Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 27.9 Billion |

| Market Size in 2025 | USD 28.8 Billion |

| Market Size by 2032 | USD 38.9 Billion |

| Projected CAGR | 4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

Report Code: 13585

This Report Provides In-Depth Analysis of the U.S. Metal Can & Container Market Report Prepared by P&S Intelligence, Segmented by Material (Aluminum, Steel, Tin), Product type (Containers & Cans, Bottles & Jars, Caps & Closures, Tins, Barrels & Drums), End-use (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Chemicals), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 27.9 Billion |

| Market Size in 2025 | USD 28.8 Billion |

| Market Size by 2032 | USD 38.9 Billion |

| Projected CAGR | 4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. metal can & container market size was USD 27.9 billion in 2024, and it will grow by 4% during 2025–2032, to reach USD 38.9 billion by 2032.

This market is driven by sustainability and recycling initiatives, rising demand for ready-to-eat and on-the-go food products, growing food & beverage industry, advancements in packaging technology, and health and wellness trends. All this is itself a result of the growing population, rapid urbanization, increasing disposable incomes, and changing lifestyles and associated choices. As per the Census Bureau, the population of the country rose from 336,806,231 in 2023 to 340,110,988 in 2024. Moreover, 80% of it lives in cities, which characterizes the daily life in the U.S.

The aluminum category held the largest market share, of 75%, in 2024, and it will grow at the highest CAGR, of 5%, during the forecast period. This is because of its bulk usage for beverages, mainly soft drinks, beers, smoothies, and sparkling waters. Nearly 100% of the metal can be recycled without losing quality, which is a big advantage nowadays, as consumers and manufacturers are strongly focused on sustainability. The growing trend of consuming bottled drinks, craft beer, and premium canned beverages has increased the consumption of aluminum cans.

The materials analyzed in this report are:

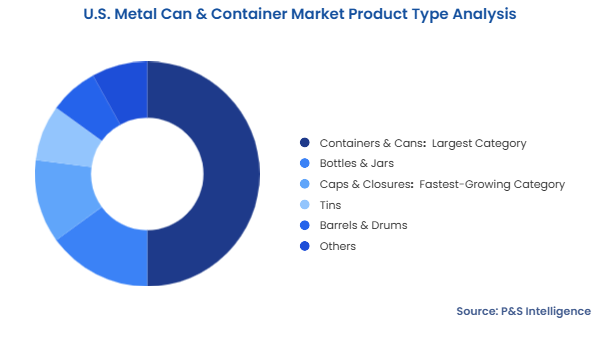

The containers & cans category is the largest with 50% share. This is due to the wide use of metal cans in different industries, including food & beverage, pharmaceutical, and personal care. Their recyclability, low weight, and ability to preserve product quality make them popular for canned foods, soft drinks, and beer.

The caps & closures category will grow at the highest CAGR during the forecast period, due to the increasing demand of consumers for convenience and product safety. This drives tamper-evidence, reliability, and multi-functionality in caps & closures meant for the pharmaceutical and personal care industries, where secure packaging solutions are a necessity. According to the National Association of Manufacturers, 2,121 cases of counterfeit pharmaceuticals were registered in the U.S. in 2022.

The product types analyzed in this report are:

The food & beverages category held the largest market share, of 55%, in 2024, because of the long-standing popularity of canned foods, drinks, and ready-to-eat meals. Metal cans are highly effective at protecting products against contamination, keeping them fresh for longer, and preserving nutrients. The rising demand for quick, handy, and sustainable packaging, particularly for soft drinks, beer, and energy drinks, strengthens the market.

Cans are the top choice for drinks, such as soda, beer, energy drinks, and sparkling water, as their lightweight and portable designs make them perfect for an on-the-go lifestyle. There has been a shift toward all-metal cans as they are 100% recyclable and environment-friendly. Essentially, the increase in the consumption of craft drinks, ready-to-drink beverages, and healthier options to flavored sparkling water drive the category.

The personal care & cosmetics category will grow at the highest CAGR during the forecast period. The rising demand for personal care products, such as deodorants, hairsprays, shaving creams, and skincare items increases the use of metal aerosol cans. Consumers now favor more-innovative, eco-friendly, and visually appealing packing.

Tin cans are seen as ideal for these products due to their durability, recyclability, and ability to protect sensitive formulations from air and light. As per the HIPAA Journal, citing a report by the Centers for Medicare and Medicaid Services, people in the U.S. spend an average of USD 11,197 on personal care regimens each year.

The end uses analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South region held the largest market share, of 35%, in 2024 due to the high-volume consumption of food & beverage products, chemicals, personal care items, pharmaceuticals, and industrial goods. Texas and Florida are major food processing and manufacturing centers, thus creating high demand for metal cans. The biggest reason for the market dominance of the South is its massive population, which numbered 132,665,693 in 2024, accounting for 39% of the country’s total. The South is also a major export center with numerous ports and dedicated cargo airports, which drives the demand for convenient packaging for long-distance transportation.

The West region has the highest CAGR, of 5.2%, during the forecast period. This is because of the increasing consumer demand for cost-effective, lighter, sustainable, and portable packaging, especially for beverages. With an active craft beer industry, growing interest in canned wines and sparkling waters, and increasing eco-consciousness of households, the West favors metal cans for their recyclability. California leads the way with its high population and progressive environmental policies.

The geographical breakdown of the market is as follows:

The market is consolidated because a few major players hold substantial shares. The leading companies include Ball Corp., Crown Holdings, and Ardagh Group due to their production capacities, modern technologies, and strong distribution networks. Their economies of scale enable them to meet the high demand from the food, beverage, and industrial sectors, and they also focus strongly on innovation, sustainability, and strategic mergers or acquisitions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages