Key Highlights

| Study Period | 2019 - 2032 |

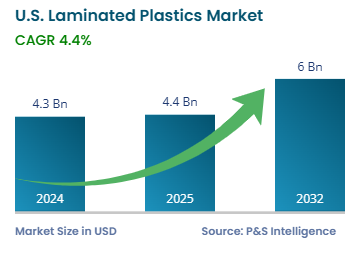

| Market Size in 2024 | USD 4.3 Billion |

| Market Size in 2025 | USD 4.4 Billion |

| Market Size by 2032 | USD 6.0 Billion |

| Projected CAGR | 4.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13573

This Report Provides In-Depth Analysis of the U.S. Laminated Plastics Market Report Prepared by P&S Intelligence, Segmented by Material Type (Thermoplastics, Thermosetting Plastics), Resin Type (Polyethylene, Polypropylene, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, Polycarbonate, Polyethylene Terephthalate, Phenolic Resin, Epoxy Resin, Melamine Resin), Lamination Type (High-Pressure Laminates, Low-Pressure Laminates, Rigid Laminates, Flexible Laminates), Application (Decorative Laminates, Industrial Laminates, Packaging Laminates, Electrical & Electronic Laminates, Automotive Laminates, Aerospace Laminates), End-User (Construction & Architecture, Automotive & Transportation, Electronics & Electrical, Aerospace, Healthcare, Packaging, Furniture & Interior Design), Manufacturing Process (Extrusion, Injection Molding, Compression Molding, Thermoforming), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 4.3 Billion |

| Market Size in 2025 | USD 4.4 Billion |

| Market Size by 2032 | USD 6.0 Billion |

| Projected CAGR | 4.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The size of the U.S. laminated plastics Market in 2024 was USD 4.3 billion, and it will reach USD 6.0 billion by 2032 at a CAGR of 4.4% during 2025–2032.Laminated plastics appear in every corner of our lives including kitchens and cars and shape industries with their use in machinery and devices. U.S. industries has a continuous increase in their demand for laminated plastics based on solid performance characteristics including longevity and multifunctionality and economical benefits. The resistance of laminated plastics to heat and moisture and chemicals allows businesses within every sector to use them for useful purposes as well as beautiful designs.

Manufacturers practice innovation burst while creating eco-friendly and high-performance laminates to fulfill advancing consumer needs , official requirements.

The laminated plastics industry in the United States works toward extensive sustainability transitions. Manufacturers dedicate their resources to green materials and production technologies to resolve environmental problems and fill the market demand for sustainable products. The global push to decrease plastic waste stands in harmony with this trends. The market explores biodegradable laminates and adds recycled materials to their products as methods for sustainable footprint reduction. The market transformation allows companies to serve eco-conscious consumers while maintaining competitive advantages because sustainable solutions gain popularity in the market.

The U.S. laminated plastics market expands, the development of important end-user industries including construction and automotive and electronics technology.This growth emerges because manufacturers use expanding quantities of plastics throughout all their products from automotive parts to packaging solutions The automotive sector now uses various plastic types including polypropylene because it satisfies market demand for lightweight vehicles. The strong manufacturing base in the country supports continuous market growth for laminated plastics because of rising product requirements.

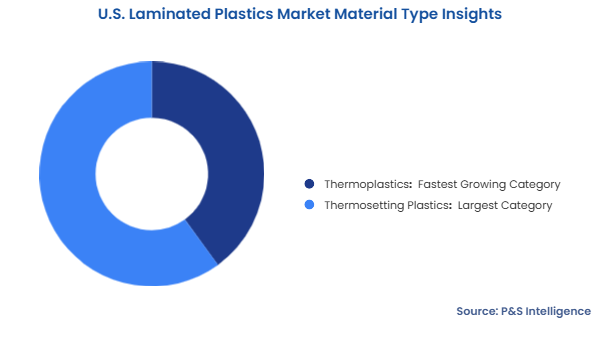

Thermosetting plastics lead the U.S. laminated plastics market and is expected to have the highest revenue in 2024 with a share of 70% because their excellent strength properties and durability , resistance to high temperatures. The construction and electrical insulation industries , high-performance industrial applications rely on phenolic and epoxy and melamine resins for their wide material use. The permanent nature of thermosetting plastics prohibits reheating because they maintain their form without softening thus making them suitable for critical structural applications. Their dominance in the market grows because of rising requirements for fire-resistant chemicals in aerospace , the automotive and electronics industries. Government fire safety and electrical insulation standards encourage industries to use these materials within infrastructure systems and industrial operations.

The material type analyzed here are:

The U.S. laminated plastics market led by PVC (Polyvinyl Chloride) resin material and is expected to have the highest revenue in 2024 with a share of 60% because it presents an ideal combination of flexible usage and durability and cost-efficient performance. The extensive use of PVC arrives from its technical applications in construction and automotive industries , healthcare applications because it shows exceptional chemical resistance and flame retardance , weather resistance. PVC demonstrates perfect suitability in laminated flooring and wall panels , medical-grade laminates because it resists moisture while offering convenient maintenance features. PVC maintains market leadership in the United States because of rising construction and infrastructure development , escalating demands for tough materials that need minimal maintenance. The market value of PVC receives further sustainment through plasticizing technology innovations , bio-based PVC incorporation which improves sustainability aspects.

The resin type analyzed here are:

HPL leads in U.S. laminated plastics market and is expected to have the highest revenue in 2024 with a share of 65% due to its combination of strength and reliable toughness and decorative capabilities. Homeowners , commercial clients use HPL for countertops while also selecting it for furniture production and wall paneling and flooring applications. HPL stands out as a perfect material for busy locations including hospitals and schools because it successfully endures moisture and heat while handling continuous use. HPL leadership continues to grow as people choose premium interior solutions and new infrastructure , remodeling investments increase. Digital printing improvements , new customization options have increased its aesthetic value which made HPL solidify its position as the most popular lamination type on the market.

The lamination type analyzed here are:

The United States market for laminated plastics led by decorative laminates and is expected to have the highest revenue in 2024 with a share of 75% because they have become common in residential and commercial interior designs. The laminates find extensive use throughout furniture as well as cabinetry and flooring while serving as wall paneling since they merge attractive appearance with durability and cost-effectiveness. Decorative laminates maintain their dominant market position because people choose them for home renovations, remodeling and retail and hospitality and office space applications , their stylish and easy-care surface properties

The application analyzed here are:

The construction and architecture industry led in U.S. laminated plastics market and is expected to have the highest revenue in 2024 with a share of 80% because it demands robust materials that resist the weather while offering attractive design features. The construction industry makes extensive use of laminated plastics for flooring and wall panels and countertops and exterior cladding thus offering cost-efficient low-maintenance materials for buildings in residential and industrial as well as commercial sectors. The continuous development of urban areas and infrastructure booster the requirement for advanced laminates as a result of ongoing urbanization. Eco-friendly laminated plastics have emerged through the sustainable and energy-efficient building materials push which reinforced their position in the market. The consistent market expansion associated with residential remodeling and commercial renovation activities keeps construction & architecture as the primary sector for market consumption.

The end user analyzed here are:

Injection molding is the leading manufacturing process in the U.S. laminated plastics market and is expected to have the highest revenue in 2024 with a share of 85% due to its efficiency, precision, and ability to produce high-volume, complex components with minimal waste. This process is widely used across industries such as automotive, electronics, healthcare, and construction, where durable and lightweight plastic parts are in high demand. Injection molding offers excellent consistency, allowing manufacturers to create strong, impact-resistant laminates with intricate designs and varying thicknesses. Its dominance is further reinforced by advancements in automation and material science, enabling faster production cycles and enhanced customization. Additionally, the increasing adoption of bio-based and recycled plastics in injection molding is driving sustainability efforts, ensuring its continued leadership in the market.

The manufacturing process analyzed here are:

Drive strategic growth with comprehensive market analysis

The United States laminated plastics market is leading in the Southern region and is expected to have the highest revenue in 2024 with a share of 40% because of the established manufacturing sector and strengthening construction and automotive markets. The states Texas Florida and Georgia experienced major infrastructure growth thereby driving up the market need for laminated plastics used in countertops floorings and external building elements. Major automotive assembly plants based in the region increase product requirements for lightweight and durable laminated plastic parts. Market growth receives additional support from dominating plastic manufacturing companies , convenient access to fundamental raw materials. Laminated plastics benefit the South through expanding healthcare demands that require them for medical equipment surfaces and hospital hygienic materials. Laminated plastics market dominance belongs to the South region due to population expansion coupled with commercial and residential development investments.

The regions analyzed here are:

Various regional as well as global manufacturers operate in the fragmented U.S. laminated plastics market to serve applications ranging from construction through automotive and electronics to healthcare products. Minimal-sized manufacturers , specialty companies direct their laminated solutions towards specialized industry requirements. Large companies invest in sustainable and high-performance laminates which gives them superiority against smaller businesses.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages