Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 29.1 Billion |

| Market Size in 2025 | USD 29.7 Billion |

| Market Size by 2032 | USD 36.7 Billion |

| Projected CAGR | 3.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13564

This Report Provides In-Depth Analysis of the U.S. Lubricant Oil Market Report Prepared by P&S Intelligence, Segmented by Base Oil (Mineral Oil, Synthetic Oil, Biodegradable Oil), Product Type (Engine Oil, Hydraulic Oil, Metal Working Fluid, Gear Oil, Compressor Oil, Turbine Oil), Application (Automotive & Transportation, Industrial, Marine, Aerospace), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 29.1 Billion |

| Market Size in 2025 | USD 29.7 Billion |

| Market Size by 2032 | USD 36.7 Billion |

| Projected CAGR | 3.1% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. lubricant oil market size was USD 29.1 billion in 2024, and it will grow by 3.1% during 2025–2032, to reach USD 36.7 billion by 2032.

This market is driven by automotive industry growth, industrial expansion, technological advancements in lubricants, rising demand for high-performance vehicles, stringent emission & fuel economy regulations, and growing e-commerce market. In all, the growth of the market can be attributed to urbanization, which raises the demand for vehicles for personal, public, and goods transport.

To meet the demand, major petrochemical companies are increasing their investments in refining and R&D activities. For instance, Exxon Mobil Corporation will increase its capital expenditure to USD 27–29 billion in 2025 and USD 28–33 billion from 2026–2030.

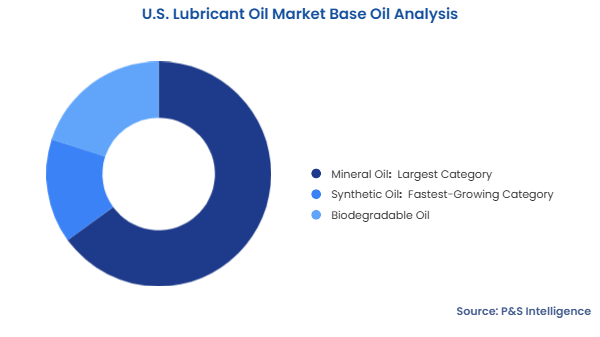

The mineral oil category is the largest, with 65%, share due to its cost-effectiveness, easy availability, and versatility. These oil-based lubricants are preferred for conventional internal combustion engine (ICE) vehicles, industrial machinery, and other general applications. The huge oil refining capacity of the U.S. leads to a ready supply of lubricant oils for various applications.

The synthetic oil category will grow at the highest CAGR during the forecast period. This is because they perform better and are suitable for modern machines and vehicles with high-performance requirements. These oils offer superior thermal stability, better control over viscosity, and stronger protection in severe operating conditions. The rising demand for energy efficiency, extended drain intervals, and reduced emissions drives this category.

The base oils analyzed in this report are:

The engine oil category is the largest, with 60% share, because it is essential in vehicles for smooth operation, long working life, and fuel efficiency in ICE cars, trucks, and off-roading equipment. Regular oil changes are required for maintenance, to improve emission control and fuel efficiency, thus creating a consistently high demand.

The metalworking fluids category will grow at the highest CAGR during the forecast period. This is because of their high demand in the automotive, aerospace, and machinery sectors. These fluids are crucial for close precision machining, CNC processing, and additive manufacturing for increasing the life of the tools, enhancing surface finish, and ensuring operational efficiency.

The product types analyzed in this report are:

The automotive & transportation category held the largest market share, of 70%, in 2024 because of the strong demand for engine oils, transmission fluids, and greases for cars, motorcycles, and trucks. The vast number of vehicles on the road and the requirement for regular maintenance and oil changes ensure a stable demand for lubricants. Further, the utilization of synthetic and high-performance lubricants is increasing due to the stringent emission and fuel efficiency standards.

The industrial category will grow at the highest CAGR during the forecast period because of the growth of the manufacturing, construction, and energy sectors. Hydraulic fluids, gear oils, and greases enable heavy-duty machinery and equipment in these sectors to run smoothly. This increasing usage of automated equipment, advanced manufacturing technology, and predictive maintenance practices drives the demand for high-performance oils that can work under extreme operating conditions and increase the life of industrial equipment.

The applications analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South region held the largest market share, of 40%, in 2024 due to its strong industrial presence, high automotive usage, and expansive energy sector. Texas, Georgia, and Florida are major hubs for the manufacturing, construction, and petrochemical industries. They use lubricants in high volumes for equipment and machines.

The West region has the highest CAGR during the forecast period because it leads in technological advancements in renewable energy projects and environmental conservation efforts. California is leading the way in the adoption of electric vehicles and the development of green technologies, creating a huge demand for specialized lubricants targeted at EV batteries and electric motors. Renewable energy sources, including wind and solar, are also stimulating the demand for high-performance lubricants for turbines and other equipment.

The geographical breakdown of the market is as follows:

The market is fragmented because of the presence of a few large multinational players, regional companies, and smaller, niche producers. Top multinational firms, such as ExxonMobil, Shell, Chevron, BP, and Valvoline, have gained large market shares by exploiting their broad distribution networks, branding, and R&D strength. These main players hold a considerable market share in automotive as well as industrial lubrication as their high-quality technical innovative products meet the stringent statutory and performance specifications.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages