Key Highlights

| Study Period | 2019 - 2032 |

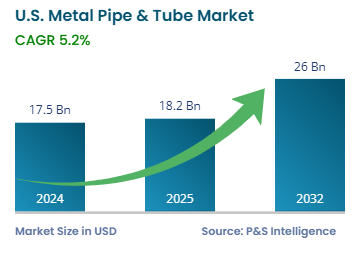

| Market Size in 2024 | USD 17.5 Billion |

| Market Size in 2025 | USD 18.2 Billion |

| Market Size by 2032 | USD 26.0 Billion |

| Projected CAGR | 5.2% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13592

This Report Provides In-Depth Analysis of the U.S. Metal Pipe & Tube Market Report Prepared by P&S Intelligence, Segmented by Material Type (Steel, Aluminum, Copper, Nickel& Nickel Alloya, Titanium), Product Type (Seamless Pipes & Tubes, Welded Pipes & Tubes, Spirral Welded Pipes), Distribution Channel (Direct Sales, E-commerce, Distributors & Wholesalers), End-Use (Construction & Infrastructure, Oil & Gas, Automotive, Energy & Utilities, Aerospace & Defense), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 17.5 Billion |

| Market Size in 2025 | USD 18.2 Billion |

| Market Size by 2032 | USD 26.0 Billion |

| Projected CAGR | 5.2% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. metal pipe and tube market size was USD 17.5 billion in 2024, and it will grow by 5.2% during 2025–2032, to reach USD 26.0 billion by 2032.

This market is driven by domestic manufacturing reshoring initiatives, infrastructure development, industrialization, urbanization, rise in oil & gas exploration, technological advancements, sustainability & recycling initiatives, and focus on supply chain resilience.

As per the Census Bureau, the population of the country rose to 340,110,988 in 2024 from 336,806,231 in 2023. Moreover, 80% of it lives in cities, which drives infrastructure development on a massive scale.

The steel category held the largest market share, of 65%, in 2024, because it is versatile, affordable, and strong, making it essential for all major industries. In oil & gas facilities, carbon steel pipes are used for transportation and drilling operations. Similarly, stainless steels are used in chemical plants and food processing sectors, where corrosion resistance is needed.

The nickel & nickel alloys category will grow at the highest CAGR, during the forecast period, because they are essential in extreme operating conditions. The aerospace & defense sector relies on these materials for jet engines and hypersonic systems due to their thermal stability and corrosion resistance.

The material types analyzed in this report are:

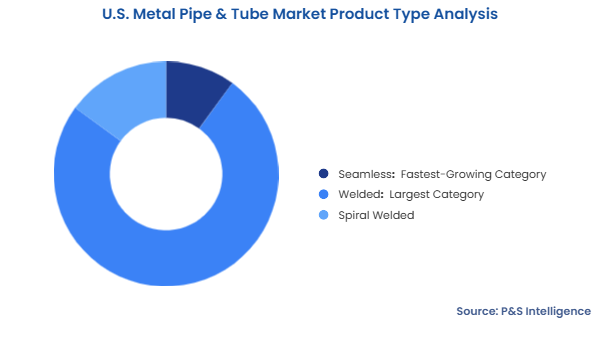

The welded pipes & tubes category held the largest market share, of 75%, in 2024, because they are cost-effective and highly adaptable. This is why they are widely used in construction, water infrastructure, and low–medium-pressure industrial applications. Electric resistance welded (ERW) pipes are cost-effective and work well in plumbing, fencing, and exhaust systems.

The seamless pipes & tubes category will grow at the highest CAGR, during the forecast period. They are more expensive, but critical in power plants, refineries, and chemical processing facilities because of their high purity, strength, and reliability. These pipes are essential for oil & gas exploration as they can sustain under high pressures and tough underground conditions.

The product types analyzed in this report are:

The direct sales category held the largest market share, of 70%, in 2024, due to the large purchase orders, need for customization, and stringent technical standards in oil & gas, power generation, and large construction projects. Manufacturers prefer to work directly with clients to ensure quality, provide engineering support, and secure long-term contracts.

The e-commerce category will grow at the highest CAGR, during the forecast period, because they provide real-time pricing, easy inventory tracking, and a simple purchase process. With digital transformation and the rising need for higher convenience, fabricators, contractors, and maintenance teams increasingly preferring online purchasing.

The distribution channels analyzed in this report are:

The oil & gas category held the largest market share, of 60%, in 2024, because metallic pipes are critical for the drilling, extraction, and transportation of oil & gas. These pipes are essential in pipelines, drilling rigs, and offshore platforms as they can withstand high pressure, temperature, and corrosive environments.

The EIA estimates crude oil consumption in the U.S. in 2023 at 20.25 mbpd, majorly for transportation, heating, cooking, electricity generation, and industrial production. Around 36% and 38% of the energy in the country was produced from natural gas and petroleum in 2023, respectively. All Supermajors—BP, Shell, ConocoPhillips, Phillips 66, Chevron, and Exxon Mobil—own and operate massive oil & gas drilling rigs, pipelines, storage dumps, refineries, and fuel stations around the country.

The energy & utilities category will grow at the highest CAGR, in 2024. This is because of huge investments in renewable energy projects, such as solar and wind, which need a lot of structural steel and aluminum tubing. The country also requires an urgent modernization of outdated water systems and power grids. The Bipartisan Infrastructure Law and other federal initiatives support projects to replace lead pipes with modern alternatives and build next-generation hydrogen pipelines. As per the Department of Energy, the U.S. produces more than 10 million tonnes of hydrogen each year.

The end-uses analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South category held the largest market share, of 40%, in 2024. The Gulf Coast has a large oil & gas sector with many pipelines, expanding drilling and refining operations, which creates a consistent demand for standard and specialty piping. The petrochemical corridor from Houston to New Orleans raises a continuous demand for corrosion-resistant alloys due to the use of heavy and aggressive chemicals.

The West category will grow at the highest CAGR, during the forecast period, because of innovation and environmental conservation efforts. The growing network of solar and wind energy projects boosts the need for specialized tubing. Similarly, the aerospace industry, based in Everett, Washington, requires pipes and tubes made from high-performance titanium and nickel alloys.

The geographical breakdown of the market is as follows:

The market is fragmented as metal pipes and tubes are not specialized objects for most general-purpose applications, such as HVAC, utilities, and construction. Therefore, a significant number of regional players supply them in bulk alongside the major international companies. On the other hand, industries such as oil & gas, power generation, aerospace, defense, and marine, have specific technical, performance, and compliance requirements. Therefore, a handful of large players pick up most of the supply contracts for these projects.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages