are:

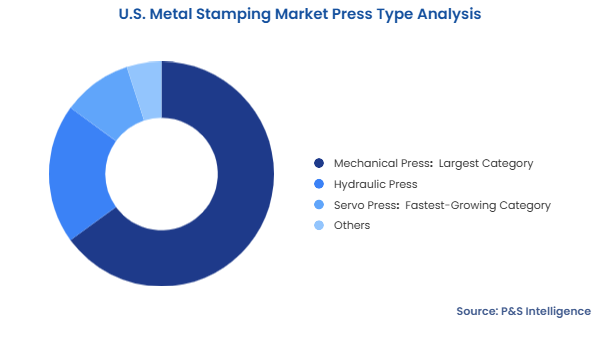

The mechanical press category held the largest market share, of 65%, in 2024, because it is cost-effective, quick, and dependable. It is widely used for high-volume stamping for body panels, appliance parts, and electrical connectors, where speed and consistency are crucial.

The servo press category will grow at the highest CAGR in 2024, because the advancements in precision manufacturing, energy efficiency, and smart automation. Servo presses use programmable servo motors to adjust in stroke lengths, speeds, and forces. Unlike mechanical or hydraulic presses, this feature offers flexibility in making complex and strong parts, such as EV battery enclosures, medical device components, and aerospace fasteners.

The press types analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Midwest category held the largest market share, of 40%, in 2024 because of the long-standing presence of the automotive and industrial manufacturing industries. Michigan, Ohio, and Indiana are home to major automakers, such as Ford, GM, and Stellantis, as well as a dense network of Tier-1 and Tier-2 suppliers.

The South category will grow at the highest CAGR during the forecast period. This is because of industries’ relocation from other regions, increase in foreign investments, and business-friendly environment. Therefore, Alabama, Tennessee, Texas, and Georgia have become major production hubs for OEMs, including Hyundai, Mercedes-Benz, BMW, and Tesla, in recent years.

The geographical breakdown of the market is as follows:

The market share is fragmented due to the presence of a few major players and a large number of small and mid-sized companies, who, cumulatively, hold the larger share. The industry supplies to diverse sectors with varying requirements, such as automotive, aerospace, consumer goods, and industrial machinery. Large companies, such as Ford, Tesla, and Boeing prefer multiple suppliers to avoid dependence on one.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages