Key Highlights

| Study Period | 2019 - 2032 |

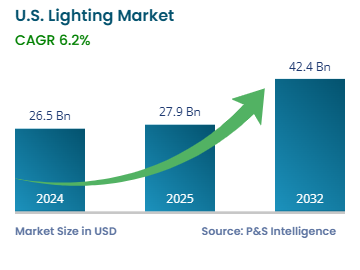

| Market Size in 2024 | USD 26.5 Billion |

| Market Size in 2025 | USD 27.9 Billion |

| Market Size by 2032 | USD 42.4 Billion |

| Projected CAGR | 6.2% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13546

This Report Provides In-Depth Analysis of the U.S. Lighting Market Report Prepared by P&S Intelligence, Segmented by Smart & connected luminaires (Lamps & Bulbs), Light Source (Incandescent, Halogen, Fluorescent, LED, HID), Application (General Lighting, Automotive Lighting, Backlighting, Emergency & Exit Lighting, Horticultural Lighting), End User (Residential, Commercial, Industrial, Outdoor & Public Infrastructure, Automotive & Transportation), Distribution Channel (Offline, Online), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 26.5 Billion |

| Market Size in 2025 | USD 27.9 Billion |

| Market Size by 2032 | USD 42.4 Billion |

| Projected CAGR | 6.2% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. lighting market valued USD 26.5 billion in 2024, and this number is expected to increase to USD 42.4 billion by 2032, advancing at a CAGR of 6.2% during 2025–2032.

This is because of the rising population, rapid urbanization and industrialization, expansion of commercial, industrial, residential, and public infrastructure, and developments in intelligent and energy-efficient lighting solutions. The adoption of LEDs is surging because they deliver better energy efficiency and longer operational lives, along with witnessing a continuous decrease in prices. The regulations of the U.S. DoE regarding sustainability and carbon footprint reduction speed up this transition.

Smart lighting systems, which use IoT, AI, and cloud technologies, are also witnessing rapid uptake in residential and commercial spaces. Consumers are now choosing wireless, automated lighting solutions because they provide convenience, energy efficiency, and security.

The usage of human-centric lighting is rising in offices and healthcare facilities because it allows people to adjust brightness, color, and temperature. The rising demand for horticultural lighting, especially for indoor farming, is due to a strengthening focus on sustainable agricultural practices. Moreover, the development of adaptive headlights and laser-based technology will drive product demand in the automotive sector.

Lamps & bulbs dominate the market with 60% share as most existing luminaires support LED bulbs. Hence, the majority of the LED bulbs bought so far have been for retrofitting into the existing fixtures. Additionally, the LEDs initially available were not smart variants; hence, they were just bought to replace the conventional incandescent and CFL lamps.

The product types covered in this report are:

LED is the largest category because of the government requirements for energy savings and the price drops. They are quickly replacing incandescent, halogen, and fluorescent lights since the former provide an extended product life, reduced power consumption, and great illumination. They use up to 75% less power and last 25 times longer than incandescent bulbs. The ongoing advancements for more-efficient and less-expensive LED technology enable its dominance.

Major light sources covered in this report are

General lighting is the largest category with 65% share because it serves residential properties, commercial buildings, and industrial facilities. The extensive need for ambient and task illumination throughout homes and offices, retail stores, and public infrastructure drives the market. People are shifting toward LED and smart lighting technologies because they offer energy savings and durability.

Major applications covered in this report are:

Commercial is the largest category with 40% share because offices, retail stores, hotels, hospitals, and educational facilities consume massive amounts of electricity and generate significant emissions. As per the EPA, when considering indirect emissions from electricity use, residential and commercial buildings in the country account for 31%, the most among all sectors. The commercial sector has greatly adopted LED and smart lighting technologies to achieve financial savings and regulatory compliance. The implementation of motion sensors, daylight control, and IoT-based lighting systems helps businesses cut their operational expenses. Commercial businesses are seeking LEED certifications for their green buildings, which drives the adoption of sustainable lights.

The end users covered in this report are:

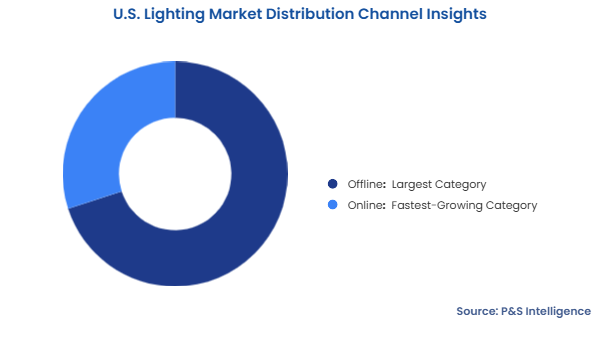

Offline is the larger category with 70% share because lighting products are predominantly sold through specialty lighting stores; retali chains, such as Home Depot and Lowe’s; electrical wholesalers, and B2B mode. Customers and companies prefer personally testing the products and getting expert guidance. Large commercial and industrial projects use bulk purchase orders and specialized vendors to obtain custom solutions, installation help, and post-purchase assistance.

The distribution channels covered in this report are:

Drive strategic growth with comprehensive market analysis

The South region is the largest category with 35% share because of the quick urbanization, growing population, and large-scale construction of commercial and residential properties. The cities of Houston, Dallas, Atlanta, and Miami are experiencing a rising demand for LED and smart lighting due to the expanding infrastructure construction initiatives. The market is also driven in the region by the growth in industrial space and adoption of energy-efficient lights by businesses and public agencies.

The regions analyzed covered in this report are:

The market is severely fragmented due to the presence of global industry leaders, local producers, and specialized entities. Numerous smaller businesses and startups supplement major brands, including Signify, GE Lighting, Acuity Brands, and Cree Lighting, fueling innovation in smart lighting technologies and IoT-based solutions. Manufacturers provide a diverse range of lighting solutions, which include basic products, horticultural lighting solutions, and automotive applications.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages