Key Highlights

| Study Period | 2019 - 2032 |

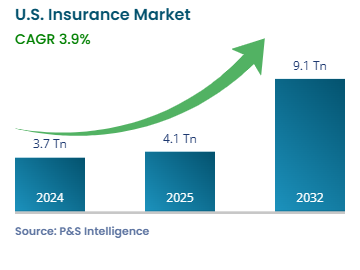

| Market Size in 2024 | USD 3.7 trillion |

| Market Size in 2025 | USD 4.1 trillion |

| Market Size by 2032 | USD 9.1 trillion |

| Projected CAGR | 3.9% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13507

This Report Provides In-Depth Analysis of the U.S. Insurance Market Report Prepared by P&S Intelligence, Segmented by Type (Life Insurance, Health Insurance, Property & Casualty Insurance), End User (Individual, Businesses, Families), Distribution Channel (Direct Sales, Insurance Agents/Brokers, Bancassurance), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 3.7 trillion |

| Market Size in 2025 | USD 4.1 trillion |

| Market Size by 2032 | USD 9.1 trillion |

| Projected CAGR | 3.9% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. insurance market size was USD 3.7 trillion in 2024, and it will grow by 3.9% during 2025–2032, to reach USD 9.1 trillion by 2032.

This market is driven by technological advancements, regulatory changes, rising healthcare costs, aging population, increasing awareness of risk management, economic growth, and increasing income. The market growth is promoted by the focus on customer-centric products, efforts to enhance financial literacy, and expanding distribution channels.

With the rising population living in cities, people’s lives change drastically. They own more property and are at a greater risk of chronic diseases. Incidents such as murders, violence, and road accidents are also common in cities, which raises the demand for different kinds of insurance.

The health insurance category is the largest, with 65% share. This is due to the growing demand for coverage for various types of medical treatments, owing to the rising healthcare costs. The incidence of all kinds of chronic and acute diseases is rising in the U.S., which is driving the demand for healthcare. Procedures carried out using advanced technologies are expensive and out of reach for many people. Insurance makes such costly treatments affordable to the masses.

The property & casualty insurance category will grow at a higher CAGR during the forecast period. This is because of the increasing incidence of hurricanes, wildfires, and floods, which damage properties, often beyond repair. The high property rates in the country make it imperative for people to have them insured, to save themselves from the financial burden in the aftermath of such events.

The types analyzed in this report are:

The individuals category is the larger, with 70% share. This is due to the high demand for health insurance, driven by employer-sponsored plans, Medicare, and individual plans from the Affordable Care Act. Auto insurance follows, as it is mandatory in most states. Homeowners and renters’ insurance, which covers personal property and liabilities; and life insurance, which people buy to provide financial security to their families, are also popular.

The businesses category will grow at the higher CAGR during the forecast period. The frequent Cyberattacks, natural disasters, and supply chain disruptions in the U.S. have increased demand for specialized policies, such as cyber, commercial property, and business interruption insurance. Small and medium enterprises are in the search for cost-efficient, specialized insurance solutions for financial and business stability in dark times. The rapid growth of SMEs and their rising need for risk management drive the market in this category.

The end users analyzed in this report are:

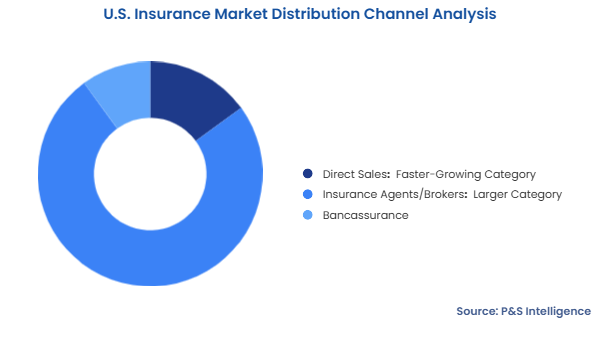

The insurance agents/brokers category held the larger market share, of 75%, in 2024. This is because of their long experience and ability to give personalized services in life insurance, commercial policies, and specialty lines, which require special advice and counsel. Agents and brokers earn credibility through face-to-face interactions and a continuing relationship with the client, making them popular among consumers who value personal service and custom solutions.

The direct sales category will grow at the highest CAGR during the forecast period. This is because of the rise in the usage of digital technologies and shift in consumers’ preferences. Insurance is sold directly to customers through digital platforms, mobile phones, and call centers, removing intermediaries. This channel is attractive to tech-savvy consumers, especially millennials and Gen Z who value convenience, speed, and transparency. Many insurtech companies use AI and data analytics to simplify the buying process and compete on pricing.

The distribution channels analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The South region held the largest market share, of 40%, in 2024. This is due to the huge population, strong economies, and continuous exposure to climatic risks in Texas, Florida, and Georgia. These factors create a high demand for homeowners’, auto, and commercial insurance. The Rapid urbanization, growth of small businesses, and expansion of infrastructure boost the need for insurance coverage in this region.

The West region has the highest CAGR during the forecast period. This is because of the high demand for specialized insurance products due to the unique regional risks and a tech-driven economy. California, Washington, and Colorado regularly witness wildfires, earthquakes, and droughts, thus increasing the demand for specialized coverage. The rise in the demand for cyber insurance can be attributed to the presence of Silicon Valley and other technology hubs.

The geographical breakdown of the market is as follows:

The market is fragmented because of the large number of players. This is itself because of the diverse customer needs, emergence of new risks, and evolution in technologies. Regional companies and insurtech startups target specific segments, while larger national insurers cater to corporations. Moreover, several independent agents and brokers sell insurance policies from established companies, which further fragments the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages