Market Statistics

| Study Period | 2019 - 2032 |

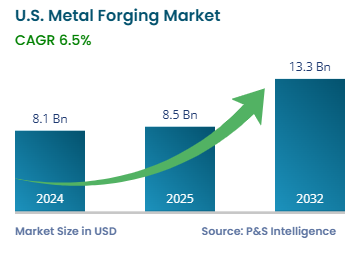

| 2024 Market Size | USD 8.1 billion |

| 2025 Market Size | USD 8.5 billion |

| 2032 Forecast | USD 13.3 billion |

| Growth Rate(CAGR) | 6.5% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Consolidated |

Report Code: 13504

This Report Provides In-Depth Analysis of the U.S. Metal Forging Market Report Prepared by P&S Intelligence, Segmented by Raw Material (Carbon steel, Alloy steel, Stainless steel, aluminium, Magnesium, Titanium), Technology (Closed Die, Open Die), End-user (Automotive, Mechanical Equipment, Oil & Gas, Aerospace, Railways, Agriculture, Construction), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 8.1 billion |

| 2025 Market Size | USD 8.5 billion |

| 2032 Forecast | USD 13.3 billion |

| Growth Rate(CAGR) | 6.5% |

| Largest Region | Midwest |

| Fastest Growing Region | South |

| Nature of the Market | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. metal forging market size was USD 8.1 billion in 2024, and it will grow by 6.5% during 2025–2032, to reach USD 13.3 billion by 2032.

This market is driven by automotive industry expansion, rising demand for metallic components from the aerospace and defense sector, infrastructure development and renewable energy projects, technological advancements in forging processes, and government initiatives and trade policies.

The government’s IIJA and Inflation Reduction Act have allocated USD 1.2 trillion and USD 500 billion, respectively, in numerous industries for infrastructure development. Since metals are critical to almost every sector of the economy and human life, these initiatives act as the strongest drivers for the market in present times.

In December 2023, The Department of Defense (DoD), in partnership with the Institute for Advanced Composites Manufacturing Innovation (IACMI), launched the Metallurgical Engineering Trades Apprenticeship & Learning (METAL) program. Under this, the government aims to train at least 122,000 skilled workers by 2028 through certification, apprenticeships, and degree programs, to enhance the domestic supply chain for defense applications.

The carbon steel category held the largest market share, of 70%, in 2024. This is because of its strength, cost, and versatility, which give it priority in the automobile, construction, shipbuilding and industrial machinery sectors. Moreover, its ease of forging, heat treatment, and machining drive the demand for it. Another reason for its high popularity it is recyclability, which fits into the sustainability approach of the country.

The titanium category will grow at the highest CAGR during the forecast period. This is because of the rising demand for titanium in the aerospace, defense, and medical sectors due to its high strength-to-weight ratio, corrosion resistance, and high-temperature performance. These properties make it ideal for jet engine components, military equipment, and surgical implants. This category is driven by the technological advances in forging aimed at making the process cheaper and investments in next-generation aircraft and military systems.

The raw materials analyzed in this report are:

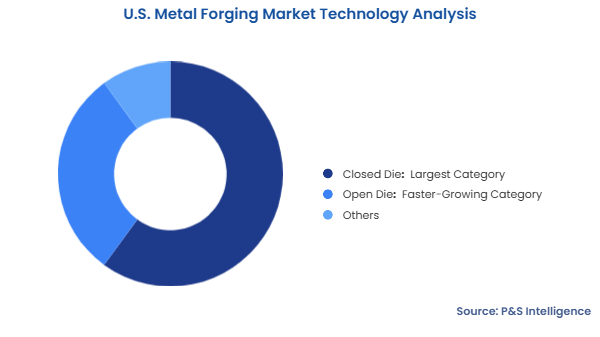

The closed-die category held the largest market share, of 60%, in 2024, because it is efficient in producing complicated, precise components in mass quantities. This near-net-shape application, with its high mechanical properties, is important for automotive, aerospace, and defense applications that require accuracy and strength.

The open-die category will grow at the highest CAGR during the forecast period The growing demand for large, customized components in renewable energy and infrastructure drives its usage in the manufacturing of wind turbine shafts and pressure vessels. Up to 450 tons can be handled by the open-die process, making it ideal for creating durable structural components.

The technologies analyzed in this report are:

The automotive category held the larger market share, of 65%, in 2024. This is because of the criticality of metals for crankshafts, transmission gears, axle beams, chassis, and the outer shell. The forging process gives parts superior strength, fatigue resistance, and durability, all of which are essential for modern vehicles amidst the rising passenger safety concerns.

The end uses analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Midwest held the largest market share, of 40%, in 2024. Michigan, Ohio, and Illinois have long been the key hubs for heavy-duty manufacturing, leading to a consistent demand for forged metal products. These include crankshafts, gears, and axles for the automotive and machinery industries. It is close to the suppliers of steel and has a skilled workforce, with major forging companies, such as Scot Forge and Ellwood Group, operating there.

The South will grow at the highest CAGR during the forecast period, because of the investments in manufacturing facilities and infrastructure. This increases both the production capacity and demand for forged metals. The market is essentially driven by the expansion of the automotive, aerospace, and manufacturing industries due to the favorable business environment and lower operational costs.

The geographical breakdown of the market is as follows:

The market share is consolidated because of the presence of large players, including Scot Forge, Precision Castparts Corp. (PCC), Ellwood Group, and Alcoa. They hold major shares in various high-value sectors, such as aerospace, defense, and energy. They control prices and technologies, using advanced manufacturing, securing long-term contracts with OEMs, and achieving economies of scale.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages