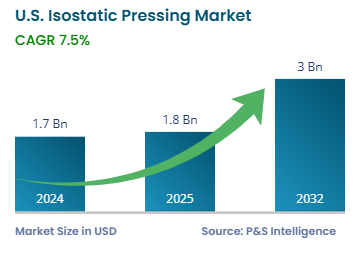

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 1.7 billion |

| 2025 Market Size | USD 1.8 billion |

| 2032 Forecast | USD 3 billion |

| Growth Rate(CAGR) | 7.5% |

| Largest Region | Northeast |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13478

This Report Provides In-Depth Analysis of the U.S. Isostatic Pressing Market Report Prepared by P&S Intelligence, Segmented by Offering (Service, System), Type (HIP, CIP), Capacity (Small, Medium, Large), End User (Automotive, Aerospace and Defense, Energy and Power, Medical, Manufacturing), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 1.7 billion |

| 2025 Market Size | USD 1.8 billion |

| 2032 Forecast | USD 3 billion |

| Growth Rate(CAGR) | 7.5% |

| Largest Region | Northeast |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. Isostatic Pressing Market revenue was USD 1.7 billion in 2024, and it is expected to witness a CAGR of 7.5% from 2025 to 2032, reaching USD 3 billion in 2032. This market growth is due to the government funding and initiatives in the support of isostatic pressing.

In March 2023, the U.S. Department of Energy's Office of Energy Efficiency and Renewable Energy (EERE) announced an investment of approximately USD 30 million for the development of net shape manufacturing techniques, which will include metal additive manufacturing, hot isostatic pressing (HIP), powder Metallurgy (PM), and die-casting.

The aerospace and Defense industry in the U.D. widely utilizes isostatic pressing for manufacturing high-strength, lightweight components, such as turbine blades, engine parts and structural materials. In October 2024, the U.S. government requested a budget of USD 849.8 billion for the Department of Defense (DoD) for FY 2025.

The shift of the automotive sector toward electric vehicles is further increasing the demand for lightweight materials. The metal powders and ceramics used in EV components, such as batteries and engine parts, require isostatic pressing, which is driving the market.

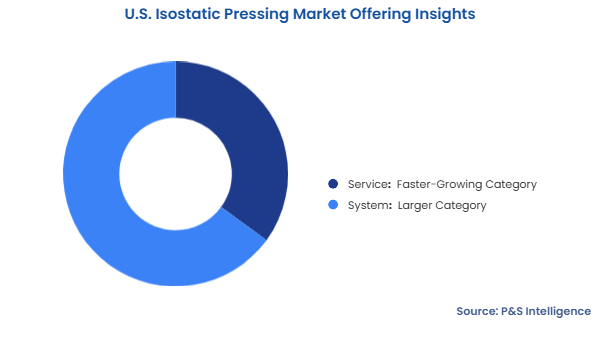

The system category holds the larger market share, of 65%. This can be attributed to the investment by the U.S. Department of Defense and NASA for the usage of HIP for making critical aerospace components from high-performance alloys.

The services category will grow with the higher CAGR of 8.1%, during the forecast period. This is due to the rising demand from numerous sectors for isostatic press components and the fact that not everyone has these machines onsite. Essentially, the increasing demand for high-quality medical implants made from titanium and cobalt–chromium alloys is driving the demand for third-party IP services in the country.

The market has the following offerings:

The hot category held the larger share, of 70%, in 2024 due to its wide use in critical industries such as aerospace, defense, and medical sectors. The high isostatic pressure and heat that it applies uniformly in all directions improves the performance of ceramic and metallic parts. The voids, drinking defects, and internal porosity, which are created by powder metallurgy, 3D printing, and die-casting processes, and eliminated by HIP, which also improves toughness, creep resistance, and strength.

The cold category will grow with the higher CAGR, of 7.6%, during the forecast period, due to its increasing use in the automotive, electronics, and energy industries. Additionally, the electronics industry in the U.S. is increasingly using cold isostatic pressing for high-performance, miniature components, such as sensors and connectors.

Based on the type, the market has the following categories:

Large-capacity pressing held the largest share, of 45%, in 2024. This is due to their widespread adoption across industries such as aerospace, automotive, and energy for the manufacturing of complex components in large numbers.

The small category will grow at the highest CAGR of 7.7%, during the forecast period. This is due to the increasing demand for small-scale IP machines for research and development, prototyping, and low-volume production. The increasing use of this process in the U.S. medical device industry for the manufacturing of surgical tools and prosthetics further drives the growth of the small category.

Based on capacity, the market has the following categories:

The largest category is aerospace and defense, with a market share of 30% in 2024. This is because HIP is widely used in the manufacturing of turbine blades, engine casings, and structural materials for aircraft and defense systems. The U.S. not only manufactures aircraft and defense system for itself but also for exports. As per reports, in March 2025, Boeing had 6,319 pending for delivery to airlines worldwide.

The medical category will grow at the highest CAGR of 8.2%, during the forecast period. This is due to the increasing use of this process for the manufacturing of medical products, such as customized implants, prosthetics, and surgical tools.

Based on end user, the market has the following categories:

Drive strategic growth with comprehensive market analysis

The Northeast region held the largest market share, of 40%, in 2024. This is due to the presence of a significant number of aerospace manufacturers and medical research centers in states, such as New York, New Jersey, and Massachusetts.

The south region will grow at the highest CAGR, of 8.5%, during the forecast period. The region is experiencing development in the oil and gas industry, especially Texas and Florida. This industry requires valve pumps, and other equipment made of high-strength materials, which makes isostatic pressing necessary.

The market has been categorized into the following regions:

The market is fragmented due to the large number of market players, both small and large ones, such as Quintus Technologies, Bodycote, and American Isostatic Presses. They and others offer a wide range of solutions for both the HIP and CIP. Additionally, the large number of small and medium-size companies emerging in the market, which are targeting niche industries, such as consumer electronics and medical device, fragments the market. Another reason for the market fragmentation is a huge number of IP service providers for low, medium-, and high-capacity applications.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages